LeBron James’ SpringHill Company is moving into new territory, backed by some of the biggest names in sports, apparel, and gaming.

The media company received a major investment — led by RedBird Capital Partners and joined by Nike, Fenway Sports Group, and Epic Games — at a $725 million valuation. Existing stakeholder UC Investments upped its stake. James and CEO Maverick Carter will maintain a controlling stake.

SpringHill plans to expand into new sectors, particularly gaming, and into areas outside of North America. It is eyeing investments in businesses, intellectual property, and content creators.

- The company said it would “work with Epic to bring unique content to the metaverse.”

- It is planning to “create original content in and around the sports, teams, and venues associated with FSG.” In March, James and Carter bought into Fenway Sports Group, which owns the Boston Red Sox, Liverpool, and Roush Fenway Racing.

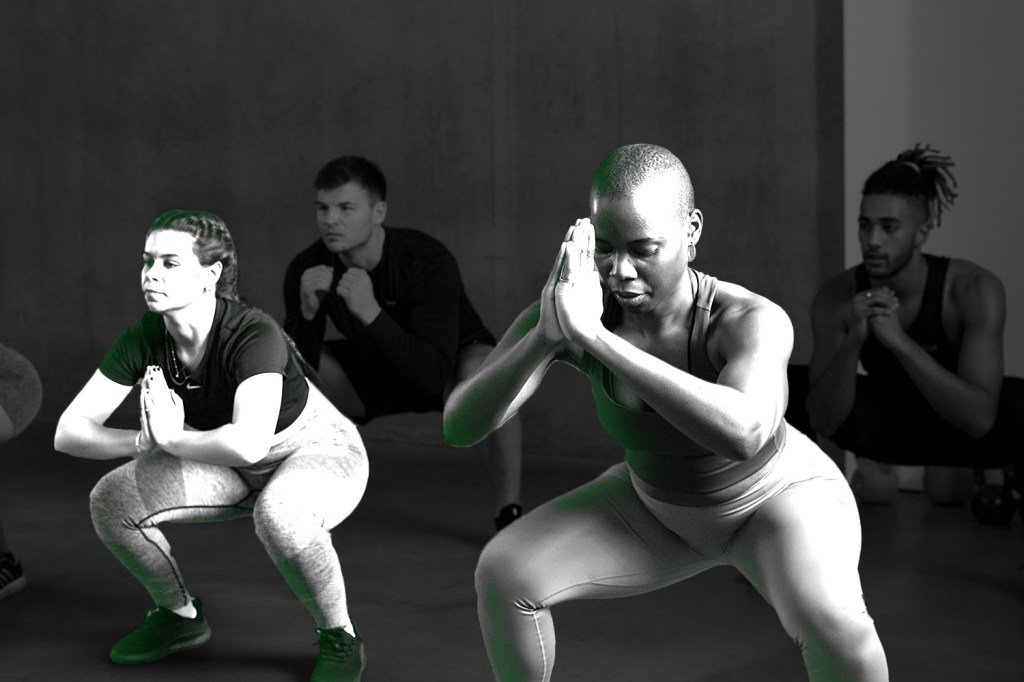

- SpringHill said it would expand its partnership with Nike around athlete storytelling.

SpringHill raised $100 million in June 2020 from a group that included Guggenheim Partners, UC Investments, and SC.Holdings. Serena Williams, Elisabeth Murdoch, and executives from Live Nation Entertainment, Apollo Global Management, and the Red Sox joined its board at that time.

The company is best known for “Space Jam: A New Legacy” and its UNINTERRUPTED network, which has produced content for HBO and Netflix.

Editor’s note: SC.Holdings is an investor in FOS.