A decade ago, Adam Silver faced his first critical test of leadership. On April 29, 2014, the media was waiting for the rookie NBA commissioner to address racist comments by Clippers owner Donald Sterling about Black players that had sparked a national scandal. NBA players were threatening to boycott, with LeBron James warning: “There’s no room for that in our game.” Still, many thought Silver would be able to only fine or suspend the execrable Sterling, who’d been a stain on the league’s image for decades.

Wrong. Silver, who’d officially succeeded the late David Stern less than three months before, hammered the billionaire owner with the NBA equivalent of the death penalty, banning Sterling for life, fining him $2.5 million, and forcing him to sell the franchise he’d owned for 33 years. The bespectacled, mild-looking former lawyer instantly became the hero of NBA players and a swooning sports media.

Lesson learned: Never underestimate Adam Silver.

“[Silver] did what had to be done for the sake of what appeared to be an owner who was way out of step with what the NBA represents,” recalls Harvey Araton, the longtime basketball columnist for The New York Times and author of When the Garden Was Eden. “But also he got off to the right start with the players, in terms of recognizing their unhappiness with that situation.”

Ten years later, Silver is at the helm during another watershed moment in the league’s history: the NBA’s multibillion-dollar media-rights negotiations. We don’t know which TV networks and streaming giants will land which packages. Heading into Memorial Day weekend, we still don’t know exactly when. But one thing is clear: The winners of this high-stakes poker game have been, and will be, Silver and the NBA.

The league entered talks at a time when the sports rights market was tightening, economic headwinds were rising, and TV ratings were flattening. Before negotiations started, some thought the NBA would struggle to achieve a significant increase over its current nine-year, $24 billion deal. Instead, as Front Office Sports has learned, the league could double rights fees to more than $50 billion over 10 years, which would put the value of its long-term rights behind only the NFL’s $110 billion—and solidify Silver’s position on the commissioner hierarchy next to the NFL’s Roger Goodell, and above everyone else.

The NBA declined comment for this story. But Mark Cuban, the former principal owner of the Mavericks, told the Associated Press earlier this year: “(Silver’s) been a great leader who built on David’s legacy and really turned us into a major multinational organization.”

The NBA is poised to fill its coffers at a time when its biggest stars of the past two decades—James, Steph Curry, and Kevin Durant—are aging out of the hardwood.

TV viewership for the 2023–24 regular season inched up 1% to 1.09 million viewers for games on ABC, ESPN, TNT, and NBA TV, according to Sports Media Watch. But viewership across the NBA’s three main TV partners (ABC, ESPN, and TNT) dropped 1% to 1.56 million, the lowest in three years. In ’23, All-Star Game viewership plunged to a record-low 4.6 million viewers. While the audience rose 14% to 5.5 million this year, even Silver has worried the game is broken.

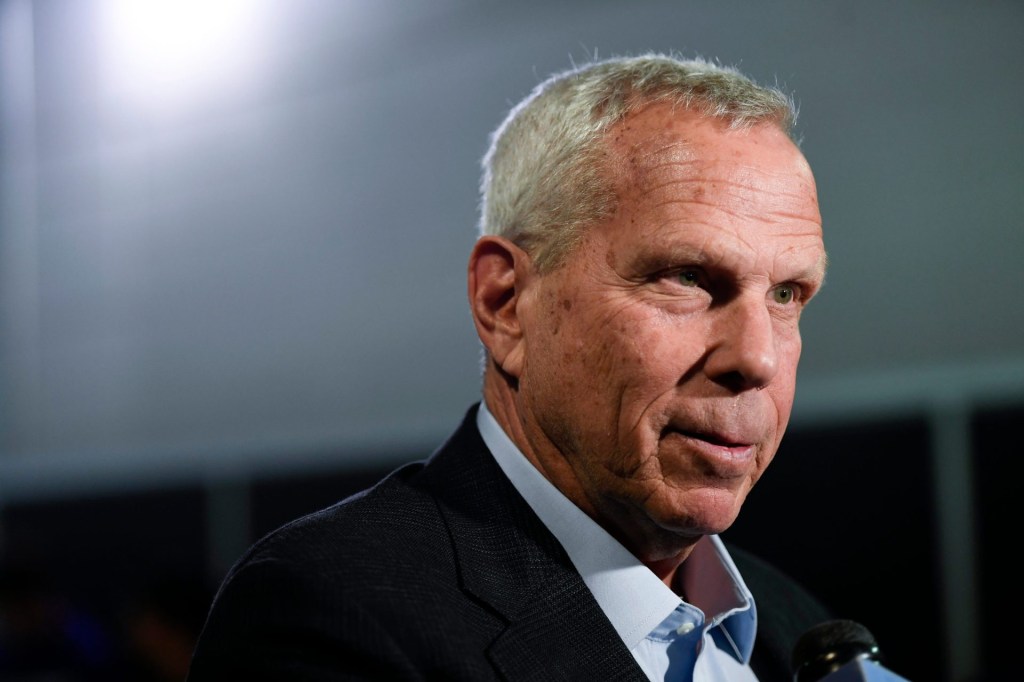

Yet the 62-year-old commissioner is poised to break the bank thanks to cunning planning. Silver has consistently orchestrated efforts to increase the media value of each property; for example, by breaking events like the All-Star Game and early playoff games into distinct, sellable parts, and creating bidding wars wherever possible. It also helps that he has the nerves of a cat burglar to experiment with brand-new concepts for a 77-year-old league.

Knowing the NBA needed more tentpole events to shop to possible partners, he launched the inaugural In-Season Tournament this season. Group-stage games on ESPN and TNT averaged 1.5 million viewers. That was up 26% from comparable TV windows the season before. During current negotiations, the NBA has dangled the in-season event as a stand-alone property and a sweetener.

Silver has also continued what his mentor Stern started: the NBA’s growth as a global property with a young, international fan base. (Approximately 1 billion people around the world annually watch some part of an NBA game—the most ever.)

Silver used the global strategy to entice giant streamers such as Amazon Prime Video, Apple, and Netflix—all with hundreds of millions of customers around the globe—to covet the NBA just as they were expanding into live sports. In 2022, the NBA inked a deal with Prime to livestream games in Brazil. The partners expanded to Mexico in early ’24. Now Prime is on the verge of scoring its first exclusive NBA streaming package in the U.S., which could be modeled after its Thursday Night Football deal with the NFL.

Then there’s Silver’s coolly disciplined media-negotiating strategy. The easy move would be to simply renew the NBA’s existing deals with TNT and ESPN. But Silver, who joined the league in 1992, has watched the cable TV bundle slowly crumble around his two TV partners amid a growing appetite for live sports among deep-pocketed streamers. The NBA’s following the NFL negotiating playbook of always having more bidders in play than packages.

Silver is not showy. But as with media rights, he tirelessly pursues new revenue streams to increase the value of teams and the league at every turn.

In November 2014—only seven years after the Tim Donaghy betting scandal—he shook up the sports world with his New York Times editorial declaring “sports betting should be brought out of the underground and into the sunlight.” That made Silver the only commissioner to support legalized sports betting. A decade later, virtually all pro sports leagues have embraced gambling.

Under his stewardship, the NBA became the first major North American league to sell jersey patch sponsorships. Silver also beat everyone to the punch to allow private equity funds to invest in NBA franchises, and, in 2022, NBA owners voted to allow sovereign wealth funds, pension funds, and endowments to buy team stakes. All the while, Silver has to juggle the demands of a more demanding, bottom-line-oriented group of owners than Stern, notes Araton.

The result? Over the last decade, Silver, whom owners recently rewarded with a long-term contract extension, has more than doubled the NBA’s annual revenue to $12 billion from $4.8 billion. With 22,538,518 fans attending games, the league set an all-time regular-season record this year, and the average NBA franchise is now worth $3.85 billion, according to Forbes, up 75% from 2019.

In 2014, Silver oversaw negotiations for the current nine-year deals with ESPN and TNT that run through the ’24–25 season. He and chief rights coordinator Bill Koenig have been preparing for this moment for years.

This year, there was little doubt what the NBA was going to do: Wait for the incumbents’ exclusive negotiating windows to expire, then open negotiations to third-party bidders. Now the NBA’s on the verge of a “Roundball Rock” reunion with NBC, which held the rights during the golden era from ’90 to 2002. Prime’s ready to write another huge check. And TNT is on life support for its NBA rights.

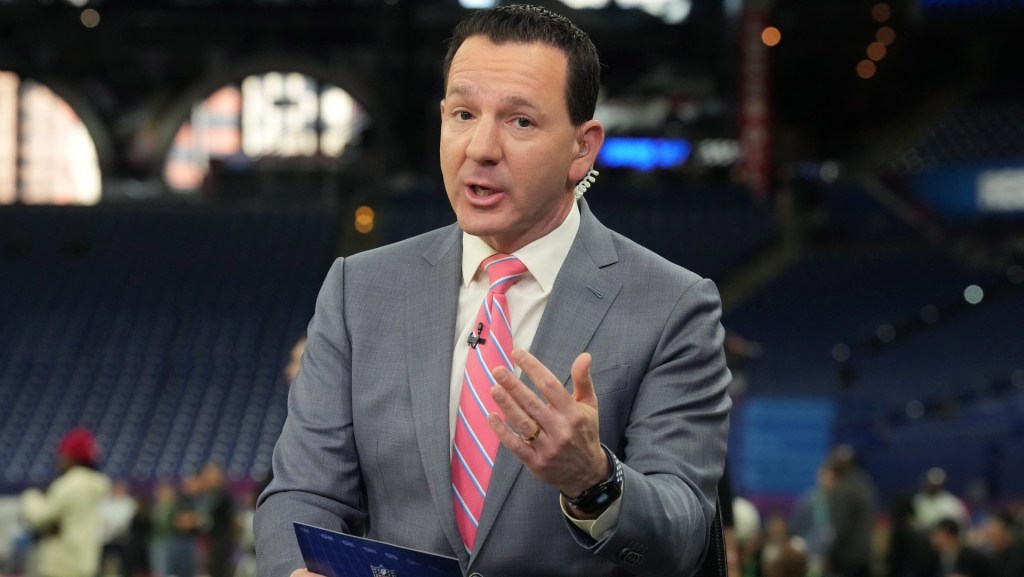

Yes, it would take cojones for the NBA to drop TNT after 40 years. Charles Barkley’s Inside the NBA is the gold standard for sports studio shows. The network has done an incredible job covering the NBA. But David Zaslav, chief executive officer of TNT parent Warner Bros. Discovery, shot himself in the foot by telling Wall Street in 2022: “We don’t have to have the NBA.”

That comment “probably pissed Adam off,” Barkley told Dan Patrick on Thursday. “When we merged, that’s the first thing that our boss said: ‘We don’t need the NBA.’ Well, he doesn’t need it. But me, Kenny [Smith], Shaq [Shaquille O’Neal], and Ernie [Johnson], and the people who work there, we need it. It just sucks right now.”

As did Sterling, Zaslav might learn the hard way not to underestimate Silver. Somewhere, David Stern is smiling down on his protégé.