Morning Edition |

October 24, 2025 |

|

|

The 2025 World Series pits the underdog Blue Jays against the big-spending Dodgers in a truly international showdown. As MLB steps onto the global stage, Toronto hopes to prove that David can still take on Goliath.

—Eric Fisher and David Rumsey

|

|

|

TORONTO — As the 2025 World Series has been billed as a David-versus-Goliath matchup between the financial behemoth Dodgers and the upstart Blue Jays, Toronto superstar Vladimir Guerrero Jr. leaned right in to the supposed mismatch dynamic.

“We all know who won that, right?” Guerrero said.

The underdog theme could also be applied to Major League Baseball itself as it enters the 2025 World Series, starting Friday, with arguably more momentum than it’s had in years as the league writes its own story of overachievement.

The season to date has featured an extensive series of increases across its core business, including with attendance and on television. MLB is also on the cusp of resolving its long-troublesome issue of the national media rights forfeited by ESPN in February, and an ever-increasing profile in the realm of pop culture. On-field rule changes such as the pitch clock continued to have an outsized impact on the game’s appeal, in turn paving the way for next year’s introduction of the automated ball-strike (ABS) challenge system.

After an often-scintillating 2025 postseason that included a series of epic on-field performances, such as Shohei Ohtani in the clinching game of the National League Championship Series, MLB doesn’t have the mega-attraction of the Yankees, last year’s American League champion, in the World Series. The league, though, does have its first truly international World Series since the Blue Jays’ last championship in 1993, and surging viewership in countries such as Canada and Japan.

Betting odds strongly favor the Dodgers to continue their torrid postseason run and claim MLB’s first back-to-back championship in 25 years. Blue Jays manager John Schneider, however, echoed the sentiments of his first baseman.

“The one thing we cannot do is look over there and say this is Goliath,” he said, referring to the Dodgers and a $416.9 million luxury-tax payroll that is the largest in MLB history. “That is a beatable baseball team that has its flaws, and that has its really, really good strengths. How we expose each of them will determine who wins this series. And I’ve got all the confidence in the world in my guys.”

Under the Surface

For all the feel-good vibes entering the World Series, however, there are still plenty of troubling issues for MLB heading into 2026.

The league and MLB Players Association will enter collective bargaining next year, in advance of a labor deal expiring next December. The union fears management will pursue a salary cap, tensions have already run high, and payroll disparities continue to grow, sparking widespread concern within the game and among fans.

The Dodgers’ unprecedented spending in particular is widely cited as something “ruining baseball,” something that manager Dave Roberts referenced directly last week, saying the team should win the World Series to “really ruin baseball.”

For now, though, the World Series begins with Toronto at a fever pitch.

“It means a lot to be here,” Guerrero said of the city. “We do this for the fans, and I feel so good and so happy to be here. We’ve been working really hard to make this happen, and now it’s really happening.”

|

|

|

|

|

Jarrad Henderson-Imagn Images

|

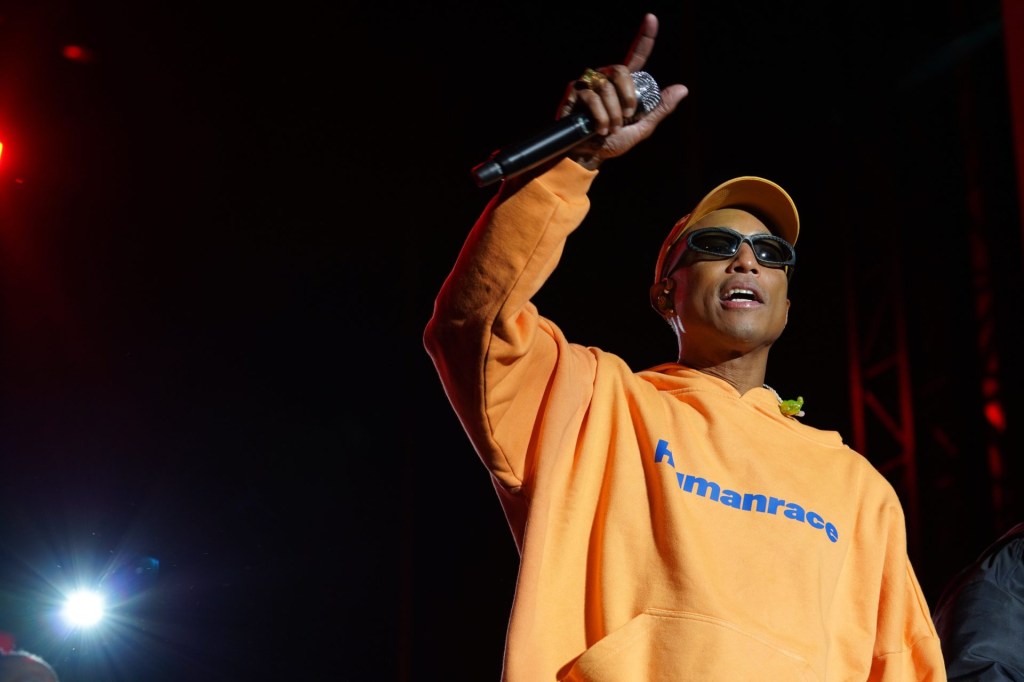

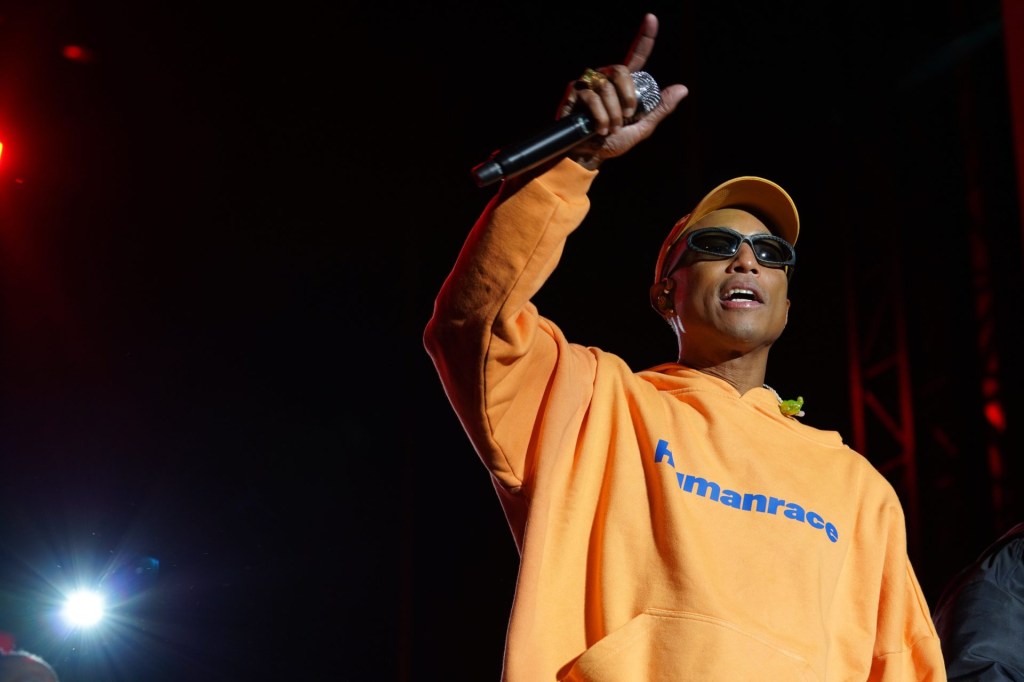

TORONTO — Major League Baseball is rolling out the red carpet—literally—to boost its celebrity profile during the World Series.

The league has scheduled a series of endeavors aimed at bringing its championship event further into the realm of pop culture. Among the specific plans:

- Famed musician and filmmaker Pharrell Williams will perform before Friday’s Game 1 of the World Series at Rogers Centre, along with Voices of Fire.

- The performance with Williams and Voices of Fire will involve Jesse Collins Entertainment, which also helps produce the NFL’s Super Bowl halftime show. It will also serve as a culmination of MLB’s postseason marketing campaign, “October Hits Different,” that featured Williams.

- Superstar pop group the Jonas Brothers will perform their hit, “I Can’t Lose,” during Saturday’s Game 2 during the league’s annual Stand Up to Cancer moment. The performance of the full song, which has become the campaign anthem, will bring that long-running, in-game recognition of cancer research and advocacy to a heightened level.

- The league has planned a red-carpet entrance at Rogers Centre to welcome celebrities, other VIP guests, and influencers. Some of those entrances will become social media content, leading up to and during the games.

Those efforts also build directly on the extensive pregame concert at the rain-impacted MLB Speedway Classic in August, featuring Tim McGraw and Pitbull.

“There’s no question that we’ve been much more deliberate in this area over the last couple of years, and are looking to hit another level here,” MLB deputy commissioner for business and media Noah Garden tells Front Office Sports. “With the music in particular, it goes hand in hand with us. I often joke that athletes always want to be musicians and musicians always want to be athletes.”

Garden did not disclose any names of confirmed celebrity attendees for Games 1 and 2 of the World Series, but he said “everybody that you would think would be there will be there.” Notable Blue Jays fans include Canadian rapper Drake, Rush front man Geddy Lee, and Arkells singer Max Kerman.

Earlier in the postseason, more than 100 celebrities, athletes, and influencers attended MLB postseason games, bringing a combined social-media following of more than 100 million. That group has posted 350 pieces of their own content, generating more than 200 million impressions.

Building on the Base

The moves arrive as MLB looks to accelerate what has already been a banner year for the sport on multiple fronts. Viewership of the league championship series set milestones in multiple countries, adding to audience lifts through every other part of the season to date.

The league’s overall fan base, meanwhile, continues to trend younger—something that the pop-culture-related efforts also seek to address. MLB’s average single-game ticket buyer this year was 43 years old, down from 46 two years ago. A similar downward trend exists on the secondary market, with an average buyer there of 39 years old, down from 42 in 2023.

Each of MLB’s national media partners, meanwhile, posted double-digit-percentage viewership increases this year in audiences ages 18 to 34.

“It starts with the game on the field,” Garden says. “Players are coming up [to the majors] faster now, making an impact quicker, and it goes hand in hand with what is happening among our younger audiences. You put it all together, it just lights the match.”

|

|

|

|

A murky situation around how local-market sports viewership is tabulated by Nielsen and reported has created a scenario in which both the YES Network and Sportsnet New York are still vying for supremacy in the nation’s largest media market.

SNY, which shows the Mets, announced earlier this month the team was “the most-viewed sports franchise on RSNs in New York across the board,” and said it averaged nearly 257,000 viewers per game locally for the Mets during the 2025 season—more than any other New York–area regional sports network, including the YES Network. The announced figures did not cite Nielsen, as is customary for any RSN or national network announcement of viewership, but were based on Nielsen tabulations of linear viewership.

YES Network, which shows the Yankees and is controlled by the Steinbrenner family who owns the club, said Thursday that it averaged 293,000 viewers per game for the Yankees, up 5% from last year. That also was a Nielsen figure, and was credited as such, and also included viewership data from its streaming through Gotham Sports, the app it operates in partnership with MSG Networks.

The YES Network figure conforms to the cross-platform reporting of viewership that is now standard across all of U.S. media, not just in sports. The RSN, however, did not make any comparisons to any other network in its viewership. Nielsen rules typically allow for one network to reference another in its viewership announcements, so long as the comparisons are on a strictly equal basis.

That is all but impossible for YES Network, however, because of Nielsen-related intricacies. The YES Network receives, and pays for, a separate Nielsen report of its Gotham Sports viewership to help report an accredited count of total audience delivery that is the industry standard, similar to what national networks do.

Because that supplemental streaming data is not broadly available to other Nielsen clients, such as SNY, making a direct comparison to other RSNs across all platforms is not permissible under Nielsen rules. Nielsen also does not measure SNY streaming at all, further limiting the ability for full, cross-platform comparison of viewership for the two RSNs.

SNY, meanwhile, did make comparisons to other networks, but only with regard to linear viewership. The RSN’s streaming data, which would not have Nielsen auditing and accrediting, has not been released, but network officials said it was “up substantially” in 2025.

YES Network did not comment beyond the announcement of its viewership figures. SNY, meanwhile, touted its own 23% rise in linear viewership, mirroring trends seen more broadly across baseball in 2025.

“We’ve seen a really healthy lift across baseball this year, and we’re very pleased to be a big part of that,” SNY president Steve Raab tells Front Office Sports.

|

|

|

|

|

Melina Myers-Imagn Images

|

As more money continues to flow into college football for players, the sport’s coaching carousel is spinning like never before—and getting more expensive each week.

The firings of Florida’s Billy Napier and Colorado State’s Jay Norvell pushed the buyout total for canned coaches this year to roughly $116 million, led by the $49 million Penn State owes to James Franklin.

Former Alabama coach Nick Saban, now a regular on ESPN’s College GameDay, said he’s not surprised by the high-priced moves. “Because everybody’s raising money to pay players. So, the people that are giving the money think they have a voice and they’re just like a bunch of fans,” Saban said this week. “When they get frustrated and disappointed, they put pressure on the [athletic directors] to take action, and it’s the way of the world.”

Heating Up

Heading into Week 9, several other coaches with large buyouts remain on the hot seat, Florida State’s Mike Norvell (about $54 million) and Wisconsin’s Luke Fickell (about $25 million), despite public statements of support from their respective ADs. The Seminoles are 3–4 (on a four-game losing streak) and the Badgers are 2–5.

Auburn coach Hugh Freeze (whose buyout is roughly $15 million) said a vote of confidence from his own AD “would be huge,” as the Tigers (3–4) are still searching for their first SEC win of the season.

There are just six weeks left in the college football season, which means more moves could be on the way soon.

This season has already turned out to be much more expensive than 2024, as 15 FBS firings either midseason or in the days immediately following the regular season accounted for only roughly $36 million in buyout fees.

In 2023, a record $118 million in contract buyouts was spent, led by the unprecedented $76.8 million cost for Texas A&M to fire Jimbo Fisher.

If Florida State fires Mike Norvell by season’s end, this year’s total could easily reach or surpass $200 million.

|

|

|

|

| A federal indictment suggests information about several teams was being sold. |

| The arrests of Rozier and Billups are just the latest scandal involving basketball. |

|

|

How many college football coaches will be fired after Week 9?

|

|

Thursday’s result: 76% of respondents plan to watch the World Series.

|

|

|