The Chernin Group is living large after its third round of funding.

The investment firm is raising $1 billion in its latest round, according to Axios. The report also included news of three new partners.

In February, TCG led a $40 million growth capital round in Goldin Auctions — a collectible and trading card marketplace — with a group including Mark Cuban, Kevin Durant, and Dwyane Wade.

TCG has a track record of investing in sports content, commerce, and consumer tech.

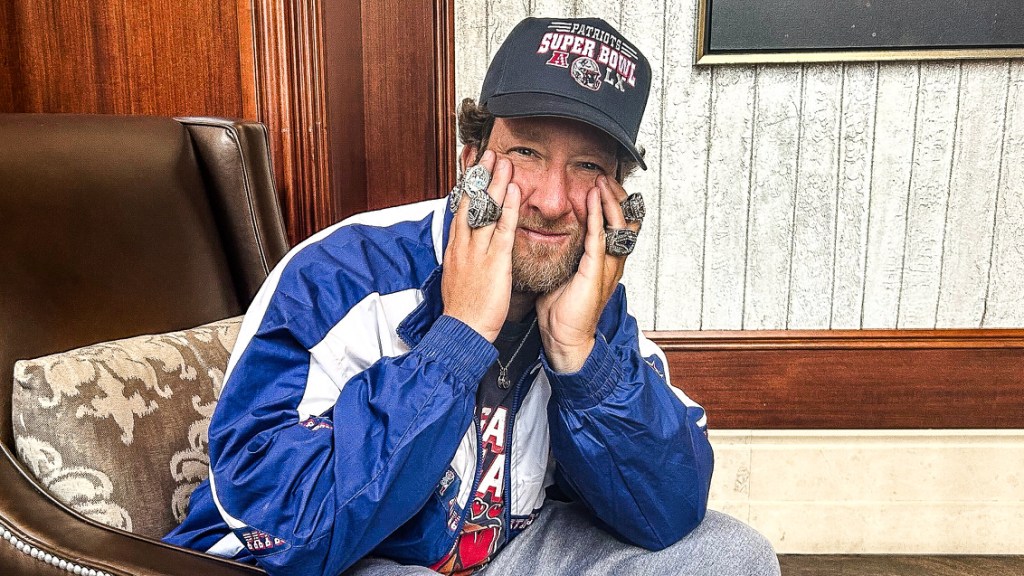

- Bought a 51% stake in Barstool Sports in 2016. Penn National announced it would buy a 36% stake in Barstool last year for $163 million.

- Partnered with Barstool Sports’ CEO Erika Nardini in March to form a SPAC with a $250 million funding goal for “internet businesses” including companies in sports and gaming and wellness.

- Formed The Action Network in October 2017. Last month, Better Collective announced it would purchase the network for $240 million.

- Was part of the $4.6 million venture capital funding round in Stadium Goods with Forerunner Ventures and Mark Cuban.

TCG’s new partners include Maureen Sullivan, former president and COO of Heyday, who’ll concentrate on female-focused businesses; Luke Beatty, former CEO of Brandfolder, for outdoor space; and Jarrod Dicker, a former Washington Post VP, who will work on blockchain and crypto.

“We are totally focused on growth stage right now,” said TCG’s Mike Kerns. “You won’t see us doing more early-stage (investments) from our growth funds.”