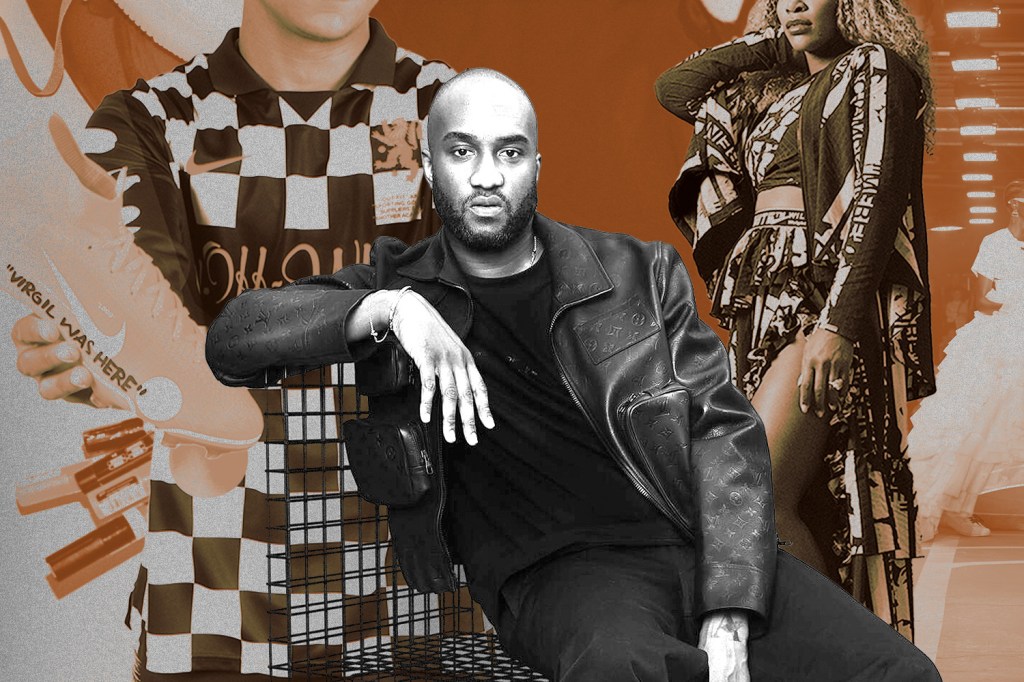

On Nov. 28, renowned designer and cultural icon Virgil Abloh passed away from a rare form of cancer — cardiac angiosarcoma — at the age of 41. Abloh, most famous for founding the streetwear brand Off-White and helming menswear designs at Louis Vuitton, was revered by many throughout the fashion, music, and sports industries.

Abloh first came to prominence as a creative director for Kanye West and was responsible for acclaimed album covers like those for “Watch The Throne” and “Yeezus.” He also DJ’d and helped propagate the streetwear craze with his early brands Pyrex Vision and Been Trill.

Then Off-White was founded in 2012, encompassing and evolving beyond his previous creative endeavors.

Off-White was born out of Abloh’s “3%” design approach, a premise that assumes a new design could be created with a 3% change to an original. His metamodernist aesthetic was akin to sampling — taking tenets from hip-hop’s remix culture to bring innovative products to life.

Abloh’s work with Nike is especially iconic and the foundation for much of his work within sports.

- 2017: “The Ten” collaboration between Nike and Off-White, in which Abloh reimagines 10 of Nike’s most iconic sneakers with new deconstructed models.

- 2018: Off-White partners with Nike and Kylian Mbappe before the World Cup to create a soccer capsule.

- 2019: Serena Williams steps on the clay at the French Open in a custom Off-White outfit.

- 2019: Nike and Off-White release the “Athlete In Progress” collection for women’s track and field athletes.

What will become of the brand now that its auteur is no longer with us?

Ownership Structure

In 2015, New Guards Group (NGG) — an Italian luxury fashion production and distribution holding company — became the exclusive licensor of the Off-White brand, though Abloh still owned the trademark.

Four years later, NGG was acquired for $675 million by FarFetch, another online luxury retail platform. This meant increased distribution capabilities and greater reach for Off-White, and Abloh’s brand equity remained intact.

Intangible assets — “indefinable” non-monetary assets — are a major indicator of Off-White’s value. In FarFetch’s financial statements, the 2021 balance sheet shows that over 61% ($1.3 billion) of the company’s total assets came from their brand value, an intangible asset.

One French conglomerate has been taking notes. In August of this year, LVMH bought 60% of the Off-White trademark from Abloh. Now, LVMH indirectly has control over a portion of FarFetch’s balance sheet.

- The licensing rights agreement between FarFetch and Off-White runs through 2026.

- With LVMH holding majority creative control of the brand, a transfer of licensing rights could be imminent.

The transfer would be a positive both for brand integrity and upholding Abloh’s legacy. Abloh was the first black creative director for Louis Vuitton and its parent has shown a strong commitment to the designer’s vision over the years. They should be a strong purveyor of the brand going forward.

Assuming that LVMH does retain the brand and continues to invest in Off-White, what is their potential upside?

The Streetwear Market

In 2019, PWC teamed up with online streetwear and fashion blog Hypebeast to conduct a comprehensive market study on streetwear. The executive summary touted the industry as “one of the most striking retail and fashion trends to have emerged in recent years.”

According to the report, the global streetwear market was estimated at $185 billion, or 10% of the entire global footwear and apparel market, at the time of publication. 54% of survey respondents said they spent between $100-$500 per month on their favorite brands.

- Average age of consumer was less than 25

- Average income was less than $40,000

- 61% of respondents were most likely to buy sneakers

- 40% of consumers stated their biggest influencers came from sports

- 65% of respondents said Off-White best represented streetwear

Over half of the participants were willing to spend 10% of their income on these goods, demonstrating an almost cult-like following.

As this cohort of consumers matures into their HENRY (high earner not rich yet) phase, there could be an explosion in the space, as capital shifts from legacy luxury brands to a more youth endemic product set centered around streetwear. Blockbuster deals like VF Corporation’s $2.1 billion acquisition of streetwear brand Supreme seem to cement that notion.

In 2020, the luxury fashion industry was estimated at $324 billion, per the Italian Luxury Trade Foundation. With shifting consumer preferences and expansion, it’s feasible that streetwear, once seen as simply counterculture, could become even more of a behemoth in the mainstream consumer goods space.

The Economics of Luxury

Most brands are governed by the basic economic laws of supply and demand. Flip open any economics textbook you’ll find the classic chart depicting an upward-sloping supply curve and a downward-sloping demand curve.

As the price of a good increases, the demand for it should decrease as buyers seek out more economically feasible goods. There are, however, exceptions to this rule.

Consumers see brands like Rolex, or Off-White, outside the purview of standard economic law.

The Veblen Effect, coined by American economist Thorstein Veblen, posits that as the price of a luxury good rises so does its demand.

- Streetwear changed the paradigm of what’s considered luxury.

- Abloh and Off-White have been instrumental in the evolution of that perception.

Sneakers, in particular, have taken on a life of their own, with entire exchanges built around the world’s most sought after footwear. Estimates from Statista indicate the global sneaker market will grow to $102 billion by 2025.

Sports, and the way Abloh’s vision of streetwear was embraced by everyone from Naomi Osaka to the NBA, cannot be separated from the story of this category’s unprecedented rise.

So much of the credit goes to Abloh’s prolific output and legendary work ethic. He created a brand of the highest caliber — a Veblen good — and his legacy persists on the court and the runway.

Thank you, Virgil.