A lost college football season would cost the 65 Power Five schools at least $4 billion.

As many as 20 FBS athletic departments have announced pay cuts and furloughs to staff as schools have endured heavy losses without spring sports and March Madness. Conferences, meanwhile, are announcing scheduling changes and eliminating tournaments to help shave costs.

Approximately 50% of FBS athletic departments are self-sustaining, meaning expenses don’t exceed revenue and require student fees or university support to fill gaps. Without football revenue, only two schools – Georgia and Texas A&M – would meet that definition.

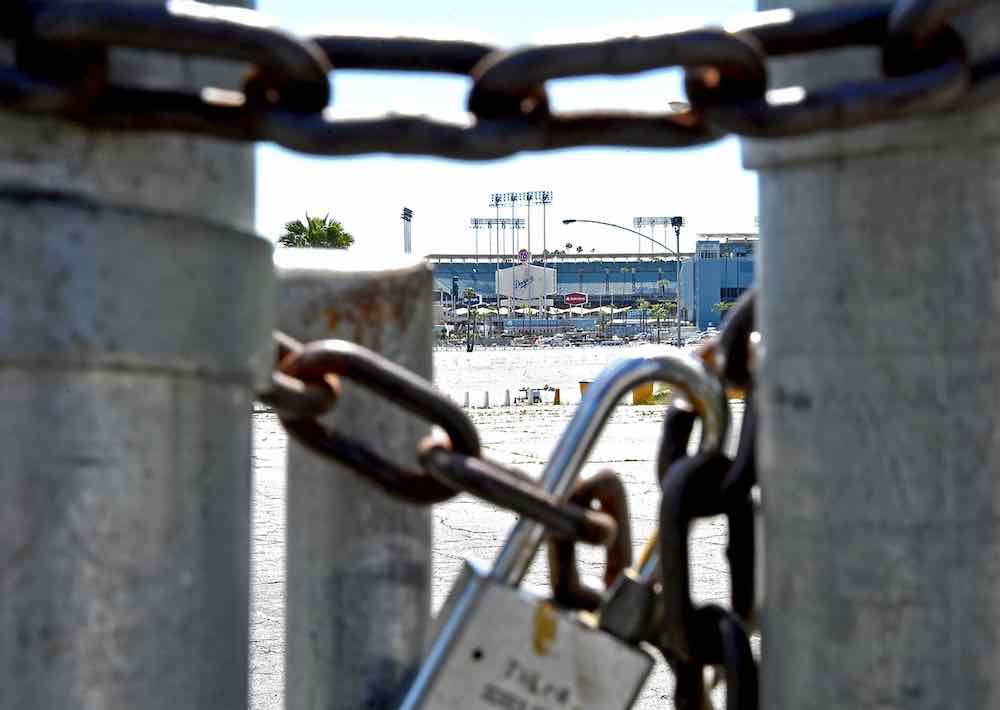

Implications of No Football Season

- At least $1.2 billion in lost ticket sales

- An average loss of $62 million for each Power Five School

- Football revenue accounts for nearly 50% of Power Five athletic budgets