A minority investor in AC Milan has been authorized to obtain documents as it attempts to block the sale of the Italian soccer club to private investment firm RedBird Capital Partners.

U.S. District Judge Katherine Polk Failla has authorized Blue Skye Financial Partners, which owns a 4.3% stake in Milan, to obtain a “limited” number of documents to use in a Luxembourg court.

Blue Skye claims Elliot Management — Milan’s majority shareholder since 2018 — held talks “behind closed doors” about the potential sale of Milan to New York-based RedBird Capital.

- In May, RedBird Capital — which has $6 billion in assets under management — agreed to purchase Milan from Elliot in a deal valued at $1.3 billion.

- Blue Skye’s claims are a breach of minority rights, and the firm hopes to prove Elliot “operated with malice or deceit.”

Despite the potential scrutiny, Elliot has vowed to cooperate with the request and provide everything that is owed in defense of Blue Skye’s “frivolous and vexatious” claims.

Elliot has invested as much as $838 million into the top-flight club since 2018, per Bloomberg.

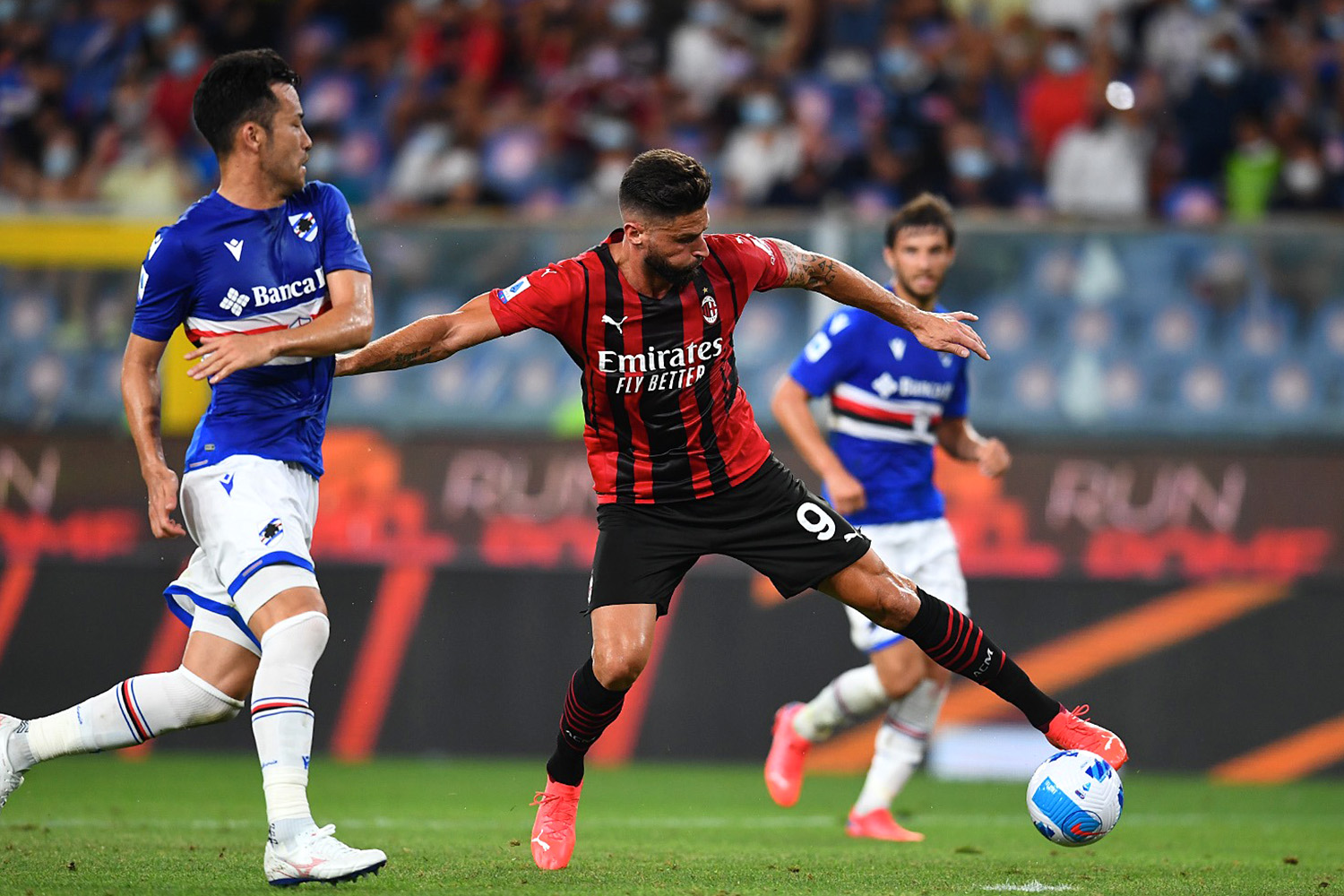

On-Pitch Success

The 14th-most valuable soccer club in the world, Milan won its 19th Serie A title in the 2021-22 season and has generated $257 million in revenue in 2022, up from $165 million in 2021.

Last month, the club extended its kit sponsorship deal with sportswear brand Puma. The Germany-based company will pay Milan $31.5 million annually over five years.