A subsidiary of Sinclair Broadcast Group is underperforming ahead of a probable shakeup.

Diamond Sports Group — the owner of Bally Sports’ regional sports networks — has reported a 10% decline in subscribers in 2022 as it faces a potential change in ownership or structure. The drop in subscribers has been attributed to consumers transitioning from linear TV to streaming.

In August, Diamond — once believed to be valued at $3 billion — hired investment banks LionTree and Moelis & Company, leading to speculation that Sinclair could sell its broadcast provider of local sports or that the company could be facing bankruptcy.

New York-based LionTree facilitated Comcast’s sale of NBC Sports Washington in September to Washington Wizards, Capitals, and Mystics owner Ted Leonsis for an undisclosed amount.

- Sinclair generated $843 million in revenue in Q3 2022, a 45% decline year-over-year.

- The company purchased Diamond in 2019 for $9.6 billion.

- Diamond owns 19 RSNs, which air games of 42 NBA, MLB, and NHL teams.

- Those leagues have reportedly expressed interest in Diamond’s RSNs if available.

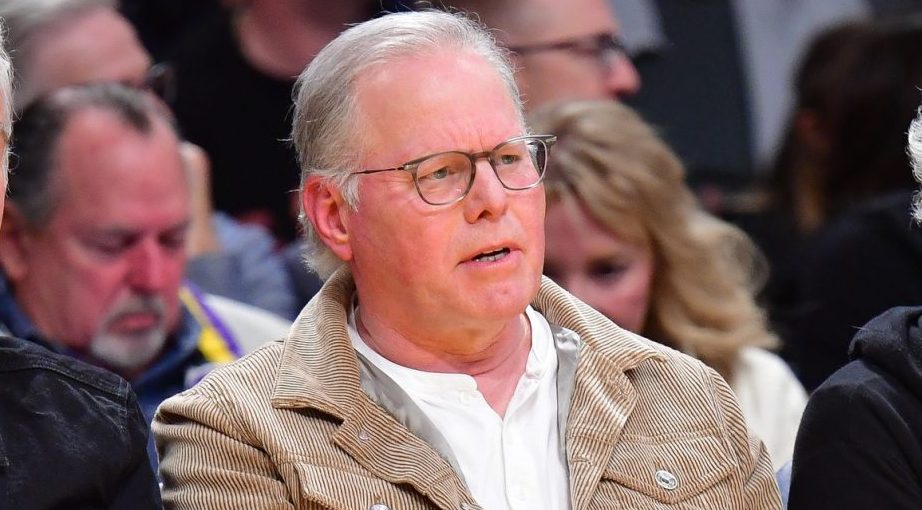

“There is no sale process,” said Sinclair CEO Chris Ripley on a third-quarter earnings call. “But we’re talking to parties about deleveraging, strategic partnerships, and things of that nature.”

Cutting the Cord

In June, Diamond launched direct-to-consumer streaming service Bally Sports+ in five regions and has since expanded to all 19 of its RSNs. Sinclair has yet to disclose how many subscribers the service has added at pricing options of $20 per month or $190 per year.