The Paris Olympics began Friday with the expansive and unprecedented opening ceremony along the Seine river, kicking off the global event aimed at reviving the Olympic movement. But that heady ambition of the Paris 2024 Olympics is joined by similarly lofty goals within NBCUniversal and parent company Comcast for the Peacock streaming service.

As the traditional parade of nations took on a bold new form, albeit under rainy weather, Peacock began a coverage plan that will make the outlet a central component of NBC Sports’ entire coverage plan for the Paris Olympics. Overall, Peacock will offer more than 5,000 hours of live coverage from Paris, including all 329 medal events, marking by far the biggest presence yet for the platform in the three Olympics it has streamed.

Seeking Redemption

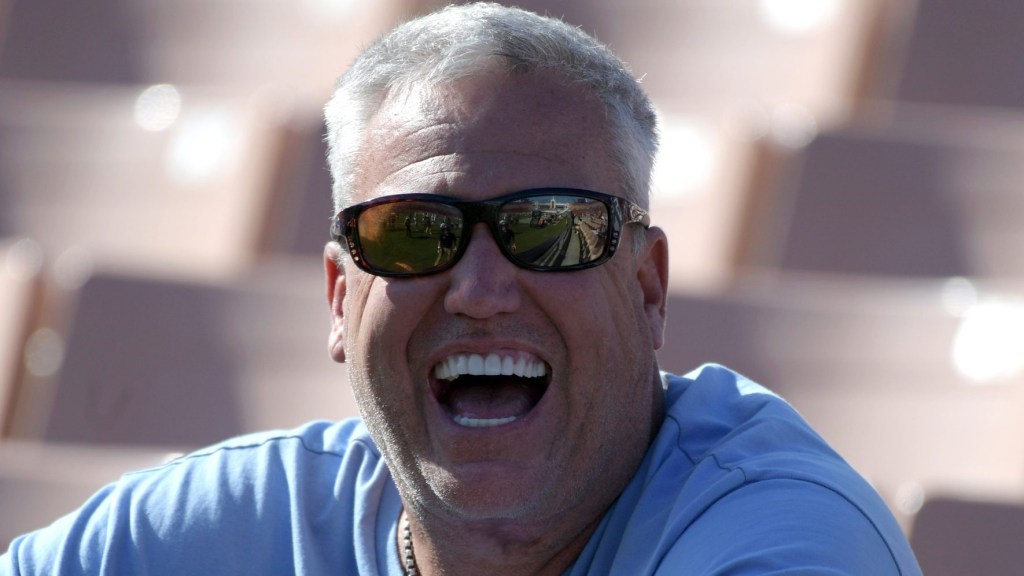

Beyond just coverage volume, though, NBCUniversal officials are looking to make good on its initial Olympic vision for Peacock—a strategy that saw the company’s efforts during the 2021 Tokyo Games and in Beijing a year later marred in part by technical glitches, user-interface problems, and incomplete programming lineups.

“Frankly, we didn’t do a very good job for our customers,” on Peacock for those prior Olympics, said NBCUniversal chairman Mark Lazarus. “We didn’t exactly deliver what we said we were going to deliver. We’ve learned a lot from that.”

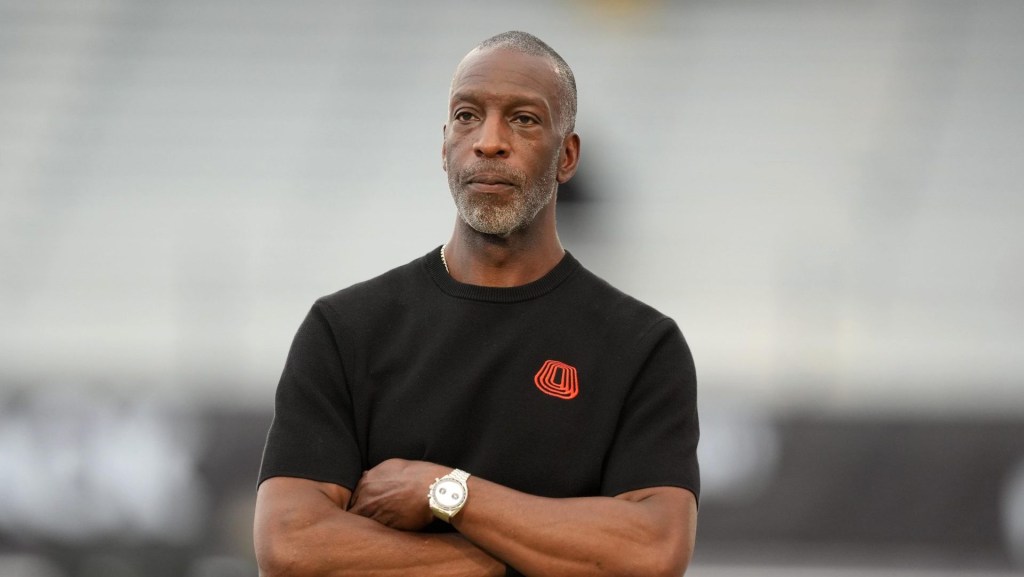

For Paris, conversely, the livestreams will be supplemented by a multiview option, as well as a whip-around show, modeled in part on NFL RedZone and hosted by that program’s iconic figure, Scott Hanson.

“This is the first time in history the consumer will have one comprehensive destination for all things Olympics,” said Kelly Campbell, president of Peacock and direct-to-consumer for NBCUniversal.

Bigger Pivot

NBCUniversal and Comcast, meanwhile, are looking far beyond just leveling up Peacock during the Paris Olympics. After setting a U.S. streaming record in January for an NFL wild-card game and then enjoying a subsequent boost in subscribers, Comcast reported Tuesday a surprising slip for Peacock from the first quarter’s 34 million to an updated figure of 33 million.

That total remains far below the comparable measures for many of Peacock’s general-entertainment streaming competitors, including Netflix (277.7 million), Disney+, (117.6 million), Max (99.6 million), and Hulu (50.2 million).

But in the effort to catch up, sports will be a critical component for Peacock. In addition to the full-throttle Paris effort, Peacock also figures heavily into NBC Sports’ new 11-year rights agreement with the NBA, and the network’s existing NFL deal is being further burnished with an exclusive stream of that league’s first game in Brazil.

“Sports has been a great source of [customer] acquisition for us in Peacock, and a great source of value for the consumer,” said Comcast president Mike Cavanagh in an earnings call with analysts. “But what’s very interesting to us is how significant the viewership is of sports viewers on Peacock of things other than sports.”

Peacock, meanwhile, last week implemented previously disclosed $2 monthly price increases that boost the price of the ad-supported version of the service to $7.99, and the ad-free one to $13.99.