The Buffalo Sabres haven’t made the Stanley Cup playoffs since 2010-11 and could average less than 10,000 fans for a full season, but they’re not going anywhere. A Pegula Sports and Entertainment executive put rumors to rest Monday, saying the team is not for sale.

|

|

|

|

Kirby Lee-USA TODAY Sports/Design: Alex Brooks

|

Last year, the NFL negotiated media rights deals worth over $110 billion. Now the league is exploring its own streaming service.

NFL Chief Media and Business Officer Brian Rolapp said the service — tentatively called “NFL+,” — is “under consideration,” but he added that the league continues to talk to companies to license those rights.

The service would allow users to stream games from mobile devices without a cable subscription, for a potential monthly price of $5.

- The service would include games, radio, podcasts, and team content.

- The league previously distributed in-market games for free on mobile devices in a deal initially exclusive to Verizon and later broadened to include all mobile carriers.

- The NFL also distributed games to tablets and laptops through Yahoo.

Rolapp said a decision to launch its own service for in-market games or license that content would occur well before the start of the 2022 season.

Bite from the Apple

The league is also looking to sell distribution rights to the out-of-market package “NFL Sunday Ticket” and a stake in NFL Media, which includes the NFL Network and NFL.com.

Both Amazon and Apple are interested in the media properties, and a deal for one of those could involve ties to NFL+.

Amazon won rights to “Thursday Night Football” in a $1 billion-per-year deal beginning this year and running to 2033.

Apple made its first leap into live sports in March with a seven-year for a package of MLB games worth $85 million annually.

|

|

|

|

|

Ligue 1/Design: Alex Brooks

|

France’s Ligue de Football Professionnel has agreed to a deal with CVC Capital Partners.

The agreement is reportedly for a 13% stake in the company that will facilitate a media rights sale — an allocation worth $1.6 billion — that would bring LFP’s commercial arm valuation up to $12.6 billion.

In meetings last week, both Ligue 1 and Ligue 2 approved a financial distribution system. Though the French governing body didn’t reveal terms, L’Equipe and RMC Sport reported LFP will receive $658 million by July, and that clubs will be split into three distribution tiers:

- Paris Saint-Germain will receive the largest cut of the investment at about $200 million.

- Lyon and Marseille will each get slightly under $100 million, while several other clubs, including Nice and Monaco, will receive about $87.7 million.

- A third tier of clubs will get about $36 million each.

The news comes just a week after exclusive talks between LFP and CVC Capital Partners were reported.

A Similar Deal

This isn’t the first time the private equity firm has dipped into European soccer — it also previously inked a deal with La Liga for $2.3 billion.

Three individual teams didn’t react as positively to the news as those in LFP, however. They filed a lawsuit soon after, which remains ongoing.

|

|

|

|

|

Joe Camporeale-USA TODAY Sports/Design: Alex Brooks

|

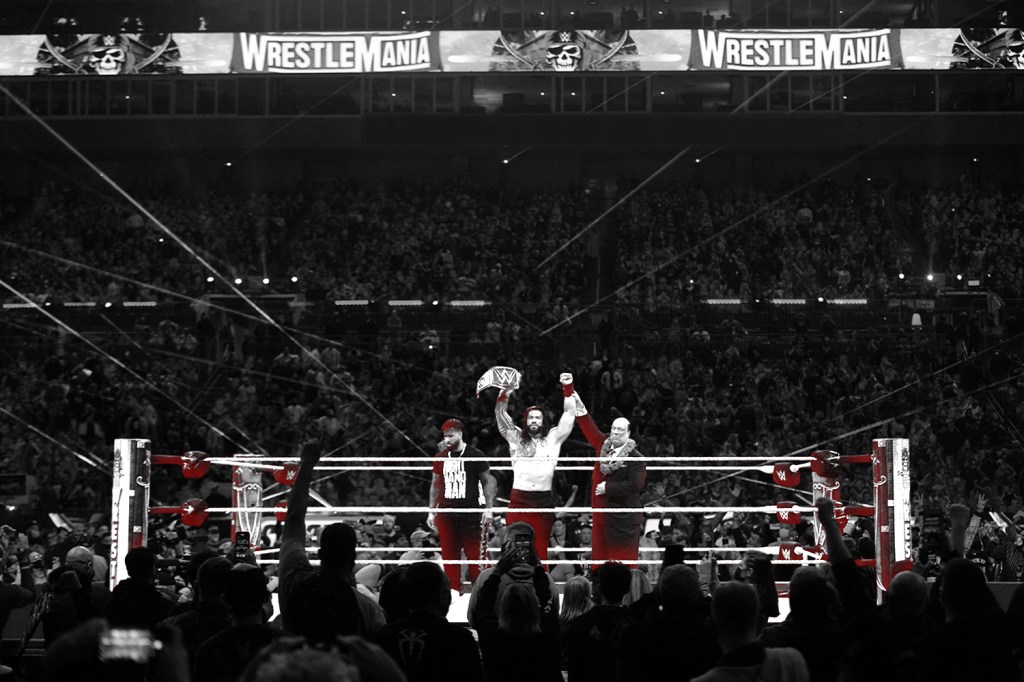

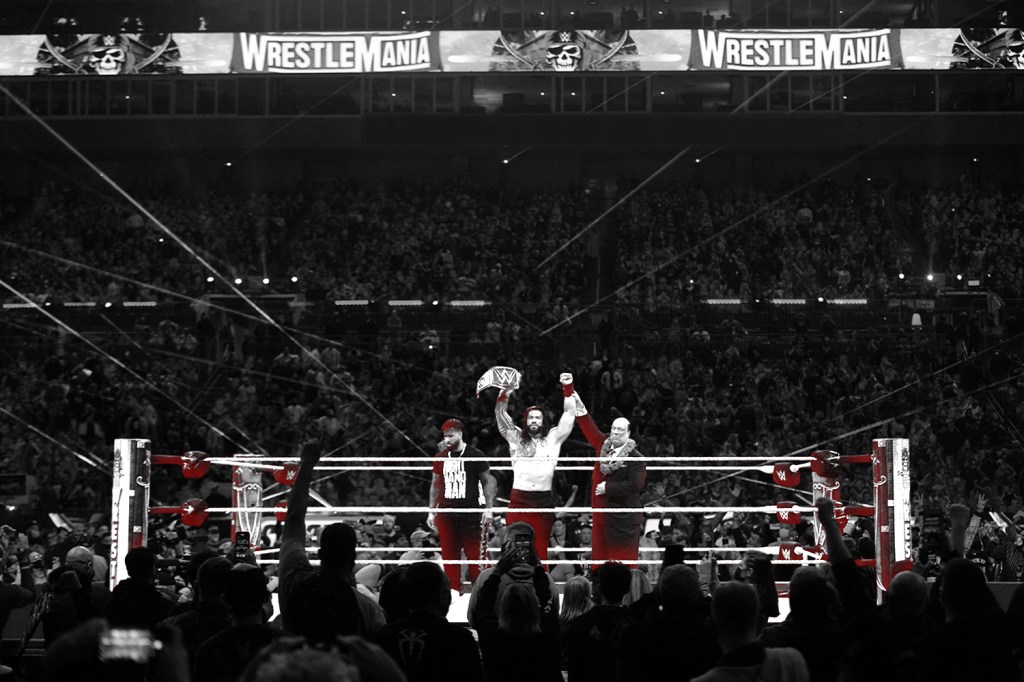

Fanatics is adding WWE to its roster in a long-term deal that will see the latter work with Fanatics Commerce, Fanatics Collectibles, and Candy Digital, the company’s NFT division.

The deal will be a “first-of-its-kind, all-in fan experience,” according to Fanatics CEO Michael Rubin. Financial terms were not disclosed.

WWE currently handles its commerce operations in-house, selling roughly $101 million in consumer products last year — an 18% increase from the previous year and 9% of the company’s total revenue.

Fanatics will relaunch the WWE Shop this summer.

- WWE will sell licensed merchandise designed and sold in a “real-time, on-demand” format based on WWE events’ live moments.

- Fanatics Collectibles, which acquired Topps trading cards for $500 million earlier this year, will become the exclusive provider of licensed WWE physical and digital trading cards once WWE’s existing rights with Panini expire. That multiyear deal was signed in October and is estimated to be worth at least $10 million.

- Candy Digital, which reached a $1.5 billion valuation in October, will become a primary NFT partner of WWE later this year.

WWE’s Upward Turn

The deal comes after WWE surpassed $1 billion in revenue for the first time in 2021, and just a week before WrestleMania, one of the most popular WWE events. Peacock, which purchased streaming rights to WWE last year in a five-year, $1 billion deal, announced new WWE content this week.

|

|

|

|

|

NAC Breda/Design: Alex Brooks

|

City Football Group now has 11 teams in its portfolio following the acquisition of Eerste Divisie soccer club NAC Breda.

Financial terms were not disclosed, but the deal was previously reported to be worth $7.7 million. The Dutch second-tier team’s shareholders opted to sell their stakes in the team as part of the deal — the team has been on the market since last summer.

The announcement comes nearly a year after CFG secured a seven-year, $650 million loan underwritten by Barclays to invest in its international soccer network.

- The company has reportedly been looking to build a $1 billion arena for New York City FC, its MLS team.

- CFG also organized a $138.2 million revolving credit facility, according to The Financial Times.

- In 2020, CFG secured $2 billion from Abu Dhabi’s sovereign wealth fund Mubadala.

The UAE’s deputy prime minister’s Abu Dhabi United Group founded City Football Group in 2013 and holds a 78% stake. CFG reached a $4.8 billion valuation in 2019.

CFG’s Big Picture

The most notable club on CFG’s roster is Premier League Champions Manchester City. The club passed Manchester United’s revenue for the first time ever last season, reaching $735.9 million compared to United’s $636.3 million.

NAC Breda adds to the company’s other clubs, which include Melbourne City, Yokohama F. Marino, Montevideo City Torque, Girona FC, Sichuan Jiuniu, Mumbai City FC, Lommel SK, and Esperance Sportive Troyes Aube Champagne.

|

|

|

|

- Crazy Sports, a China-based digital sports entertainment community operator, generated $65.3 million in revenue in FY2021, a 70% increase year-over-year. Its total number of users reached 48 million in 2021, a 50% uptick compared to FY2020.

- NHL deputy commissioner Bill Daly is expected to speak with the league’s general managers about extending the salary cap into the Stanley Cup playoffs. Daly will meet with NHL GMs on Monday and Tuesday in Palm Beach, Florida.

- Magic City Casino is working to save jai alai, a sport that originated in the Basque region of Spain and France. The Miami-based casino is the last place where jai alai is played professionally; Dania Beach Casino closed its courts after seven years.

- HBO Sports and NFL Films are partnering with the Detroit Lions for this upcoming season’s “Hard Knocks.” The five-episode season, the series’ 17th edition, debuts Tuesday, Aug. 9 on HBO and will also be available on HBO Max.

|

|

|

|

*All times are EST unless otherwise noted.

*Odds/lines subject to change. T&Cs apply. See draftkings.com/sportsbook for details. |

|

|

Are you a fan of Fanatics' expansive sports merchandising strategy?

|

|

Monday’s Answer

30% of respondents have purchased at least one pair of Kobe Bryant’s Nike sneakers.

|

|

|