On Thursday night, President Donald Trump met with House Republicans to hammer out the first budget of his second term. While his tax plans are still taking shape, press secretary Karoline Leavitt mentioned one thing that could have multibillion-dollar ramifications in sports: eliminating “special tax breaks for sports team owners.”

Under current law, sports owners are able to use their teams to save enormous amounts of money on their income taxes.

The main way owners save money on their tax bills is called “amortization.” Owners of sports teams can deduct the cost of buying a team over 15 years from their taxable income, thereby slashing the amount they have to pay tax on significantly—even if the team is profitable, or like nearly every major U.S. sports team, skyrocketing in value.

Amortization is commonly used by businesses that buy equipment that naturally depreciates in value over time—but in the case of sports owners, the deductions are for “intangible” assets such as player contracts and broadcasting rights.

For example, say a sports team is purchased for $6 billion. If the team’s tangible assets—like its stadium—came to $1 billion, then $5 billion of the purchase price could be amortized over the next 15 years. That essentially means the new owner can deduct $5 billion—more than 80% of the purchase—from their income over 15 years, significantly reducing their tax bill during that time, even if the value of the team is increasing.

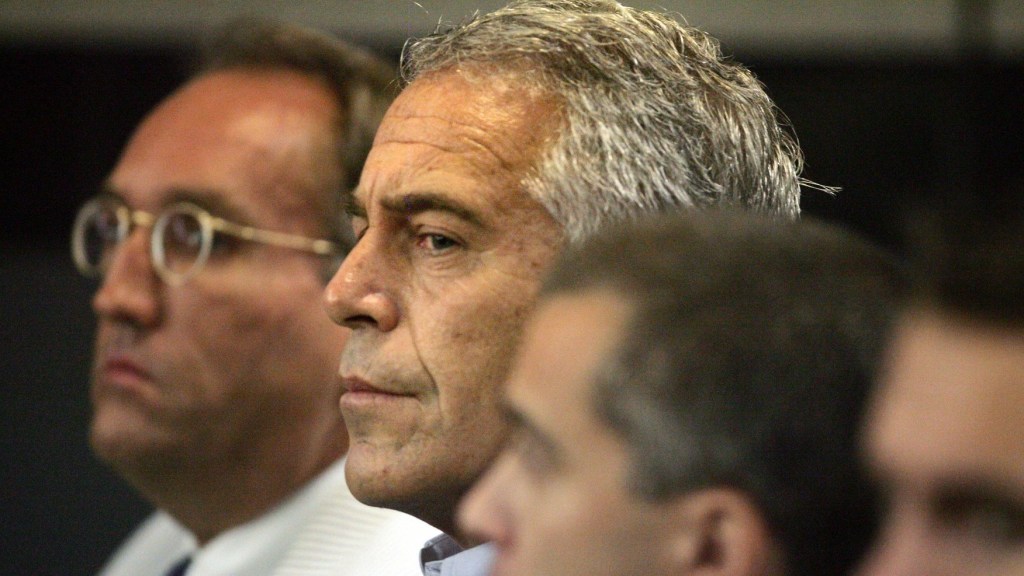

A 2021 ProPublica report found that Steve Ballmer, who bought the Los Angeles Clippers for $2 billion in 2014, saved about $140 million in taxes through this method. The former Microsoft CEO has a net worth of $120 billion, according to Forbes.

“While many other depreciable or amortizable assets do in fact decline in value, sport team values only seem to go up,” accounting firm EisnerAmper wrote in a post last year. Sports team valuations have skyrocketed over the last decade or so, and have shown no signs of stopping as the amount of premium teams remains finite. The average value of an NFL franchise in 2024 was $5.7 billion, up from $1.2 billion in 2013, according to a PwC report.

Neither Trump nor Leavitt gave specifics about which tax provisions the administration would change, but it may prove challenging to block sports owners from amortizing their purchases.

It’s a fundamental business tax rule, Joshua Horowitz, CPA and partner at accounting firm Withum, tells Front Office Sports.

“I’m not sure you can specifically carve out something for the sports space, if you can deny amortization for sports owners and not for other businesses,” Horowitz said. One of the reasons why—particularly with sports teams—the amount that can be deducted is so big is because the owner is essentially paying an upfront premium: They are paying for an NFL or MLB team, a public-facing entity that will generate significant revenue from media rights and ticket sales.

“With sports teams, you’re buying a lot of intangibles, like TV rights, so it ends up being a large number, and not a lot of tangibles outright,” Horowitz says. (“Intangible” is a technical term here, and broadcast rights and player contracts are considered intangible assets by the IRS.)

Last year under the Biden Administration, the IRS issued a memo indicating it would look more closely at whether owners of sports franchises are properly reporting losses. Sports teams often report losses, but the tax treatment of those losses differs depending on the type of owner. Some owners gain tax breaks by being an “active” owner in their team, which the IRS determines by the number of hours and extent to which the owner is involved in managing the team. In effect, a more involved sports owner can get better tax breaks than one who is not.

Owners can typically meet the requirement to “materially participate” by spending at least 500 hours per year by performing management duties. Just watching their teams play games does not count as material participation, says Horowitz, who adds that the IRS has done audits of owners to determine whether they’re active or passive.

Some teams are also set up as so-called limited liability companies, or “pass-through entities,” that have tax advantages over other types of business structures. Income and losses are passed down to the owners, so if the team reports a loss, the personal tax liability for the owner gets reduced. Pass-through business income also got large tax cuts in the Tax Cuts and Jobs Act that Trump signed into law in 2017.

And perhaps the most famous benefit to sports owners is publicly financed stadiums and arenas. Some cities have issued tax-exempt bonds to finance that construction, and one deficit-reduction group said this week that if Leavitt was referring to eliminating tax-exempt stadium bonds, the government could raise up to $100 billion over the next decade; that alone would cover nearly 2% of the cost of the tax cuts he reportedly has proposed.

Though Trump’s first term saw him in frequent culture wars with the NBA and NFL, owners in those leagues have a long history of backing his political career. U.S. sports owners tilt heavily Republican, and Mavericks owner Miriam Adelson gave the 2024 Trump campaign $100 million, surpassed by only Elon Musk.