Arctos Partners could be adding another team to its portfolio.

The investment firm is in talks to buy a minority stake in the Buffalo Bills, according to Bloomberg, adding the NFL franchise to its growing list of assets, which include Paris Saint-Germain and the PGA Tour.

A spokesperson for Arctos declined a request for comment. The Bills did not immediately respond to one.

Any purchase would not be finalized until it’s approved by the NFL, but Arctos is already on the list of private equity firms allowed to buy stakes in teams, which was approved in August. PE firms can buy up to a 10% stake in a team. Dolphins owner Stephen Ross is already taking advantage of the new rule, reportedly selling a 10% stake to Ares, another approved firm and 3% to Nets and Liberty owner Joe Tsai.

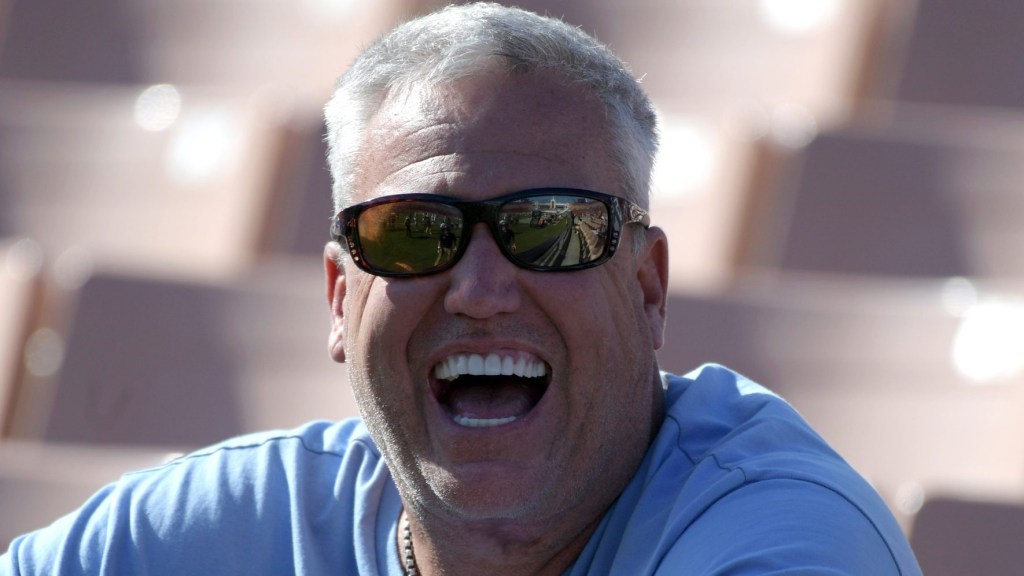

The Bills have been seeking a minority sale since April, when team owner Terry Pegula hired investment bank Allen & Company to explore a transaction. It’s unknown how much the stake is for and its valuation. The Bills are valued at $4.2 billion, according to Forbes, making the franchise the outlet’s least-valuable NFL team. Pegula, who made the bulk of his wealth in natural gas development, is worth roughly $7.6 billion.

In a statement to Front Office Sports, the Bills confirmed the Pegula family had hired Allen & Company “to explore the potential sale of a non-controlling, minority interest in the Bills. Since then, there has been a significant amount of interest, and our focus has been on finding the right partners for our organization. The process is ongoing, and any potential investor cannot be confirmed or finalized until it is approved by the NFL,” adding that the team and the Pegulas cannot comment further.

As investors scour markets for opportunities, sports has become a definitive asset class. As Arctos noted in a LinkedIn post last month, NFL franchises have consistently grown revenue at a rate of 8.6% a year since 2001 (except for the COVID-19 period). “Not only have they grown revenue, but have been able to do so with very low volatility … relative to other U.S. equity sectors and even done so during periods of economic weakness,” the company wrote.