Diamond Sports Group has shed most of its broadcast deals, cut payouts, and assumed two different naming-rights partners for its regional sports networks over the last few years. Its saga may be nearing a resolution, as the company faces a U.S. Bankruptcy Court judge this week.

One key partner monitoring the proceedings closely: Major League Baseball, which has objected to DSG’s reorganization plan and is unhappy with how the operator has treated its franchises. We’ll explain what’s at stake and how each of the 12 teams DSG televised in 2024 are affected.

—Eric Fisher, David Rumsey, and Amanda Christovich

|

|

|

After nearly two years of turbulence and many pronouncements of its impending demise, this is the week when Diamond Sports Group finally learns whether it will become a viable company once again.

The regional sports network operator is scheduled to go before a U.S. Bankruptcy Court judge in a hearing starting Thursday to determine whether its reorganization plan can be confirmed. If the plan is approved, the FanDuel Sports Network parent will have a new lease on life, marking a major turnaround after first filing for bankruptcy in March 2023.

If not, a wind-down of the company that has been expected in some corners for an even longer period of time will almost certainly accelerate.

There have been several key building blocks in DSG’s slow but steady reorganization. Among them are reworked rights deals with both the NBA and NHL, a restructuring of its debt and resolution of legal claims against parent company Sinclair Inc., a new naming rights deal with FanDuel for the RSNs, and a pending streaming distribution pact with Amazon.

The MLB Question

There has been one significant obstacle throughout the reorganization process, however: Major League Baseball. The league has been upset with DSG ever since it abruptly dropped its Padres broadcasts early in the 2023 season, and has been regularly critical of the company’s conduct, both in form and function, since then.

On Friday, MLB filed an expected objection to the reorganization plan, saying “there is a substantial likelihood that the debtors will find themselves in financial distress and/or bankruptcy court in the near future.”

That sentiment highlights a period of significant turbulence for the 12 MLB clubs that DSG televised in 2024. That group has since splintered in several directions, and most are grappling with at least a short-term hit in a critical revenue source—and possibly a longer-term one. The involved clubs’ paths include:

- Angels: The club is finalizing a return to DSG, something that’s been in negotiations for several weeks.

- Braves: This is the one team that has not seen any reduced rights fees to date from DSG, but the company’s assumption of Atlanta’s rights for 2025 was the foundation of MLB’s recent objection in bankruptcy court.

- Brewers, Guardians, and Twins: The trio last month struck separate pacts to have MLB produce and distribute their local games. The Twins, however, are also now up for sale. This group will join the Diamondbacks, Padres, and Rockies in the league-operated model.

- Cardinals: The venerable franchise renewed last week with DSG in a new, multiyear deal that reduces its rights fee by more than 20%.

- Marlins: Like St. Louis, Miami has renewed its ties with DSG.

- Rangers: The 2023 World Series champions have cut ties with DSG, and Texas is considering starting its own RSN, not unlike the new Victory+ that shows the neighboring Stars of the NHL. Completing a new-look local sports media situation in Dallas, the NBA’s Mavericks also are no longer with DSG and stream their games through MavsTV while broadcasting them over the air on Tegna stations throughout the region.

- Rays: This is still undetermined, but the local-media situation is hardly the largest of its current issues as the club also has both short-term and long-term facility problems.

- Reds: Cincinnati’s future landing spot is undetermined, but it also won’t be DSG as late Friday, the club finalized a pact to sell its equity in FanDuel Sports Network Ohio for just $1.

- Royals and Tigers: These clubs are in a similar, undetermined situation as the Rays. Any return to DSG would require a revised rights deal.

“We remain in discussions with our other MLB team partners on go-forward plans, and we are confident that our linear and digital framework drives maximum value,” DSG CEO David Preschlack said last week.

So while baseball’s hot-stove season focuses on players like Juan Soto and Roki Sasaki, there is yet another big piece of offseason drama due to unfold in the coming days.

|

|

|

|

|

Jeffrey Becker-Imagn Images

|

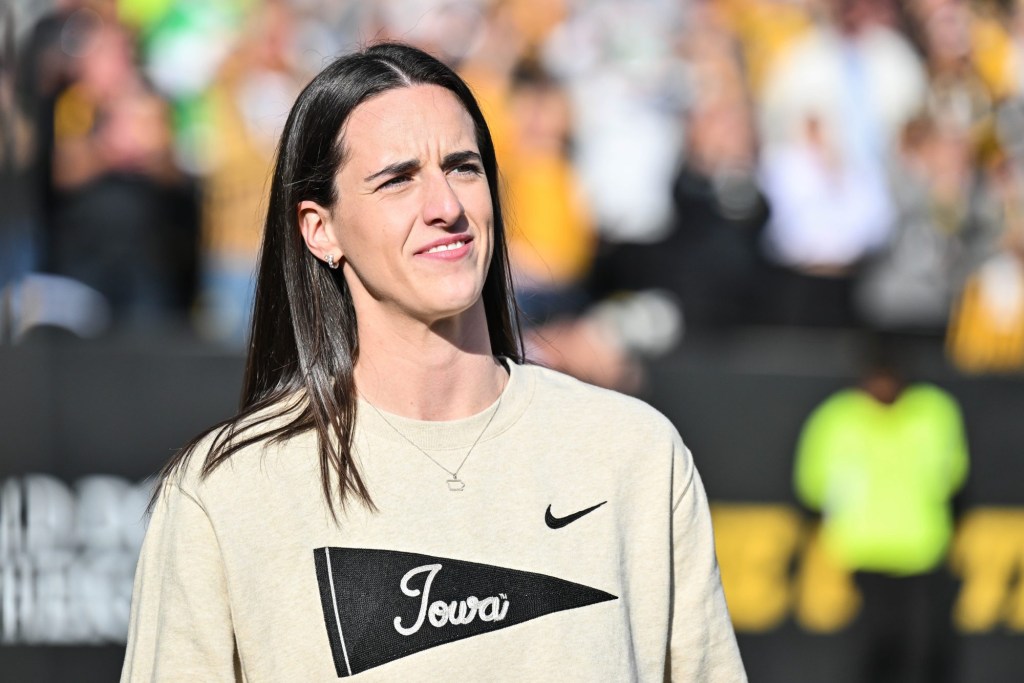

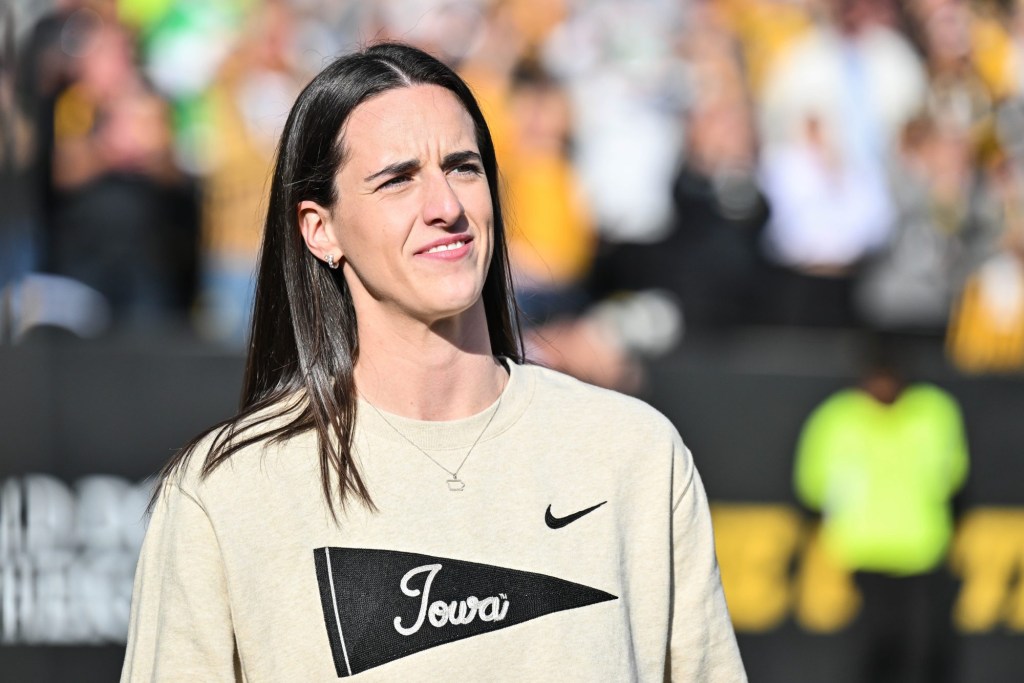

Caitlin Clark joked she would spend her WNBA offseason trying to become a professional golfer after the former Iowa women’s basketball star won Rookie of the Year, made the All-WNBA First Team, and helped set numerous attendance and viewership records across the league.

As she ponders a “Lionel Messi–like,” seven-figure offer to play in the new Unrivaled 3-on-3 women’s basketball league that will begin in January, Clark is getting the chance to show off her golf skills on the LPGA Tour, where she’s competing in Wednesday’s pro-am event ahead of this week’s event in the Tampa Bay area.

The tournament, officially named The Annika driven by Gainbridge, has seen a big boost in interest since announcing Clark’s participation last month. A tournament spokesperson tells Front Office Sports there was an increase in ticket sales ($25 for the pro-am day) after the Clark news.

Clark will play with No. 1–ranked Nelly Korda and tournament host Annika Sörenstam, winner of 72 LPGA events and 10 major championships. Before teeing off at 7 a.m. ET, Clark’s warmup range session will be livestreamed on social media.

While Clark’s full 18-hole round won’t be streamed or televised, Golf Channel’s studio show Golf Today is coming on the air at 11 a.m. ET, 90 minutes earlier than its typical start, and will include live tournament look-ins—likely including the conclusion of Clark’s time on the course. A mid-round walk-and-talk interview with Clark will also be livestreamed on social media.

On Tuesday, Clark—who has her own endorsement deal with tournament sponsor Gainbridge—will be a panelist at a women’s leadership summit at Pelican Golf Club, where the event is being played. That will also be livestreamed online.

Clark’s interest in golf has been growing in recent years. Last month, she posted a video on social media of her nearly making a hole-in-one. Last summer, she drew big crowds while playing in the pro-am of the PGA Tour’s John Deere Classic in Illinois. While at Iowa, the Big Ten Network posted several YouTube videos of Clark playing golf.

|

|

|

|

|

If the House v. NCAA settlement receives final approval in April, all Division I schools will be allowed to share revenue with players for the first time in history. Beginning in 2025, schools can pay up to about $22 million total to all of the athletes in their departments, and all power conference schools, as well as some others, are expected to participate.

But with revenue-sharing just a year away, schools are scrambling to figure out how to fund these payments—despite the fact they rake in well over $100 million, and in some cases more than $200 million, per year.

In October, the NCAA, one of the named defendants in the lawsuit, sent a brief FAQ to schools to explain the new rules set by the settlement. But the document, reviewed by Front Office Sports, did not provide guidance on how schools will pay for the revenue-sharing.

Many schools have begun soliciting donations from fans and alumni by reminding them the revenue-sharing program is looming. Others, like Ohio State, are considering more corporate sponsorships, including naming rights and jersey patch sponsors.

So far, the most popular idea appears to be adding fees to football game-day expenses.

In September, the University of Tennessee’s athletic department announced it would begin implementing a 10% “talent fee” on all football tickets. Athletic director Danny White expects to raise $10 million per year—close to half of the House revenue payments.

Arkansas has already begun charging a 3% fee on all football home-game concessions.

Fees for existing products are just the beginning. In November, UNC’s athletic department began selling alcoholic beverages, including beer and wine, at men’s and women’s basketball games and other sporting events taking place in Carmichael Arena.

Many athletic departments outside the existing Power 4 conferences, whose budgets in many cases don’t come close to nine figures, aren’t sure whether they’ll participate.

You can read the rest of Amanda Christovich’s story on schools’ preparation for the House vs. NCAA settlement here.

|

|

|

The second edition of the NBA’s in-season tournament begins Tuesday, now branded as the NBA Emirates Cup. We sit down with longtime league executive Scott Perry to discuss the process of the tournament coming together and how the NBA can continue building on last year’s major success.

Plus, we discuss how SMU’s move to the ACC has been wildly profitable, Jerry Jones’s comments about Mike McCarthy, and we hear the story of a boxing promoter turned baseball executive.

Watch, listen, and subscribe on Apple, Spotify, and YouTube.

|

|

| AT&T Stadium put up curtains for “WrestleMania” and The Eras Tour. |

| Where will the NFL go next? International expansion will only get bigger. |

| With Trump back in the White House, sports get more political again. |

|

|

Do you think Diamond Sports Group will emerge from bankruptcy?

|

|

Monday’s result: 37% of respondents said they like the NFL’s international push.

|

|

|