Is AT&T spinning off WarnerMedia and merging it with Discovery to balance its books, or to create a company that can compete in the global streaming wars?

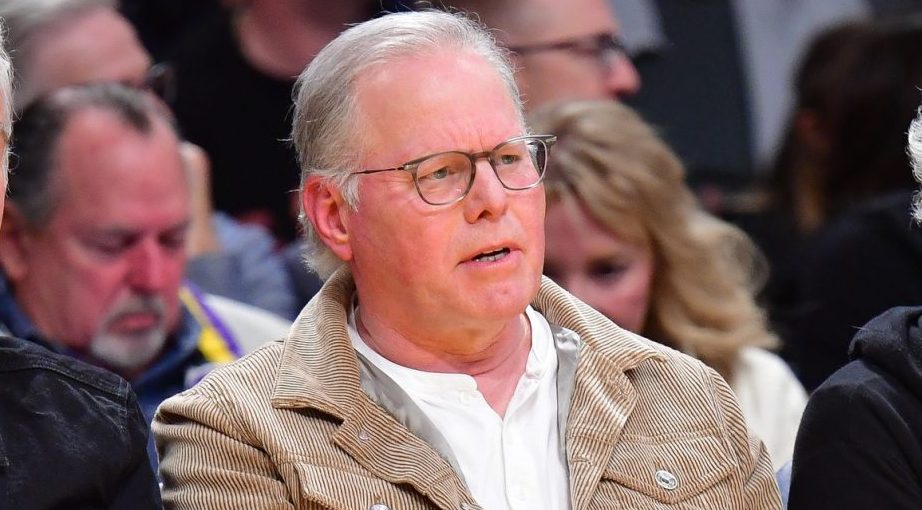

AT&T CEO John Stankey cited both reasons as key motivators for the move that will create the world’s next streaming giant.

“The new company will have a content spend that exceeds most of its industry peers,” Stankey said at a J.P. Morgan conference about tech, media, and communications on Monday.

The new entity — which will combine TNT, TBS, Eurosport, GolfTV, CNN, HBO and HBO MAX, Discovery, Bleacher Report, and numerous other media properties — will spend $20 billion annually on content. It is expected to have a market value around $130 billion.

Stankey also acknowledged that AT&T’s bank account was a factor, saying revenue from the Discovery deal will address “concerns about the balance sheet.”

AT&T’s revenue was up 2.7% year-over-year in Q1 to $43.9 billion, leading to 60% growth in profits, which reached $7.9 billion.

AT&T has mainly focused on the U.S. — until now. Stankey said, “It’s time to unleash the media assets to go and seize a multi-hundred-billion-dollar opportunity.”

- TNT and TBS have deals with the NBA, NHL, and MLB.

- Discovery’s sports media deals are all outside the U.S., namely Eurosport’s network and GolfTV’s 12-year, $2 billion overseas rights deal for the PGA Tour.

- Discovery also holds live rights to the Olympic Games in 50 territories through 2024.

Comcast reportedly had its eye on WarnerMedia as an acquisition target, as well.