Esports collective FaZe Clan went public on Wednesday after completing its merger with blank-check company B. Riley Principal 150 Merger Corp. in a deal valued at $725 million.

FaZe, which is trading on the Nasdaq, first announced plans to go public in October 2021 and received SEC approval in June. It also required approval by BRPM shareholders.

- FaZe is the fourth-most valuable esports company at $400 million, per Forbes.

- The valuation represents a 31% increase compared to 2020.

- It generated $52.9 million in revenue in FY2021, but reported a net loss of $36.9 million.

- The company started trading at $13 per share.

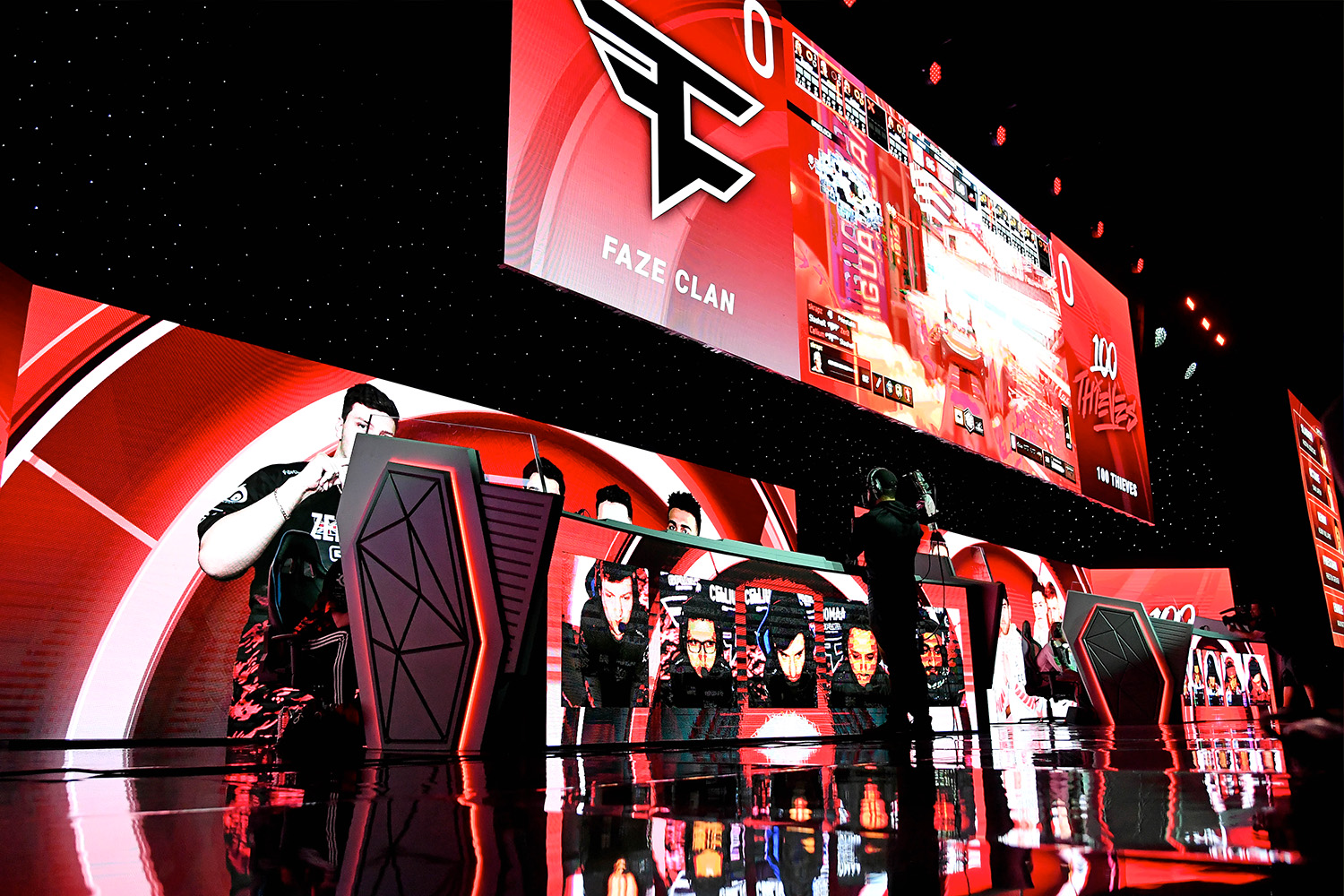

Known for its esports teams, FaZe also allows content creators to build their brands with their combined 500 million followers across social platforms.

Its creators include NFL quarterback Kyler Murray and LeBron “Bronny” James Jr.

Perfect Timing

FaZe has an opportunity to take advantage of a growing esports industry as a public company.

The global esports audience is projected to reach 532 million in 2022, up 8.7% year-over-year, per data firm Newzoo. The growth in engagement is projected to have the esports market generate $1.38 billion in revenue in 2022 — with China accounting for nearly one-third.

The highest-grossing revenue stream for the esports market is sponsorships, with revenue estimated to reach $837.3 million by the end of 2022 — roughly 60% of the entire market.

FaZe has deals with brands including McDonald’s, DoorDash, and the NFL.