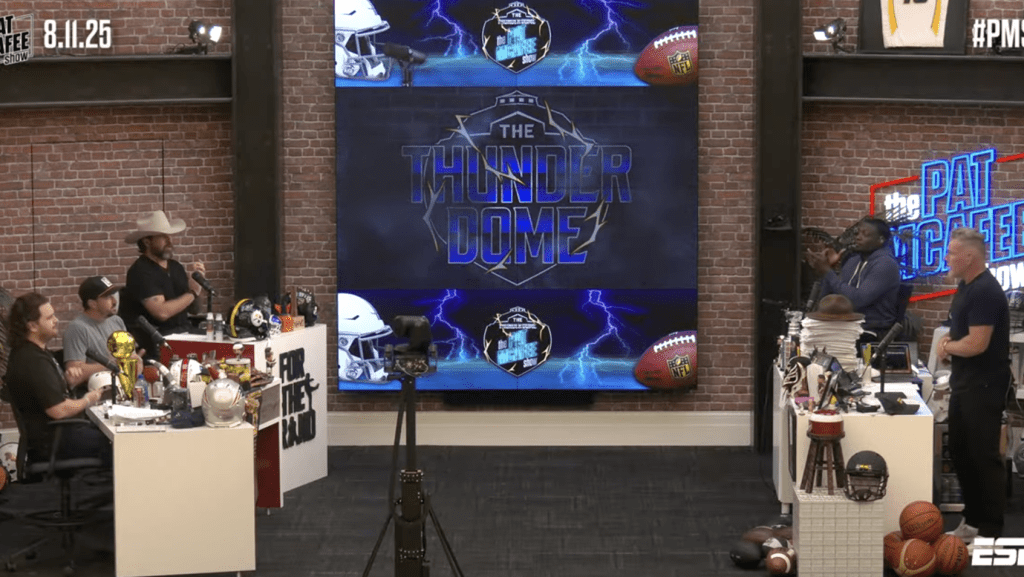

When Stephen A. Smith decided to rebrand his Know Mercy podcast as The Stephen A. Smith Show, the ESPN star spent nearly $2 million of his own money to build a state-of-the-art studio in New Jersey. When former Super Bowl QB Cam Newton decided to become a media mogul, he built a production studio in Atlanta, where he films his 4th&1 podcast/YouTube show. Shannon Sharpe films his Club Shay Shay in a stylish, high-tech set he had built at his home during the COVID-19 pandemic. The podcast expertise of Barstool Sports will be licensed by FS1 for a new weekday morning show. Like him or not, Pat McAfee set the template. He created a podcast/YouTube show, invested his own dough in an expensive Indianapolis studio nicknamed “The Thunderdome,” then licensed his bigger, better show to ESPN for $15 million a year.

Don’t look now, but top sports podcasts resemble sports TV shows and vice versa. The days of sports talent podcasting from studios the size of a closet are ending. Today’s top sports podcasts boast the production values of primetime talk shows filmed in Hollywood or New York. With their sprawling sets, stars can do just about anything their late-night counterparts do on ABC or NBC. The only things missing are live studio audiences. That’s next if Smith has his way.

Sports podcasts are being watched on TV screens as much as they are heard. Smith’s show now has 1.3 million subscribers on YouTube. McAfee has 2.87 million. Sharpe’s Club Shay Shay has more than 4 million. His interview with comedian Katt Williams has pulled in more than 90 million views on YouTube, generating 239,000 viewer comments. Consumers watched more than 400 million hours of podcasts per month on YouTube in 2024.

You can call them vodcasts, digital TV, or even streaming TV shows. Regardless, the word podcast doesn’t mean what it used to in sports, according to Ben Sosenko, founder of SRK Strategies, which works with some of the biggest podcast platforms—including Peyton Manning’s Omaha Productions, Colin Cowherd’s The Volume, and the Men in Blazers media network.

“In many ways, they are less like traditional podcasts and more like digital TV shows that are designed to be watched, listened to, and shared in whatever format the audience prefers,” Sosensko tells Front Office Sports. “The most successful brands don’t just publish long-form episodes. They break them into highly shareable moments, tailor content to each platform, and produce them with rich visual elements that keep viewers engaged.”

Video has always been easier to monetize than audio in media, notes Bleav president and executive producer Eric Weinberger. Utilizing high-quality video can help publishers triple or quadruple a show’s distribution.

“There’s such a higher ceiling level of revenue with video—and that’s not docking audio at all,” Weinberger says. “Over the last 15 years, audio has become the incubator of video talent. Even at Bleav, we go from an audio podcast to a virtual remote podcast. If it stands out, you start saying, ‘Let’s build a mini studio in your basement. Then it grows into a streaming TV show. In this digital world, there’s still exponentially more dollars doing video than there is just doing audio.”

There are no hard and fast rules—no single podcast strategy. ESPN let podcasters like Zach Lowe, Bill Simmons, Dan Le Batard, Colin Cowherd, and Ryen Russillo walk out the door to focus on their live game rights, noted Pablo Torre to Max Tani of Semafor. “If you were to collect all of those guys, and just do the math on that, ESPN legitimately let over a billion dollars walk out the door,” said Torre. “They missed, I would argue, the future of sports podcasting that was already in-house. But the economics of why they let it go was because it was still fractional compared to their actual interest.”

Travis and Jason Kelce often record their New Heights show, which boasts 2.6 million subscribers on YouTube, remotely. But rising media stars like Newton prioritize their shows for their YouTube audiences, according to Kevin Jones, founder and CEO of the Blue Wire podcast platform.

“Podcasting is becoming more visual. YouTube used to just be a place you could check out clips. Now a lot more of the consumption is happening on YouTube. The look and feel can create a larger audience,” he says. “The look and feel of a show can help clips go viral more. Cam built his own studio in Atlanta with sets. A lot of the future of podcasting is that way.”

ESPN’s Smith clearly feels the same way. When he dipped into his own pocket to build out a new studio for his owned-and-operated podcast/YouTube show, he was making a statement to ESPN, to advertisers, and to himself. According to The Washington Post, his new studio in Jersey City boasts all the “bells and whistles,” including four TV cameras, video screens, a late-night-style couch for guests, and photos of the First Take star with famous acquaintances like Magic Johnson and Taylor Swift. The thrice-weekly show has a staff of 15.

As Smith told Ben Strauss: “If you want to be viewed a certain way, you have to show them you can do it.”