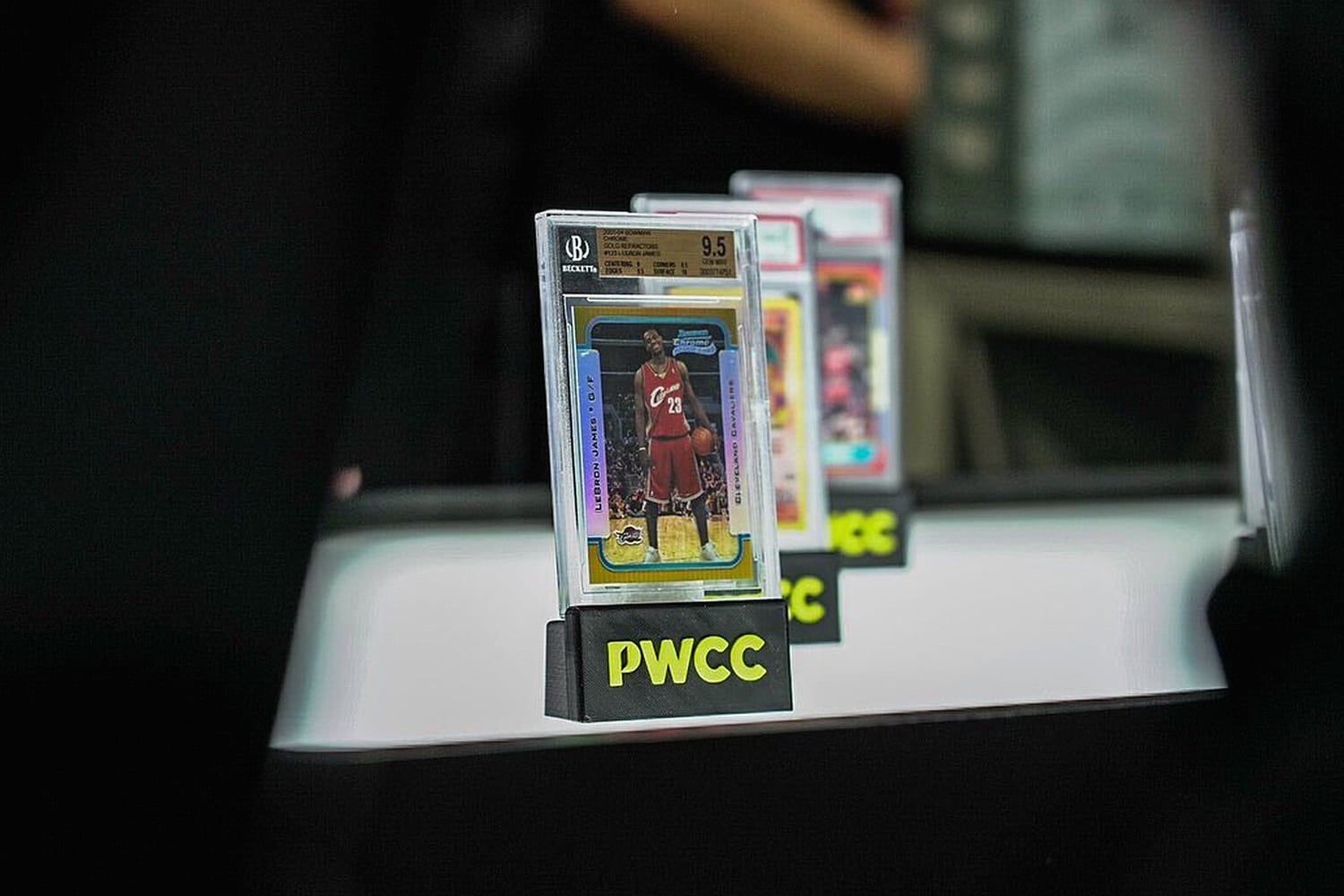

PWCC Marketplace has secured $175 million to create liquidity for its commercial financing business, which allows sports trading cards to be used as collateral for cash advances and loans.

The Oregon-based company established an asset-based credit facility led by private credit investment manager WhiteHawk Capital Partners. Finance firm Wingspire Capital and investment banking company D.A. Davidson Companies will also facilitate the credit facility.

- Since 2021, PWCC has added more than 150,000 registered clients.

- It finances roughly $50 million in cash advances and other loans per month.

- The company’s bank-style vault in Oregon has assets valued at more than $750 million.

In 2021, e-commerce giant eBay pulled down listings from PWCC — at the time its biggest trading card seller — following claims of shill bidding, which is the act of bidding on one’s own item to increase its price, desirability, or search standing.

PWCC, which denied eBay’s claim based on lack of evidence, likely generated at least $200 million worth of gross sales on eBay in 2021, per Action Network.

In 2019, PWCC worked with law enforcement to investigate the sale of altered vintage cards, after which the company ended its relationship with the implicated dealer.

Different Direction

In August, eBay agreed to acquire TCGplayer — an online sports trading card marketplace — in a deal that could fetch up to $295 million. The deal is expected to close in 2023.