The Super Bowl betting market is unquestionably expanding. It’s also hardening, with the established market leaders largely holding their dominant positions and the high-profile event doing little to reshuffle the established industry pecking order.

The American Gaming Association said it estimates $1.39 billion will be bet legally in the U.S. on Super Bowl LIX between the Chiefs and Eagles. That’s an 11% jump from a 2024 Eilers & Krejcik Gaming estimate, as wagering continues to migrate from unregulated activity such as offshore betting and casual activity such as office pools and Super Bowl squares.

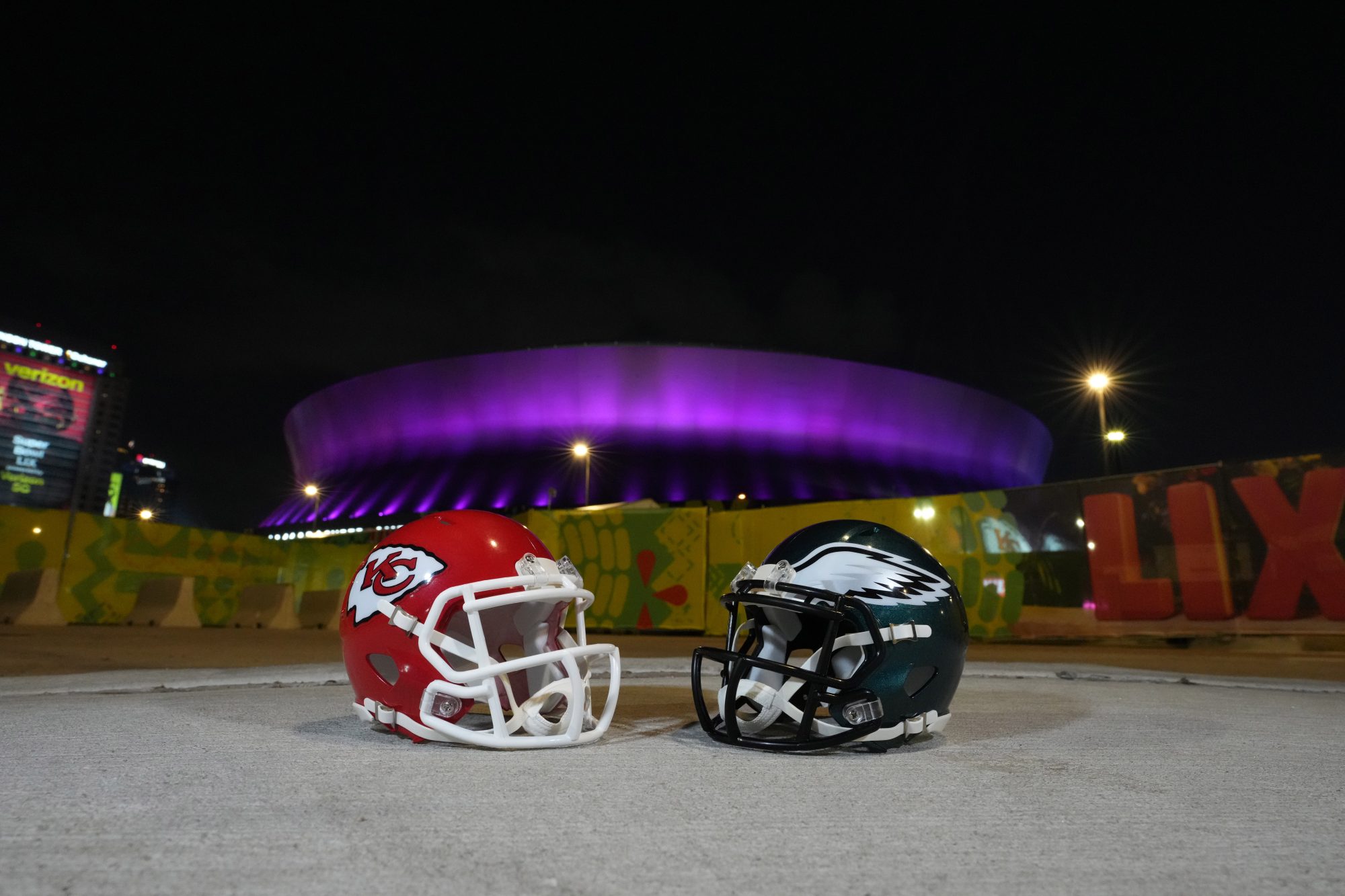

Since last year’s Super Bowl, the key market of North Carolina has started legal sports wagering, while existing betting locales have continued to grow and mature. Based on trends from 759 million regular-season bets, consumer analytics firm Optimove Insights projected the number of Super Bowl bettors will rise 48% from 2024 and surpass the 2023 Kansas City–Philadelphia matchup by 153%.

Legal Sports Report, meanwhile, projected a $1.5 billion betting handle for Super Bowl LIX, up 15% from a year ago, with New York State’s $183 million leading the way.

Regardless of the specific metrics, though, there remains little debate that overall growth of the NFL betting market and expansion of legal territories is building the Super Bowl wagering business.

“This will undoubtedly be a record year for the Super Bowl in terms of that legal activity,” AGA VP of research Dave Forman tells Front Office Sports. “This is on the backs of what we were already seeing in terms of the big rise in NFL handle and market expansion.”

Though 2024 was definitely a slower year for additional states beginning legal sports betting, with just the one addition in North Carolina, the Super Bowl remains a crucial window for sportsbooks, both big and small, to gain new customers and convert some of the squares and office pool participants into active sports bettors.

“This is one of the great times of the year for customer acquisition out there,” Dustin Gouker, a gaming industry consultant, tells FOS. “The Super Bowl is typically No. 2 behind the start of the NFL season, given how football dominates the entire market, but it’s certainly another big chance to bring in new people, and then you’re rolling right into March Madness.”

That Super Bowl appeal is further enhanced this year by the return of the Chiefs and Eagles, both polarizing—but popular—teams with many star players, including Kansas City quarterback Patrick Mahomes and Philadelphia running back Saquon Barkley.

FanDuel and DraftKings still collectively control about two-thirds of the overall U.S. betting market, while everybody else battles within the other third.

Despite high-profile—and heavily backed—market entries in the last two years by major sports industry entities ESPN, Fanatics, and others, the overall market breakdown has only slightly changed since 2023.

There also likely won’t be a seismic shift anytime soon, as FanDuel and DraftKings are gathering strength and projecting further boosts in their business—building off huge early leads from prior footholds in daily fantasy sports and billions of dollars spent on marketing, advertising, and other user acquisition efforts.

FanDuel parent company Flutter Entertainment last fall reported across-the-board improvements in average monthly players, revenue, and adjusted earnings, and slightly raised its revenue and earnings guidance for the full fiscal year based on these rising trends. DraftKings, similarly, detailed in November a surge in player acquisition and said it was expecting a roughly 31% surge in revenue for its fiscal 2025.

This season, fewer upsets meant that the betting public cashed in big—a trend described by FanDuel as “the most customer-friendly” set of results to arise since the 2018 U.S. Supreme Court decision to allow states to set their own rules for sports betting. Though termed “transitory,” that situation, in turn, has cut into some of that near-term revenue and earnings optimism.

Still, the Coke and Pepsi of the sports betting world are hugely powerful entities, and are expected to broadly reaffirm that when they report their next sets of corporate earnings soon after Super Bowl LIX.

“It’s still FanDuel and DraftKings by a mile,” Gouker says. “I don’t see anything coming around that’s going to really disrupt that. By the next Super Bowl, somebody new may be challenging for No. 3, but certainly not one of these top two spots.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![ESPN Bet broadcasts inside the PGA Tour Studios building in Ponte Vedra Beach, Florida, on March 14, 2025. [Clayton Freeman/Florida Times-Union]](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_25668497_168416386_lowres-1-scaled.jpg?quality=100&w=1024)