After more than two years of largely unanswered questions, Major League Soccer has given its first major indication on the performance of its media-rights deal with Apple. The disclosure, however, only amplifies the scrutiny around the groundbreaking, but much-debated, streaming pact.

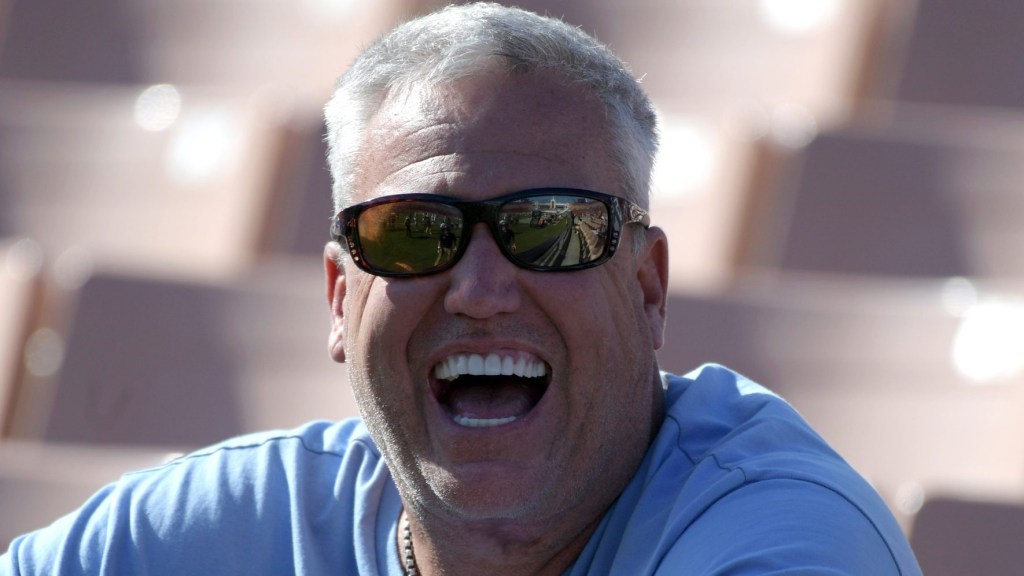

MLS commissioner Don Garber, in the midst of detailing accomplishments from the first half of the 2025 season, gave the first specific accounting late Wednesday of the average audience on MLS Season Pass games on Apple TV.

“The Apple deal has grown. We’re averaging 120,000 unique viewers per match,” Garber said. “That’s an increase of almost 50% compared to last year. Distribution has helped drive a lot of that.”

That figure—given as a matter-of-fact statement amid several other comments around the league’s large-scale schedule deliberations, competitive growth, stadium development, and other league issues—stunned many observers. After all, MLS has largely sidestepped all audience-related inquiries on the Apple deal’s performance since the league struck the 10-year, $2.5 billion agreement in 2022.

Additionally, many streaming-based sports broadcasts remain mired in opaque and often-confusing metrics. Only select outliers, such as Amazon’s Thursday Night Football coverage with the NFL, have aligned with Nielsen—the established, third-party leader in tracking viewership on linear TV and streaming, and a company expanding its measurement approach.

Garber, however, said that MLS and Apple agree that a heightened level of transparency is required to help bring the pact to the next level.

“We and Apple have been trying to figure it all out,” he said. “I know it’s frustrating for those who are looking for more information. We and Apple believe we need to start sharing some more information so you can start looking at what does it really mean. It’s the beginning, not the end.”

Bigger Issues

So what does Garber’s disclosure mean? On a surface level, the 120,000 unique viewers per match is far less than the 343,000 viewers per match that ESPN networks registered for MLS in 2022, the last year before the Apple TV pact started. That’s hardly a direct comparison, though. The latter figure is an audited one using the established methodology of average-minute audience in broadcast media, while the streaming one spans an entire match and does not have third-party certification.

Even Garber himself acknowledged that the league is wrestling with the proper means to evaluate the streaming audiences, particularly given the subscription-based economic model of Apple TV.

“What we’re struggling with, and I think what the industry is struggling with, is there has been no system to be able to evaluate how people are in a subscription service, how they’re viewing and consuming games, and what is the metric that matters most,” he said. “Is it average-minute audience? Unique viewers? Remember, we’re on a subscription service, which is very different than having your games available on a linear network.”

In the meantime, though, the league and Apple have pushed MLS Season Pass back somewhat towards linear TV, striking deals with distributors such as Comcast and DirecTV. The commissioner additionally noted how the MLS schedule greatly differs from many other North American sports leagues.

“Other leagues have a game of the night, game of the week, Friday Night Baseball on Apple TV,” Garber said. “All of our games, for the most part, are on Saturday, all up against each other. So when you have 120,000 unique viewers [per game] across that, that’s a lot of people. Aggregate all that. Depending on what week it is, you have over a million people that are unique viewers.”

Apple, for its part, will almost certainly need to embrace more established audience metrics as it looks to expand its presence in live sports, perhaps with new rights in Formula One and expanded ones with MLB.