Big-money media rights are the backbone of why pro sports franchises are worth billions. JPMorgan’s latest Sports Rights Almanac—its 10th anniversary edition—shows how the NFL and NBA keep pushing valuations to record highs while teasing the continued rise of streamers.

The 144-page document digs into media-rights deals across numerous pro sports leagues—from major U.S. sports to UFC and international soccer leagues. It outlines that rights inflation is still alive, but not every sport is bulletproof.

David Karnovsky, an executive director for J.P. Morgan Equity Research covering media, entertainment, and advertising, and one of the authors of the report, tells Front Office Sports that it has evolved significantly over time, and putting it together is no joke.

“The first Almanac included just five sports, and now we’re up to 15. So it definitely takes a lot longer to update,” he says.

When the first edition came out in 2016, media companies “didn’t really have streaming services” and the “only tech deal of note was a $10 million agreement between the NFL and Twitter for Thursday Night Football,” Karnovsky tells FOS. “There’s a lot more to cover now.”

Below, FOS explores three key takeaways from the report.

The NFL reigns supreme in the U.S.

The biggest takeaway is how completely the NFL dominates U.S. sports: The report notes that Super Bowl LIX drew 127.7 million viewers—the most-watched program in U.S. TV history—and 72 of last year’s 100 most-watched telecasts were NFL games.

That popularity underpins the league’s massive 11-year, $111 billion media-rights deal, which helps it command higher ad dollars than any other sport, according to the report.

The result is that franchise valuations keep soaring. The 49ers recently sold a total 6% stake in the team at a reported $8.5 billion valuation. Former New York Giants quarterback Eli Manning recently said he has been priced out of a potential minority stake in the team for which he won two Super Bowls. Last year, Forbes had the Cowboys as the first team to have an estimated value of more than $10 billion.

The NFL understands its power, which it uses to attain favorable terms. “Among leagues, the NFL uniquely flexes its power with media partners, extracting ongoing terms that are to its benefit strategically or financially, and sometimes to the detriment of rival sports,” the report says, citing Christmas Day games that directly compete with the NBA.

The NFL is not satisfied. Rumor has it the NFL intends to exercise an opt-out clause that allows it to exit most of the current agreements it has with partners Amazon Prime Video, CBS, ESPN, Fox, and NBC after the 2029 season (the deals are supposed to run through the 2033 season).

“That the NFL would want to revisit its 2023-33 media agreements is not surprising in our view,” the report says.

Aside from chasing a bigger payday, there’s an interesting rationale behind the NFL’s potential desire to opt out. Although the league commands the biggest rights check in sports, its cost-per-viewer-hour—just $1.37—is actually a good value for networks, the report says. That number means every hour one person watches costs the network $1.37, a figure the report says “sits in the middle of the curve” compared to other pro sports leagues and is largely offset by advertisers eager to reach that massive audience.

Karnovsky says among the biggest surprise trends from this year’s report was “the consistency of NFL viewership through so much change in media.”

The NBA is doing just fine

There was hand-wringing last season over the NBA’s lackluster ratings, but JPMorgan analysts aren’t concerned.

“The core value of the NBA rights are in the playoffs,” the report says, noting playoff games average up to three times the viewership of regular season matchups. “We estimate the Playoffs and Finals generate a ~50% increase in total viewer hours and are substantially more valuable for advertisers.”

The league’s new $77 billion media-rights deal with Disney, NBC, and Amazon, which kicks in next season, was “modestly better than our expectations” and positions the NBA to “transform its distribution.” Amazon gives the league a “pure digital partner,” while ESPN’s direct-to-consumer product and NBC’s Peacock expand streaming options. This opens up new ways to monetize, like sports betting integrations and alternative broadcasts similar to the NFL’s ManningCast.

JPMorgan is bullish on the NBA’s future, including its return to NBC (the report specifically acknowledged the decision to bring back John Tesh’s “Roundball Rock” song), as well as the deal with TNT to license Inside the NBA.

The NBA, like the NFL, is not having any franchise valuation issues. The Lakers just sold at a record $10 billion valuation, mere months after the Celtics sold at a $6.1 billion valuation. Even the team considered by Forbes to be the least valuable franchise in the league—the Memphis Grizzlies—has an estimated value of $3 billion.

Streamers still have more room to disrupt

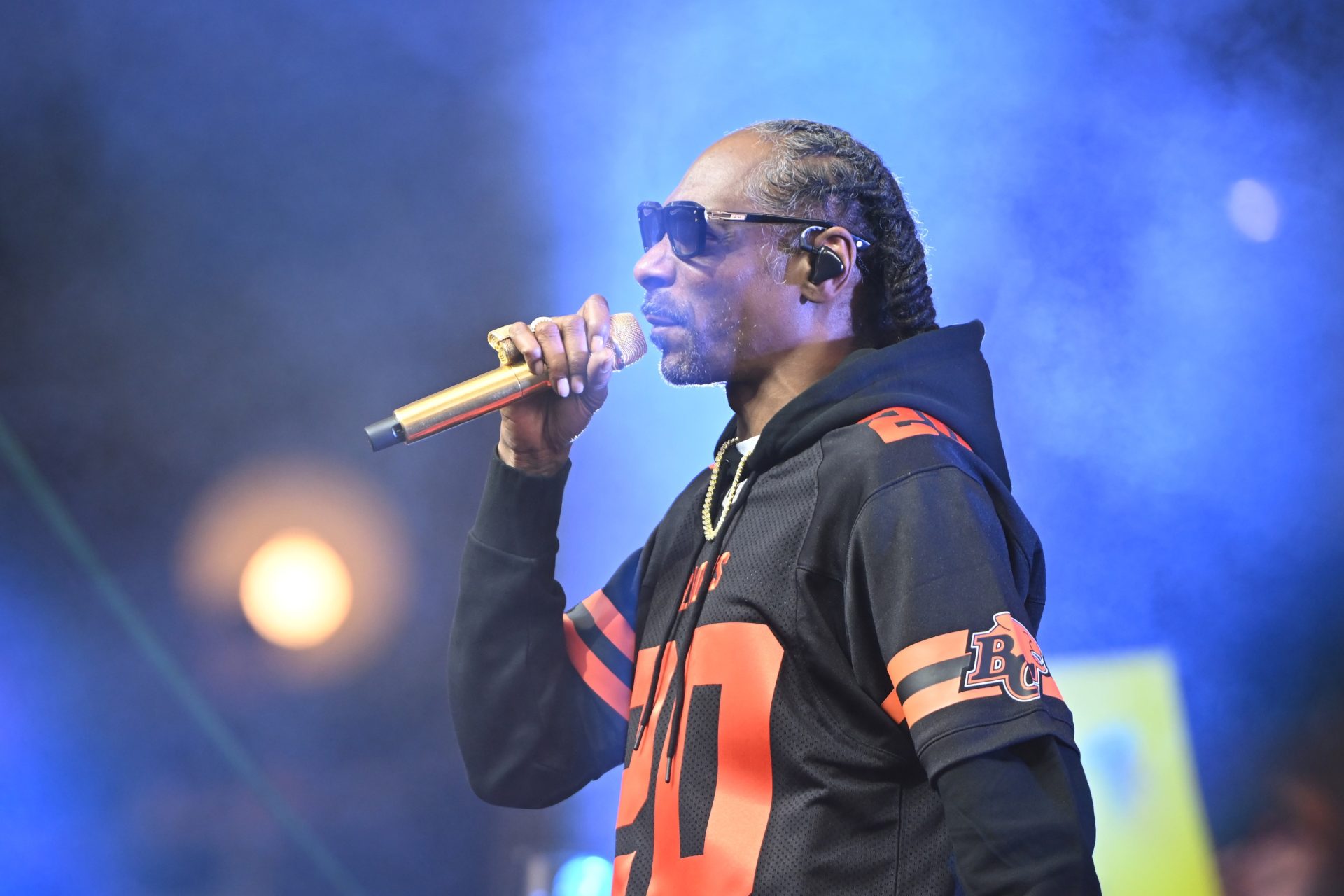

To date, Netflix, Amazon, and other streamers have done little more than dip their toes into the live sports water, but the potential impact remains huge. Netflix has hit big with live events such as NFL Christmas Day games and last year’s Mike Tyson–Jake Paul fight, while Amazon and YouTube TV have done well with Thursday Night Football and NFL Sunday Ticket, respectively.

Netflix co-CEO Ted Sarandos says the company will stick with marquee events rather than chasing full media-rights packages. Meanwhile, JPMorgan’s report notes that Warner Bros. Discovery doesn’t see sports as “critical,” and Hulu has “de-emphasized” sports rights.

“These platforms have historically disappointed leagues by not bidding aggressively for packages, instead prioritizing major event programming,” the report says—a stance JPMorgan finds “confusing given the scale of content investment elsewhere.”

At some point, streamers are expected to dive in headfirst. The collapse and tiering of regional sports networks (RSNs), highlighted by last year’s Diamond Sports Group bankruptcy, has upended local sports rights and left some franchises scrambling to find new ways to get games in front of local fans. Many teams have pivoted to direct-to-consumer streaming or free over-the-air deals.

JPMorgan’s report says the RSN meltdown is actually a “net positive” for national sports rights and makes robust national and streaming packages even more crucial to protect franchise values.

“Third-party data indicate 90% of viewers are now consuming sports on streaming, and we believe fans are gradually becoming inured to a digital experience, which in several cases we think can be superior,” the report said.

ESPN’s upcoming DTC product is expected to accelerate this shift, while Amazon’s new NBA deal covers 66 regular-season games—a “pivot point” that could spur more competition for rights, the report says.