The bankrupt running league Grand Slam Track revealed in new court filings that its debts have reached $40 million, and that it made less than $2 million in revenue last year when it launched with three track meets.

The new filings offer the most complete financial picture of the league to date, and show that its debts are about $10 million higher than Grand Slam had previously admitted.

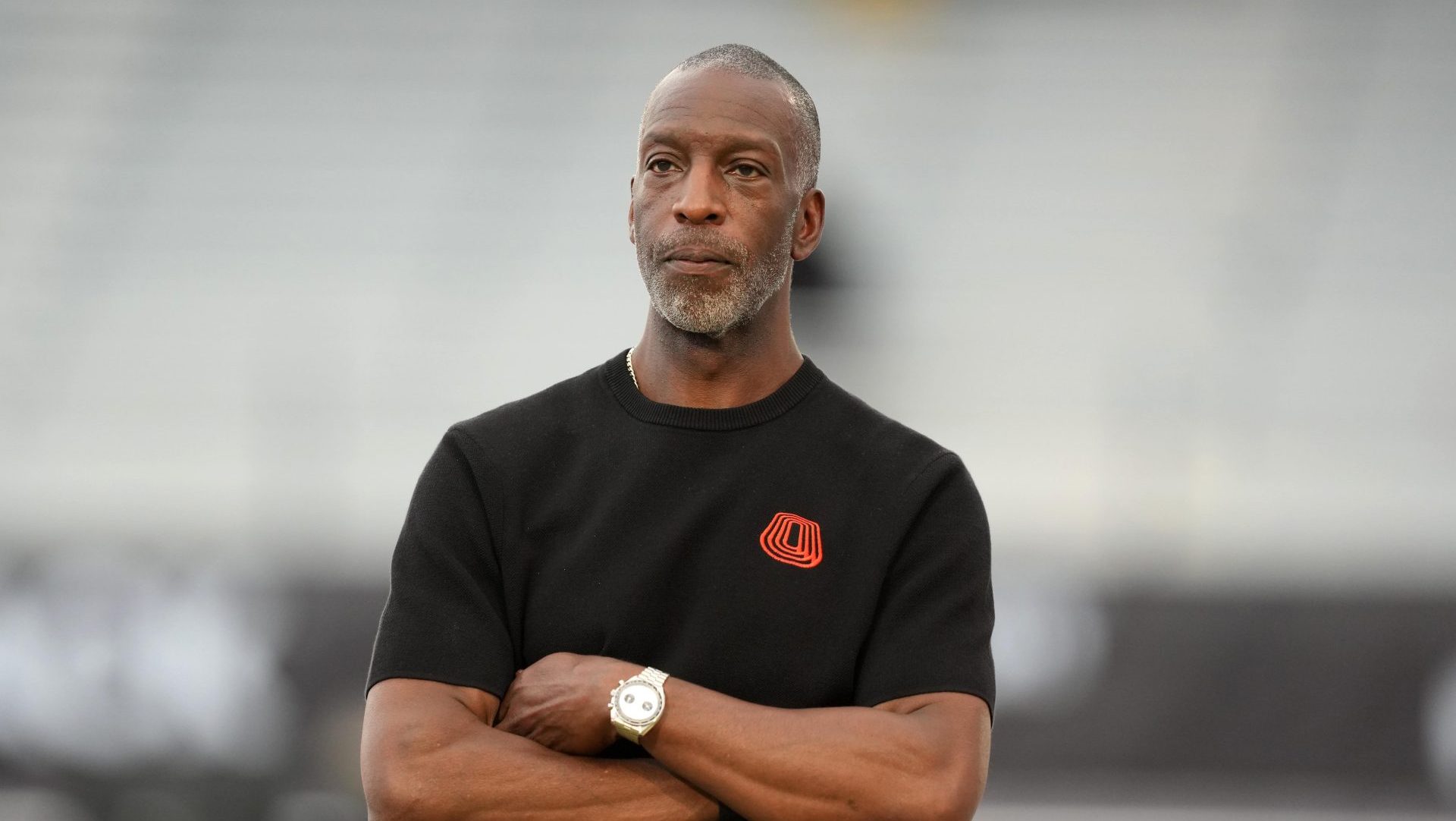

The league founded by Olympic champion Michael Johnson filed documents in Delaware Bankruptcy Court last week detailing the state of its finances. Grand Slam filed for bankruptcy last month after it couldn’t pay back athletes and vendors who participated in its first three-meet season last spring. It filed for Chapter 11 bankruptcy rather than Chapter 7, meaning it technically could still stage a comeback.

One of the new documents lists the league’s assets and liabilities across more than 200 pages, naming every single creditor and how much each is owed. Grand Slam now says that its total debts are closer to $41 million, after previously reporting that number as about $31 million. Meanwhile, the league claims it has less than $1 million in assets.

Another filing says the league banked just $1.8 million in revenue last year. While startup leagues rarely aim to make a profit in their first year, it shows the degree to which Grand Slam struggled to attract blue-chip sponsors and sell its media rights. The league said it would not take any sponsorships from shoe companies and had to pay to produce its own broadcasts.

For example, Alexis Ohanian said his Athlos track meet made “millions” in revenue its second year as a single track meet, thanks largely to his ability to reel in major companies as sponsors. Startup women’s basketball league Unrivaled has struggled to draw fans in its second year but banked $27 million in revenue—largely through media rights—in its first. (Both leagues lost money overall.)

Grand Slam’s three-day model did allow it to sell thousands of tickets in Miami and Philadelphia, although the Kingston meet was so poorly attended that it ended up giving away tickets for free.

Grand Slam is currently being kept afloat by a mechanism called debtor-in-possession (DIP) financing, which is a high-interest loan made after a bankruptcy petition. It gives the struggling business a bit more time and cash to plan a way out of bankruptcy.

Winners Alliance, the for-profit arm of the Professional Tennis Players Association, is the lender providing Grand Slam with its DIP financing. The firm has funded much of Grand Slam’s existence, first as an investor that led the league’s primary funding round, then as an organizer for an eight-figure emergency lifeline this fall, and finally as the only lender to participate in DIP financing. Winners Alliance is chaired by hedge fund billionaire Bill Ackman.

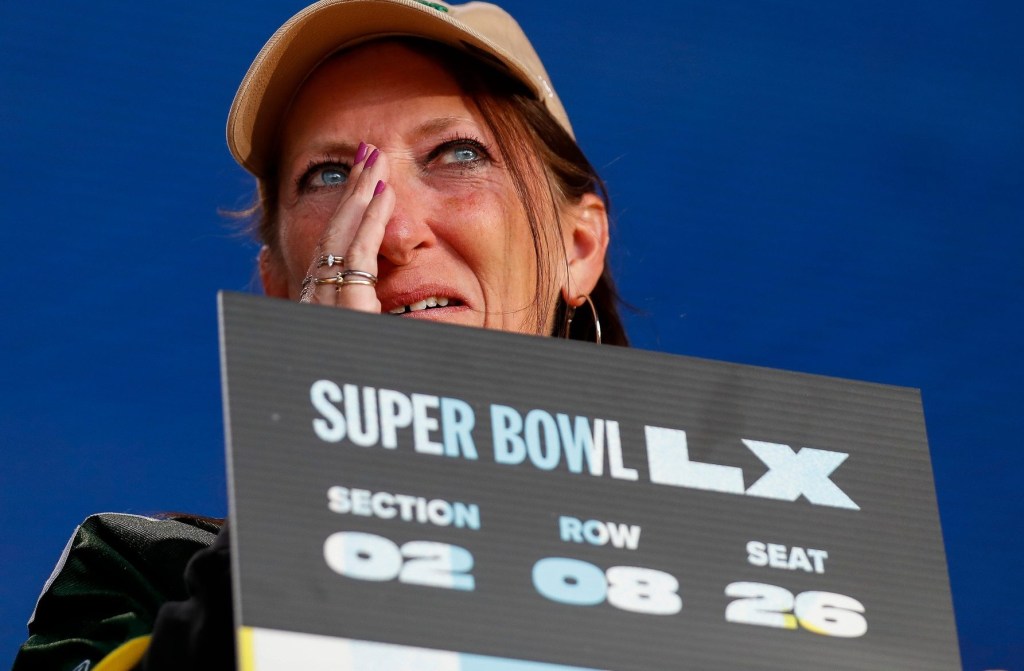

The league will make an even more important filing later this week: its Chapter 11 plan is due on Friday. This document will lay out exactly how Grand Slam plans to emerge from bankruptcy and pay back its debts. The league confirmed in a hearing with creditors earlier this month that it intends to use some of its emergency financing from Winners Alliance to sign new contracts with athletes, so it can ensure a path forward for future events. Additionally, according to the filing, a handful of athletes—Cole Hocker, Alison Dos Santos, Josh Kerr, and Masai Russell—still have about 250 days left on their “League Racer Services Agreement,” meaning they agreed to multiyear contracts.

When Grand Slam announced its salary model, it was seen as a major breakthrough for track, where athletes largely live and die on shoe endorsement contracts. That remains the dominant model in the sport after Grand Slam’s collapse.

But while the promised money made Grand Slam attractive to athletes, it was also at the heart of its downfall. Grand Slam continued hosted meets in Miami and Philadelphia after an investor reneged on an eight-figure term sheet following its Kingston Slam in April, causing a “major, major cash flow issue,” Johnson told Front Office Sports in July. The October emergency financing allowed Grand Slam to pay athletes half of what they were owed, but vendors rejected a settlement offer for the same percentage back, and the league filed for bankruptcy in December.

Mounting Debts

While Grand Slam has listed all its creditors in past filings, this is the first time those names are paired with dollar amounts.

The debts are broken down into several categories. Secured claims are backed by collateral, and are the first debts to be repaid in bankruptcy (after post-petition loans such as DIP financing). According to the filing, Winners Alliance is the only secured creditor with more than $5 million in claims.

Then come the unsecured claims, about $68,000 of which are listed as “priority:” taxes to Florida and Philadelphia, and $17,150 each to Johnson and Gera in unpaid wages.

The vast majority of Grand Slam’s debts—about $35.6 million of its $40.6 million total liabilities—are nonpriority unsecured claims. This is the category with the athletes and vendors, and gets paid last in a bankruptcy case.

The biggest creditor in this category is once again Winners Alliance. The firm is listed for three unsecured claims: $6 million in “SAFE Investment” in April 2024, roughly $608,000 for “trade payable” in July of 2024, and more than $5.5 million on Oct. 2, 2025, part of the emergency financing. That brings the firm’s total up to more than $17 million, roughly 40% of the league’s total liabilities.

The “SAFE Investment,” which stands for Simple Agreement for Future Equity, was part of Grand Slam’s seed funding round. Several other creditors are owed as SAFE investors along with Winners Alliance with debts stemming from March through May of 2025: Robert Smith’s HLS Holdings for $1 million, Albert P. Lee’s APL Ventures for $300,000, MoviePass founder Hamet Watt’s Share Ventures for $250,000, entrepreneur Vivek Padmanabhan for $250,000, and creditors named Brittany Ann Nohra for $200,000 and Kobie Fuller of Upfront Ventures for $15,000.

Grand Slam lists details for the creditors over hundreds of pages. Some notable debts include:

- Several large debts that did not find a place on the top-20 creditors list that was posted last month. This includes more than $350,000 to the W hotel in L.A., $350,000 to track surface company Rekortan, and $340,000 to American Express for a credit card balance. The list shows a previously disclosed debt of more than $222,000 to The Parker Company, but now adds another roughly $900,000 debt to the same street address.

- Debts to all athletes that were not already publicized in the top-20 list. To name a few: Grant Fisher is owed $119,250, Hocker $107,500, Nikki Hiltz $80,625, Russell $60,000, and Fred Kerley $25,000.

- A $108,000 payment to a cable and wireless company in Kingston.

- More than $70,000 to UCLA’s Luskin Conference Center. Grand Slam was slated to have an event on campus but canceled it as funding faltered.

- More than $31,000 to the US Anti-Doping Agency.

- Chris Chavez, founder of running publication Citius Mag, is owed about $5,300; Chavez’s media outlet, Citius Mag, is owed $273,000 as part of a “consulting agreement.”

- Other broadcast talent owed money includes John Anderson for more than $16,000, Iwan Thomas for about $10,000, and Paul Swangard for more than $7,000. Other talent listed without dollar amounts include Sanya Richards-Ross, Matt Centrowitz, Trishana McGowan, Donald Smith, Steve Cram, and Tiara “Tee” Williams.

Creditors will be able to contest the amounts, including those whose debts are listed as “undetermined.”

The Michael Johnson Numbers

The four-time Olympic gold medalist and league founder is named throughout both filings, which show the clearest view yet of how much Johnson invested in and made from the league.

Johnson put more than $2.7 million into the league, the records show. Grand Slam paid back $500,000 of his loan, but still owes him more than $2.2 million for the rest of it.

“The filing clearly reflects the commitment of our dedicated founders making personal sacrifices to keep the business operating amidst significant financial pressure,” a spokesperson for the league said in a statement to FOS. “Despite the current situation, Grand Slam Track’s founders continue to work every day towards enabling the continued operation of the league for one reason only: because they believe in what the league can do for the sport of track.”

Additionally, Grand Slam owes its founder more than $17,000 in priority unpaid wages, roughly $206,000 in nonpriority unpaid wages, and close to $27,000 for travel reimbursements.

Altogether, Johnson is owed nearly $2.5 million.

A spokesperson for Johnson said as much last year when false rumors were swirling that Johnson had pocketed millions from the league. “Michael has actually put over $2 million of his own money into the project,” the spokesperson said in September.

The document also details how much Johnson made from the payroll throughout the league’s rise and fall. Johnson’s two paychecks in December of 2024 were roughly $11,600 apiece. From January through March of 2025, he made between $10,300 and $10,700 in each bi-monthly payments.

He didn’t take a paycheck for months, the filing shows. His next paycheck came at the end of August, the filing says, which was around the time of the emergency financing that promised to pay the league’s remaining employees. He received bi-monthly payments of roughly $3,100 each through the end of November, the last pay period before the initial bankruptcy filing.

Gera, the COO, is also listed throughout the documents. His unpaid wages are divided into $17,150 in priority unsecured claims and more than $172,000 in nonpriority unsecured claims. In addition to his paychecks, which also halted for several months, Gera was reimbursed for more than $50,000 for travel expenses in June, and nearly $20,000 for “reimbursement for payment of payroll for terminated employees.” That payment happened on Dec. 10, the day before the company filed for bankruptcy.