Executives across sports and media gathered to discuss the hot-button topics in OTT streaming during the SportPro OTT USA conference in Atlanta this week.

Conversations in and out of panel sessions ranged from fan engagement on social media and in new markets to monetization strategies for existing products – and even what the future holds for college sports distribution rights.

Below are the top five takeaways from the summit.

NFL’s Standalone OTT Product Will Have to Wait

The NFL’s relationship with DirecTV goes back 30 years, and includes the exclusive distribution of out-of-market football games to NFL Sunday Ticket subscribers.

Any future OTT offering by the NFL would likely be in partnership with the cable provider and its parent company AT&T, which manages the league’s web streaming broadcast. Maintaining widespread access to games is a priority for the NFL.

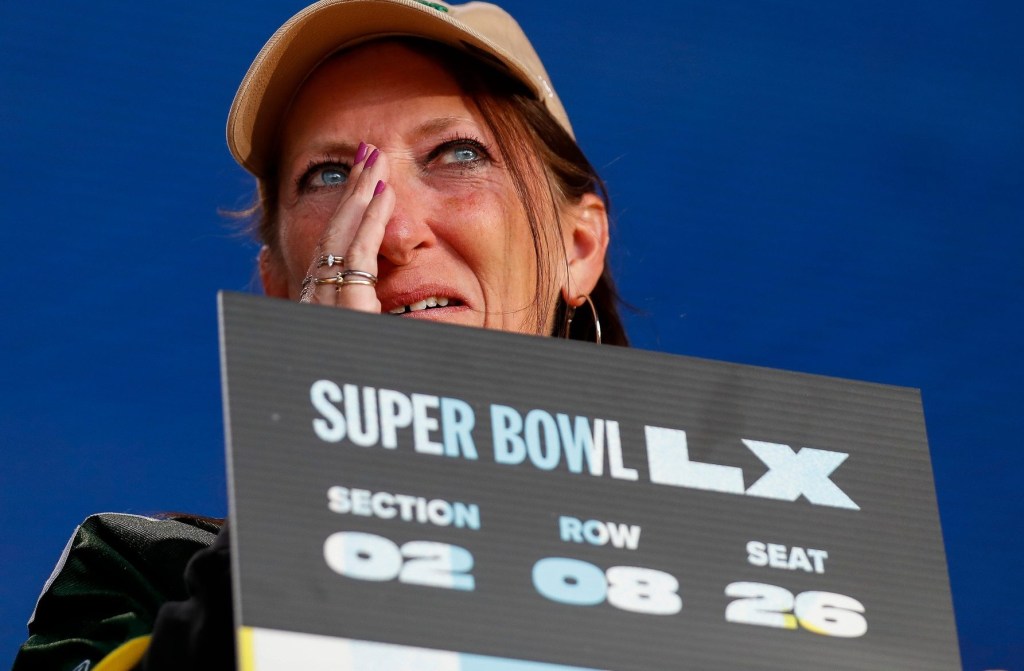

“We really want to make those games available to as many fans as possible,” Blake Stuchin, NFL VP of digital media business development, said. “We ultimately need to sell fan and economic solutions that will satisfy our owners and make sense for our business.”

At the moment, NFL Sunday Ticket is available for purchase online to fans not living in DirecTV markets. The NFL has also worked with Twitter and Amazon to stream NFL Thursday night primetime matchups on the Internet.

Live TV Trumps All Other OTT Content

FuboTV’s audience skews heavily to live news, entertainment, and sports content. Subscribers also view live programming predominantly on connected or smart TVs, says Hannah Brown, FuboTV’s chief strategy officer.

The biggest decision for OTT executives to make after acquiring content from rights holders is what to offer for free and what to stick behind a paywall. Licensing costs require FuboTV to charge a minimum of $54.99 per month for its service.

READ MORE: ESPN Takes on Network Rivals With Added Sports Streaming in Spanish

However, the company launched the Fubo Sports Network in September free of charge to subscribers, featuring a library of content and original programming. The product is largely used to convince fans to switch to paid content.

In CBS’ case, CBS Sports HQ – the network’s highlight and analysis OTT channel – is ad-supported, while the rest of its live sports programming is on CBS All Access.

“If you’re writing enormous checks, you’re probably going to put that content behind a subscription paywall.,” Jeff Gerttula, EVP & general manager of CBS Sports Digital, said. “Then you figure out what makes sense to be offered for free.”

Overtime Will Pass On Live Sports

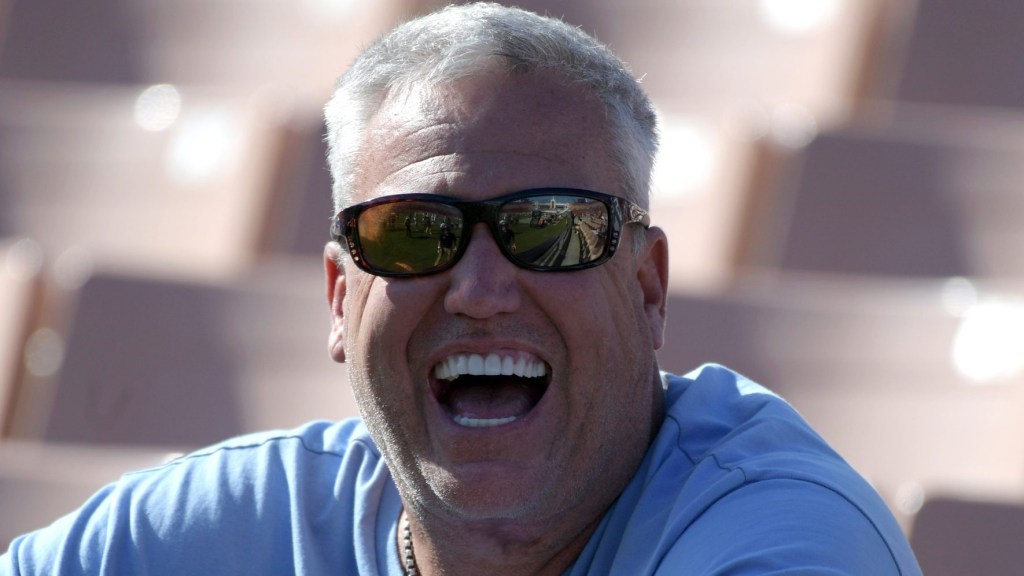

Overtime made its mark introducing sports fans to the next big stars of the NBA and NFL three years ago. But it has no interest in entering a bidding war for league rights.

CEO Dan Porter instead is focused on building social communities on Twitter, Instagram, and TikTok, then monetizing via merchandise and advertising sales.

“I look at content as a grower and creator of community,” he said. “And once the community is big enough, I can do anything with it.”

PGA Tour Live Updates Are Coming

The PGA Tour will stream every shot of the Players Championship on PGA Tour LIve for the first time on its OTT offering. The experiment will require 120 cameras around TPC Sawgrass beginning March 12 to produce 24 different streams fans can click on NBC Sports Gold.

This will be a one-time deal. But it does provide insight into the strategy the PGA Tour hopes to execute in the coming months to improve PGA Tour Live.

READ MORE: PGA Tour Live Is Coming to A Bar Or Restaurant Near You in 2020

The PGA Tour is working with NBC and vendor partners on making the experience available to fans every week. Roughly one dozen cameras follow pre-selected feature groups during golf tournaments currently. The PGA Tour also expects to bring play-by-play analysis to PGA Tour Live.

Mexico, Brazil Remain Key Digital Markets For MLS and the NBA

Both the NBA and MLS have made significant strides in growing digital offerings in Latin America. But Mexico and Brazil provide the largest opportunities, given each country’s growth in broadband adoption.

MLS games began streaming on Pluto TV in the region in May. The deal is intended to grow international fan bases while also attracting players from local leagues to MLS. Clubs spent $370 million acquiring foreign players this MLS offseason- with 50% of those signings coming from Latin America.

Meanwhile, the NBA says that 35% of its single-game NBA League Pass purchases now come from Latin America. Partnerships with the Novo Basquete Brasil and NBA regular season games played in Mexico have also boosted fan engagement. Mexico City additionally will soon be home to an NBA G League team beginning this fall.