Paramount sued Warner Bros. Discovery in an attempt to obtain the rationale behind its recommendation that shareholders reject its takeover bid, saying the TNT parent is asking shareholders to blindly trust a Netflix deal that is “financially inferior” and “less likely” to close.

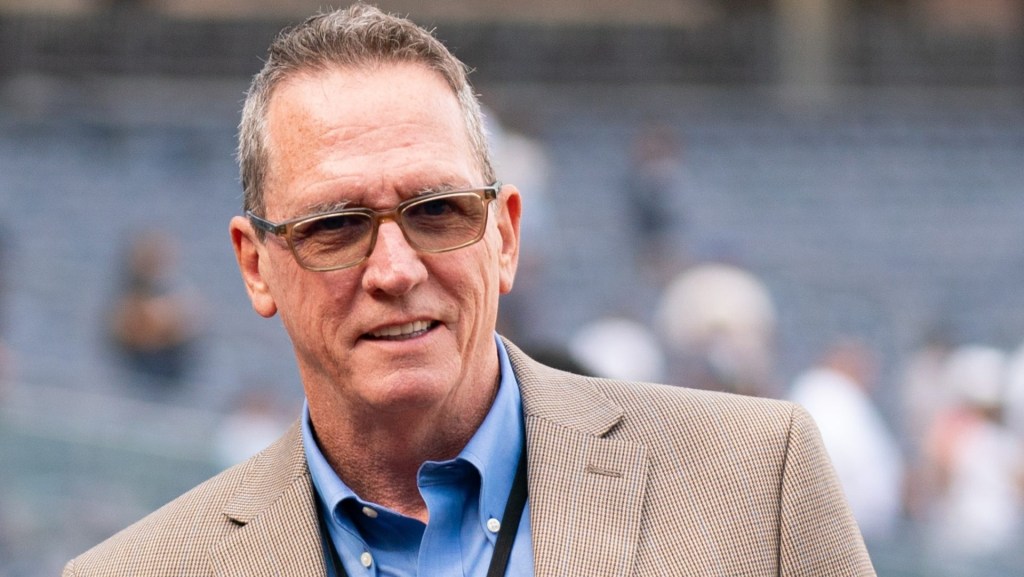

The suit from CBS Sports parent Paramount Skydance Corp., filed Monday in Delaware Chancery Court, names as defendants WBD, its president and CEO David Zazlav, and the individual members of the company’s board of directors. The suit, which claims breach of fiduciary duty, seeks to force WBD to rectify “misleading and incomplete” disclosures made through U.S. Securities and Exchange Commission filings.

According to Paramount, WBD has failed to disclose “basic, material valuation information” integral to shareholders making an informed decision about which deal to vote for, including the financial analysis and valuation math behind the board’s determination.

“There is no legitimate reason for the Board to withhold what it knows and considered in determining to recommend against Paramount’s facially-superior offer and in favor of its entrenched Netflix agreement,” the lawsuit says. “That is what the duty of disclosure requires.”

Paramount’s most recent offer of $30 per share carries an enterprise value of about $108.4 billion and would include WBD in its entirety. It includes a pledge from billionaire Larry Ellison to “personally guarantee $40.4 billion in equity financing and other commitments” (Larry Ellison is the father of Paramount chairman and CEO David Ellison.)

The Netflix agreement, valued at $27.75 per share, has an enterprise value of roughly $82.7 billion and would see Netflix buy WBD’s studio and streaming businesses, while WBD would continue with a planned split of the company. That scenario will create Discovery Global, a new holding entity that would house TNT Sports. The planned split, and the Netflix deal, are slated to close in the second half of 2026, and a new sports-centric streaming service is under development within TNT Sports and Discovery Global.

What Paramount Is Seeking

Paramount’s suit is narrowly focused. It does not aim to stop the Netflix deal—for now, Paramount is “seeking only disclosure of targeted material information,” although it noted it reserves the right to “seek further relief as appropriate.”

“We do not undertake any of these actions lightly,” Paramount said in a letter sent directly to WBD shareholders that was issued in conjunction with the lawsuit. “Make no mistake, our goal remains to have constructive discussions with WBD’s Board to reach an agreement that is in the best interests of WBD shareholders.”

The letter noted that Paramount plans to nominate directors for the WBD board ahead of its 2026 annual meeting—which is not yet scheduled—who would be in favor of the company considering its offer. If WBD calls a special meeting before then for shareholders to vote on the Netflix deal, Paramount will do what it takes to stop a deal from moving forward before shareholders are equipped with all the information they need, the letter said.

In addition to the complaint, Paramount filed a motion asking the court to expedite discovery and trial scheduling. “Time is of the essence,” Paramount said in the motion. “There is a live investment recommendation, and stockholders are being asked to tender their shares now.”

Paramount’s existing tender offer expires on Jan. 21, and “cannot be extended indefinitely,” the company said.

The lawsuit comes after WBD said in a series of regulatory filings last week that the U.S. Department of Justice would review its intended deal with Netflix, as well as the separate offer from Paramount. Meanwhile, Paramount wrote to a House Judiciary antitrust subcommittee that the planned deal with Netflix is “presumptively unlawful.”

WBD has repeatedly spurned Paramount since the bidding battle for WBD began late last year. In Monday’s suit, Paramount said “WBD has provided increasingly novel reasons for avoiding a transaction with Paramount, but what it has never said, because it cannot, is that the Netflix transaction is financially superior to our actual offer.”

Netflix declined to comment. A representative for WBD did not immediately respond to a request for comment.

Editors’ note: RedBird IMI, in which RedBird Capital Partners is a joint venture partner, is the primary investor in Front Office Sports.