The WNBA is experiencing another season with significant viewership and attendance growth, but looming over all its success are ongoing CBA negotiations.

The league and the Women’s National Basketball Players Association (WNBPA) need to agree on a new CBA before the end of the season or risk a work stoppage. However, the two sides appear to be far apart. WNBA All-Stars wore shirts that read “Pay Us What You Owe Us” ahead of the All-Star Game two weeks ago, following a meeting that union board member Breanna Stewart described as a “wasted opportunity.”

The biggest holdup in negotiations is in revenue-sharing. The 2020 WNBA CBA was the first time revenue-sharing was included, though it is far from the nearly 50-50 split between players and owners in the NBA. The WNBA needs to jump through several financial layers before players could get a chunk of the revenue.

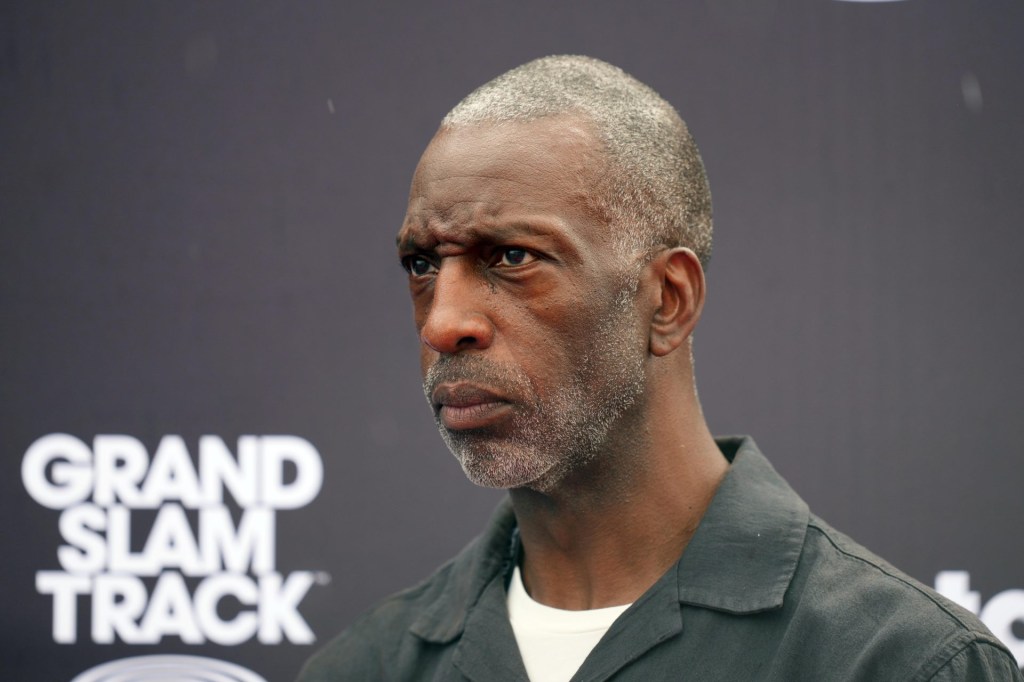

Tamika Tremaglio, the former executive director of the NBPA and a consultant on the last WNBA CBA, spoke to Front Office Sports about her thoughts on the ongoing negotiations.

This interview has been edited for length and clarity.

Front Office Sports: What was your role in the previous WNBA CBA negotiations?

Tamika Tremaglio: I was a consultant at the time. I was the managing partner of Deloitte in greater Washington. The NBPA had been a client for a long time, and we had done pro bono work for the W from 2015 on. I also was on their advisory council as well and then, in 2018, they retained us to assist with the CBA negotiations.

FOS: Were you at Deloitte when WNBA commissioner Cathy Engelbert was still working there?

TT: Yes. She, however, was working on the audit side while I was on the advisory side.

FOS: Does the increased TV deal justify the request of players for a more favorable revenue-sharing formula?

TT: We are seeing not only this $2.2 billion media deal but also 100% increases in viewership. The NBA is declining, and the WNBA is rising—and that also should play into it. If you also look at the valuation of the teams with the latest sales for $250 million, by all indications, it’s showing that the W is on the rise, and the players can see that the salaries are not growing incrementally with that.

FOS: It’s been widely reported that the league has lost money for a while. Does this factor into the pushback from their end?

TT: Some of the pushback is around sustainability. But the reality is that while this is occurring, there is no reason why the women shouldn’t be taking advantage of the growth. The new deal should continue this revenue-share model, but also give the players some benefit for the value that they bring to the game.

Essentially, what you would expect to see is you are taking into account to some extent the losses. In the last CBA, they did look at the losses from 2020 forward in determining revenue share. The league had to get to a certain amount for the players to receive revenue share.

For this new deal, they need to be much more creative in terms of a solution because just making it transactional is not going to be enough, because the players have shown their value. They have shown that as a result of the work that they have done that they should be compensated more.

However, where the rub is that nobody is talking about are these fixed costs that exist. There are certain costs that will happen regardless. And so the W has to continue to pay those fixed costs like salaries.

FOS: How much does the NBA owning 42% of the league factor into the CBA negotiations?

TT: That’s kind of what I was getting at on the fixed costs. That is a part of being part of this NBA machine. That’s the big marketing arm. They do a lot to promote the players. And so to some extent, there are going to be costs that have to be covered as well. And that is what makes this also a little bit more challenging.

I’m thinking of how to be creative: to some extent, the NBA viewership is declining a little bit and you have the W viewership increasing. Maybe we fill some of those TV slots with W as opposed to the NBA. Maybe that’s a creative way to bring more revenue in and then share that pie amongst other players.

FOS: Is there a conflict of interest with Unrivaled?

TT: No, I don’t think that there’s a conflict of interest. I think that you know they are all taking advantage of this incredible asset of women athletes. The time period for which they play does not conflict. In fact, I do see it as a good thing. I think that they both will continue to rise.

It gives the women another option, Instead of perhaps going to play internationally, they can play in Unrivaled, and we also know that they’re receiving equity in Unrivaled, which is phenomenal. The women now, they’re seeing through NIL, that they have some control over their income stream and how they market their own brand. They see that in Unrivaled, too. And that’s not happening in the WNBA.

FOS: What are the other important CBA rules other than revenue-sharing?

TT: They’re looking for practice facilities to be at a certain level for all teams. They should have state-of-the-art facilities that are the same as the men.

They’re also looking at retirement benefits. The retirement match on the 401K in comparison to the men is dismal.

Women also don’t have a one-and-done rule. They go four years of college and they can go get a full-time job where they can get the same or more than what they make in the W.

Tremaglio now works at consulting firm Secretariat as the managing director leading its global sports and consulting practice. She told FOS that she is not involved in the current CBA negotiations.

![[US, Mexico & Canada customers only] Dec 5, 2025; Washington, District of Columbia, USA; United States of America President Donald Trump, FIFA President Gianni Infantino and Canada Prime Minister Mark Carney watch from the stands during the FIFA World Cup 2026 Final Draw at John F. Kennedy Center for the Performing Arts.](https://frontofficesports.com/wp-content/uploads/2025/12/USATSI_27745262_168416386_lowres-scaled.jpg?quality=100&w=1024)