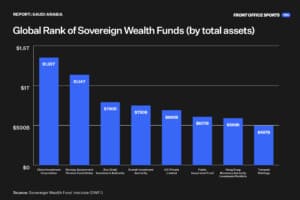

Thanks to its Public Investment Fund — one of the largest sovereign wealth funds in the world with over $600 billion in assets under management — Saudi Arabia has been dominating the world of sports business over the last few years.

The PIF acquired Premier League club Newcastle for $409 million, committed $2.3 billion to football sponsorships, and recently broke the bank to bring veteran superstar Cristiano Ronaldo to Saudi Arabian football club Al Nassr.

The nation is also behind the controversial LIV Golf league and has reportedly expressed interest in acquiring WWE, Formula 1, some gaming properties, and the rights to other major sporting events and competitions — including the 2030 FIFA World Cup — all in the last 18 months.

Why It Matters?

But two things stand out about the Saudis’ interest in sports.

The timing follows Qatar’s recently held FIFA World Cup and appears to capitalize on the increasing regional interest in sports — arguably pioneered by Abu Dhabi’s and Qatar’s investments in soccer giants Manchester City and Paris Saint Germain, respectively.

Some may argue that Saudi Arabia — a country with less than a century and a record of international scrutiny due to human rights violations — should not be considered a big fish in the sports pond.

Reputationally, Saudi Arabia ranks abysmally in human rights, has been highly criticized for the murder of journalist Jamal Khashoggi, is considered one of the unsafest countries from a state abuse perspective, and has even been blamed several times for sportswashing.

If it sounds familiar, it’s because their Qatari neighbors have a somewhat similar issue. The lack of governance and continuous social abuse is kind of a regional trend.

But given that Saudi’s immense financial resources — mostly generated from its oil and gas economy — are now flowing toward sports, it is vital for any sports stakeholder to learn the logic and potential consequences of their activities.

We must examine the reasons, timing, and implications for Saudi participation in sports from the lens of the past, present, and future of the Saudi Arabian economy — and how sports are a piece of a bigger puzzle for their strategic growth.

The Saudi Economy

Despite being largely a desert with extremely hot and dry weather where less than 2% of its soil is arable — the Saudi Arabian economy boomed in the 1970s, quickly establishing itself as one of the strongest in the non-Western world due to its crude oil resources.

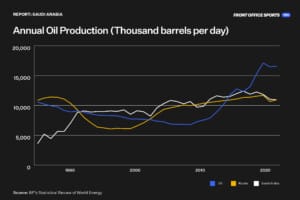

Today, Saudi Arabia supplies around 17% of petroleum worldwide and accounts for 30-40% of its real gross domestic product GDP — which is good for making it the 19th-biggest economy in the world.

But as the famous Wall Street saying goes, past performance is not indicative of future results.

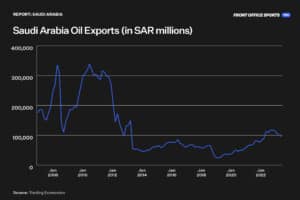

According to Capital Economics, Saudis dominated the oil industry from 1992 to 2013 and accounted for about 30% of global oil exports. Ever since, Saudis have been losing ground to other countries like Russia and the U.S.

A few facets worth noting:

- Oil is a capped resource — estimates suggest that Saudi reserves may last another 60 years at the current extraction rates. The net present value (NPV) of nonexistent revenues in the future is zero — decreasing growth and potential.

- The introduction of electric vehicles, alternative sources of energy, and a rising public concern for the environment suggest the world is pulling away from fossil fuels and is gravitating toward renewable energy sources — decreasing demand.

- The World Bank reported that Saudi Arabia is 75% dependent on oil exports for its budget — increasing the exposure and risks related to its dependency.

The massive challenge is clear for the Saudis: Move and grow, or stay and die.

For decades, the Saudi government has made diverse efforts to decrease its oil dependency — perhaps most significantly in recent years.

Vision 2030

In 2016, Saudi prince Mohammed bin Salman introduced the highly ambitious plan Vision 2030 to create a “vibrant society, a thriving economy, and an ambitious nation.”

Vision 2030 aims to diversify the sources of value for the economy), create social opportunities, expand and invest in emerging industries, and maximize the region’s capabilities by incentivizing entrepreneurship and strengthening the private sector.

Specific goals of the program include increasing the non-oil GDP from 16% to 50% and attracting $1 trillion in foreign investment. As part of the bigger plan, it also aims to expand the entertainment and cultural appeal of the country.

To execute a plan of such magnitude, the Saudis needed a proper firm with the ability to translate interests and desires into actions, investments, and results.

Enter the Public Investment Fund.

Putting The (Saudi) Money Where Their Mouth Is

Today, the PIF is the world’s sixth-largest sovereign wealth fund.

Founded in 1971, it wasn’t truly relevant or active until 2014, when the government permitted it to invest in companies outside Saudi Arabia.

This partially was an effect of the Saudis’ realization that neighboring funds from Abu Dhabi, Kuwait, and Qatar were becoming powerful investment authorities.

Mohammed bin Salman was appointed as chairman and committed to using the PIF as a core driver for Vision 2030. The fund grew in value and size, expanding from 50 to 500 employees in the next three years.

Since then, the fund has made strategic investments in innovative companies, including a massive $3.5 billion investment in Uber, a gigantic $2 billion stake in Tesla, and over $1 billion in electric vehicle startup Lucid Group.

The PIF has also been getting its hands around public and private sports properties, but why?

An Exclusive Romance?

Sports became one of the key areas of focus for the PIF — besides the aforementioned deals, the fund also holds relevant stakes in publicly traded companies in the gaming industry such as Activision Blizzard, Electronic Arts, Take-Two Interactive, Nintendo, and others.

But even though sports is a growing industry with enticing potential, relatively, its investments in sports are peanuts in size and ROI forecast compared with its more extensive investments in other markets.

So what are Saudis really buying with sports properties?

- It’s a soft power move to rehabilitate their public image by creating mental associations with sports entertainment — a strategy also known as sports diplomacy.

- Saudis can use the scarcity of sports assets to compete with Qatar and UAE and showcase their trophy investments as a form of power and name in the region.

- They can develop relationships with key stakeholders in the sports industry from diverse regions — e.g., billionaires, government officials, key decision-makers, etc. — to set foundations for future opportunities.

Saudi Arabia’s current sports investments are clearly stepping stones to bigger opportunities. For example, the Saudi-backed LIV golf recently closed the TV rights deal with CW Network — which, while a relatively small broadcaster, could provide a launch pad toward nine-figure TV deals.

The Big Picture

Sports, technology, and all other investments from the PIF since 2015 follow the premise and goals of the highly ambitious Vision 2030.

According to its whitepaper, the Saudis aim to raise the PIF’s assets to $2 trillion by then — which would make it the largest sovereign wealth fund in the world.

Ambitious? Absolutely.

Achievable? Very likely.

Scary? Maybe.

It isn’t comforting to think the biggest financier in the world is controlled by a country with high ambitions but a deficient reputation.

Despite some reports suggesting the PIF is establishing an internal ESG team, in a world where values like social, governance, and environment are becoming increasingly relevant, the Saudis may have a better chance at flexing the biggest financial muscle in the world by prioritizing their reputation.

But maybe they already know that, and that’s what they’ve been buying all this time.