It’s easy to play the hindsight game with stocks. If only you’d bought shares in Apple, Google, or Tesla in their early days. If you did, you might be doing as well as someone who invested early in a less obvious name: Monster Beverage.

Monster Beverage beat consensus analyst estimates every quarter last year. Last week, it reported record net sales of $1.2 billion in Q4, up 17.6% year-over-year. Its subsidiaries include Monster Energy, Nos, Full Throttle, and several other energy drinks.

Most of Monster’s growth came after it sold off the Hansen’s part of the business to Coca-Cola in August 2014. From there, Monster built its brand into a lifestyle centered around high-octane sports. It currently has a 39% slice of the energy drink market, second only to Red Bull’s 43%.

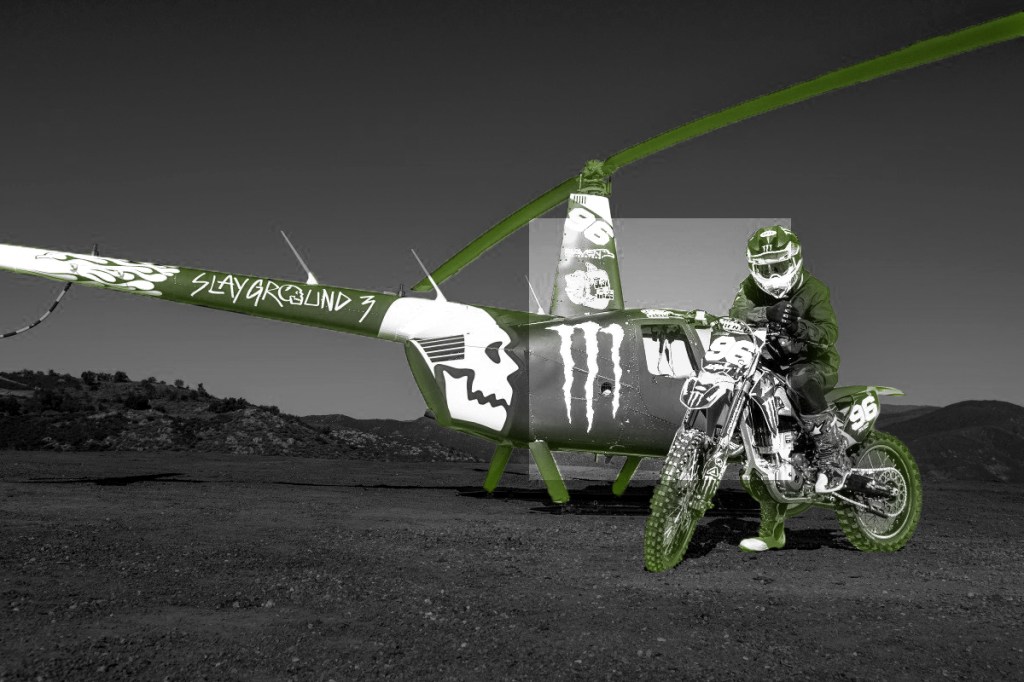

- Monster Energy is well-known for its sponsorship of sports like drag racing, wakeboarding, motocross, and many other competitions across water, snow, and land.

- Tiger Woods has played out of a Monster Energy bag since 2016, and NASCAR’s premier series was named the Monster Energy NASCAR Cup Series from 2017 to 2019.

- Monster also sponsors esports teams and has a development program for young athletes in outdoor sports.

Known then as Hansen’s, Monster went public in 1990. The juices and sodas it sold cost more than a share of the company, which was less than a dime per share until 2003. One hundred dollars of those shares would have sold on Friday for $87,740.

As of Dec. 31, 2020, Monster Beverage is holding $1.18 billion in cash and cash equivalents, along with $881.4 million in short-term investments, and $44.3 million in long-term investments.