The media-rights dispute between Warner Bros. Discovery and the NBA takes a highly combative new turn. … NBCUniversal and parent company Comcast have big ambitions both during the Paris Olympics and after for Peacock. … The competitive slump of Max Verstappen is reshaping Red Bull. … Big money is on the line this weekend across multiple golf tours. … Plus: More on Nike, On, London, and the NFL.

—Eric Fisher and Colin Salao

|

|

|

|

Ron Chenoy-USA TODAY Sports

|

The Warner Bros. Discovery–NBA battle has now formally reached the legal arena.

As increasingly expected, the TNT Sports parent company responded Friday, contesting the NBA’s rejection this week of its media-rights matching offer and subsequent deal with Amazon. The WBD lawsuit was filed under seal in the Supreme Court for the state of New York by the company’s attorneys from Weil, Gotshal & Manges LLP.

In a redacted complaint, WBD alleges the NBA breached their contract on three different fronts, and it is seeking both preliminary and permanent injunctions against the league to “enjoin the NBA … from granting [TNT Sports’] rights to Amazon or any other party.” The network also seeks a court declaration that it matched Amazon’s offer and is entitled to obtain those rights, as well as legal costs and “other relief as this court may deem just and proper.” WBD additionally is seeking unspecified monetary damages “if and to the extent that injunctive and equitable relief is not granted.”

In the complaint, WBD further accuses the league of “carefully and meticulously crafting the Amazon offer to circumvent [TNT Sports’] offer, including by agreeing to include provisions in the Amazon offer that the NBA believed [TNT Sports] and WBD could not and would not perform.”

The legal action by WBD arrives as the company faces increasing investor backlash, a sagging stock, and downgraded ratings from analysts due to the loss of NBA rights. As the network tries to retain its ties with a league clearly seeking to take its games elsewhere, the situation now is poised to become one of the most combative rights disputes in modern sports-media history.

“Given the NBA’s unjustified rejection of our matching of a third-party offer, we have taken legal action to enforce our rights,” TNT Sports said in a statement. “We strongly believe this is not just our contractual right but also in the best interest of fans who want to keep watching our industry-leading NBA content.”

Along similar lines, WBD added in the complaint that it “will suffer irreparable harm unless the NBA is ordered to specifically perform its obligations. Among other things, [TNT Sports] will lose the unique and valuable rights that the [matching rights] was designed to protect, the ‘halo’ benefits associated with telecasting such highly rated and successful content, its competitive advances with sports leagues and distributors, market share in the sports licensing market, immeasurable goodwill, and the substantial sums it has invested in building its NBA brand.”

The NBA responded to the suit Friday afternoon with a concise statement: “Warner Bros. Discovery’s claims are without merit and our lawyers will address them.”

Match or No Match

WBD is trying to match Amazon’s “C” package with the NBA, estimated at $1.8 billion per year, arguing it indeed has met those terms and that it “did not believe the NBA can reject” the latest TNT Sports offer. The NBA, however, contends that WBD’s matching rights do not apply to an all-streaming package such as what Amazon has acquired.

WBD seeks to counter that argument in the complaint, saying in part, “had [TNT Sports] and the NBA intended to distinguish between the way content was transmitted … as opposed to the way in which distributed content was viewed by the end consumer, they would have distinguished between ‘cable television,’ ‘internet television,’ and ‘satellite television.’ But they did not because that was not what was intended.”

As the league announced Wednesday a set of 11-year, $77 billion rights deals with not only Amazon but Disney and NBC Sports, it said that “Warner Bros. Discovery’s most recent proposal did not match the terms of Amazon Prime Video’s offer,” adding that “all three partners have also committed substantial resources to promote the league and enhance the fan experience.”

|

|

|

|

|

James Lang-USA TODAY Sports

|

The Paris Olympics began Friday with the expansive and unprecedented opening ceremony along the Seine river, kicking off the global event aimed at reviving the Olympic movement. But that heady ambition of the Paris 2024 Olympics is joined by similarly lofty goals within NBCUniversal and parent company Comcast for the Peacock streaming service.

As the traditional parade of nations took on a bold new form, albeit under rainy weather, Peacock began a coverage plan that will make the outlet a central component of NBC Sports’ entire coverage plan for the Paris Olympics. Overall, Peacock will offer more than 5,000 hours of live coverage from Paris, including all 329 medal events, marking by far the biggest presence yet for the platform in the three Olympics it has streamed.

Seeking Redemption

Beyond just coverage volume, though, NBCUniversal officials are looking to make good on its initial Olympic vision for Peacock—a strategy that saw the company’s efforts during the 2021 Tokyo Games and in Beijing a year later marred in part by technical glitches, user-interface problems, and incomplete programming lineups.

“Frankly, we didn’t do a very good job for our customers,” on Peacock for those prior Olympics, said NBCUniversal chairman Mark Lazarus. “We didn’t exactly deliver what we said we were going to deliver. We’ve learned a lot from that.”

For Paris, conversely, the livestreams will be supplemented by a multiview option, as well as a whip-around show, modeled in part on NFL RedZone and hosted by that program’s iconic figure, Scott Hanson.

“This is the first time in history the consumer will have one comprehensive destination for all things Olympics,” said Kelly Campbell, president of Peacock and direct-to-consumer for NBCUniversal.

Bigger Pivot

NBCUniversal and Comcast, meanwhile, are looking far beyond just leveling up Peacock during the Paris Olympics. After setting a U.S. streaming record in January for an NFL wild-card game and then enjoying a subsequent boost in subscribers, Comcast reported Tuesday a surprising slip for Peacock from the first quarter’s 34 million to an updated figure of 33 million.

That total remains far below the comparable measures for many of Peacock’s general-entertainment streaming competitors, including Netflix (277.7 million), Disney+, (117.6 million), Max (99.6 million), and Hulu (50.2 million).

But in the effort to catch up, sports will be a critical component for Peacock. In addition to the full-throttle Paris effort, Peacock also figures heavily into NBC Sports’ new 11-year rights agreement with the NBA, and the network’s existing NFL deal is being further burnished with an exclusive stream of that league’s first game in Brazil.

“Sports has been a great source of [customer] acquisition for us in Peacock, and a great source of value for the consumer,” said Comcast president Mike Cavanagh in an earnings call with analysts. “But what’s very interesting to us is how significant the viewership is of sports viewers on Peacock of things other than sports.”

Peacock, meanwhile, last week implemented previously disclosed $2 monthly price increases that boost the price of the ad-supported version of the service to $7.99, and the ad-free one to $13.99.

|

|

|

|

|

John David Mercer-USA TODAY Sports

|

On paper, Red Bull and Max Verstappen (above) enter the Belgium Grand Prix this weekend in a similar position as the last two years—with a sizable lead in the drivers’ and constructors’ championships to cushion the blow of a grid penalty to start the race.

But the air at the Circuit de Spa-Francorchamps feels different this time.

Verstappen and Red Bull are coming off a fifth-place finish at Budapest, the third race in a row that the Dutch driver failed to win, matching the total number of races he lost in 2023. While Verstappen overcame starting in the middle of the grid to win the last two Belgian GPs, he acknowledged the rest of the field has made up significant ground this year.

“It’s not going to be easy to recover from [the 10-place grid penalty] like the last two years,” Verstappen told reporters Thursday.

The race in Budapest was also marred by a team radio tirade from Verstappen and questions about his readiness after sim racing the night before the race.

“No mate, don’t give me that bulls*** now,” Verstappen said to his race engineer Gianpiero Lambiase on the team radio last weekend. “You guys gave me this f***ing strategy, O.K.? I’m trying to rescue what’s left.”

The three-time world champion said he won’t change his approach on the team radio, and he also denied reports he’s been barred from sim racing during race weekends. However, the Hungarian GP added another chapter in a tumultuous year for Red Bull, whose reign at the top of the sport is looking more precarious by the week.

Heavy Is the Head

Verstappen isn’t leaving Red Bull. He’s under contract with the team until 2028, and while there were rumors earlier this year that Mercedes was looking to poach him to replace the Ferrari-bound Lewis Hamilton, Verstappen confirmed in June he’s staying put, at least until next year.

The same can’t be said for his teammate, Sergio Pérez, who has fallen to seventh in the drivers’ championship after finishing right behind Verstappen last year. Pérez’s inability to keep pace with his teammate has limited strategy options for Verstappen, especially after McLaren utilized both its cars to prevail last weekend.

If Pérez continues to be outperformed by the two drivers at McLaren, Red Bull could find itself losing the constructors’ championship even if Verstappen manages to take the individual crown. A second-place finish would cut Red Bull’s prize money by somewhere in the range of $10 million, while also adding to the funds of the winning team.

There is speculation Pérez may be replaced before season’s end—though the discussion of which driver is next in line is also a touchy subject in the paddock.

On top of the team’s performance, Red Bull’s turbulent year started off the track after a female employee said team principal Christian Horner displayed “inappropriate, controlling behavior.” After a team investigation dismissed the claims in February, an anonymous source leaked documents that alleged some of his actions were sexually suggestive. Horner has kept his position at Red Bull—albeit with a lower profile—while the woman was suspended by the team.

As the new Formula One regulations set for 2026 threaten a change in the sport’s hierarchy, all eyes are on Red Bull in the back half of this season as it tries to remain at the top of the podium.

|

|

|

|

|

Front Office Sports tees up every weekend sporting slate with a ledger of the purses and prize pools at stake. Here’s what’s up for grabs this weekend:

PGA Tour, 3M Open, Minnesota

- When: Thursday to Sunday

- Purse: $8.1 million

- First place (individual): $1.46 million

LIV Golf, Uttoxeter, U.K.

- When: Friday to Sunday

- Purse: $20 million

- First place (individual): $4 million

LPGA, Canadian Women’s Open, Calgary

- When: Thursday to Sunday

- Purse: $2.6 million

- First place (individual): $390,000

|

|

|

Nike ⬇ The sports apparel company and sneaker giant is having a down year—and the hits keep on coming. Nike CEO John Donahoe said in February that the company would cut about 2% of its workforce, but a report in The Oregonian shows that as of May 31, 2024, the company is down 5% of its workforce compared to last year. The report also indicated that Donahoe took an 11% pay cut this year, as Nike executives are compensated based on company performance. The company’s stock is down around 32% since the beginning of 2024.

On ⬆ One of the contributing factors to Nike’s decline is the rise of smaller shoe brands such as the Swiss start-up. On is sponsoring a roster of 66 athletes entering the Paris Olympics, around three times more than it had in Tokyo in 2021. The names include back-to-back Boston Marathon winner Hellen Obiri and World No. 1 tennis star Iga Świątek (above).

London ⬆ Mayor Sadiq Khan wants more international sporting events in the city, including a push for the U.K. to bid for the 2040 Olympics. While some Olympic Games have left countries in financial distress due to the cost of building and maintaining venues, Khan said the U.K. has the infrastructure available to host. He also met with WWE executives Friday, expressing the “ambition” to bring WrestleMania to London in the future.

NFL ⬆⬇ Should the original verdict stand after appeals, the league is set up to pay more than $14 billion for losing a class action suit over NFL Sunday Ticket. The league generates the most revenue among all professional sports, but the penalty is large enough to put a dent in the pockets of team owners. Some of them are reportedly looking to pass on some of the fees to the players, according to ProFootballTalk. The NFL Players Association will likely have something to say about that strategy, as it’s strange that players would be penalized for a business plan they had no say over.

|

|

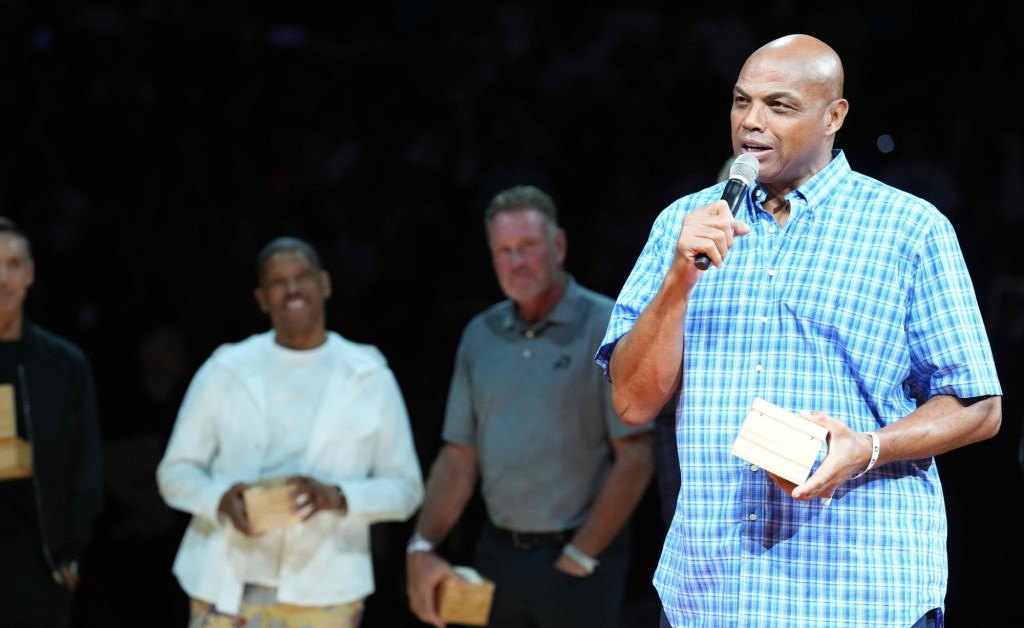

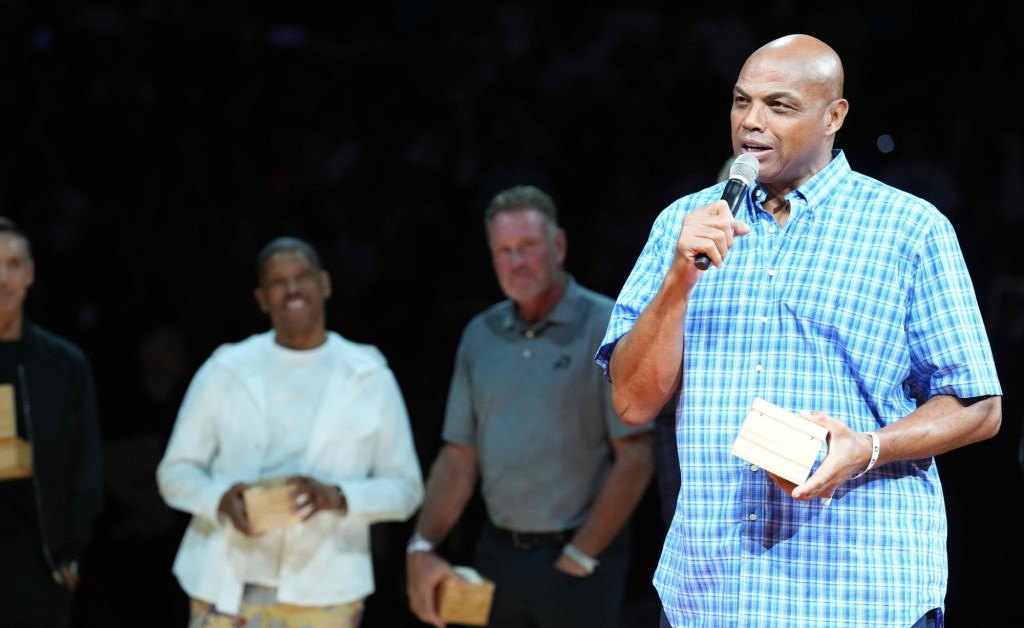

- Charles Barkley released a statement regarding TNT’s lost NBA bid, claiming the league and its owners “choose money over the fans.” Check out the full statement.

- Paris has prepared a long list of venues for the Olympics, with some even in other cities around France. Take a look.

- The Golden State Valkyries, the WNBA’s 2025 expansion team, set a women’s sports record with 15,000 season-ticket deposits. Check out the long line of fans.

|

|

| Warner Bros. Discovery’s nonchalant negotiating approach backfired. |

| Barkley appeared resigned to this season being the last for ‘Inside.’ |

| For Teahupo‘o’s locals, the Olympics are a mixed blessing. |

|

|