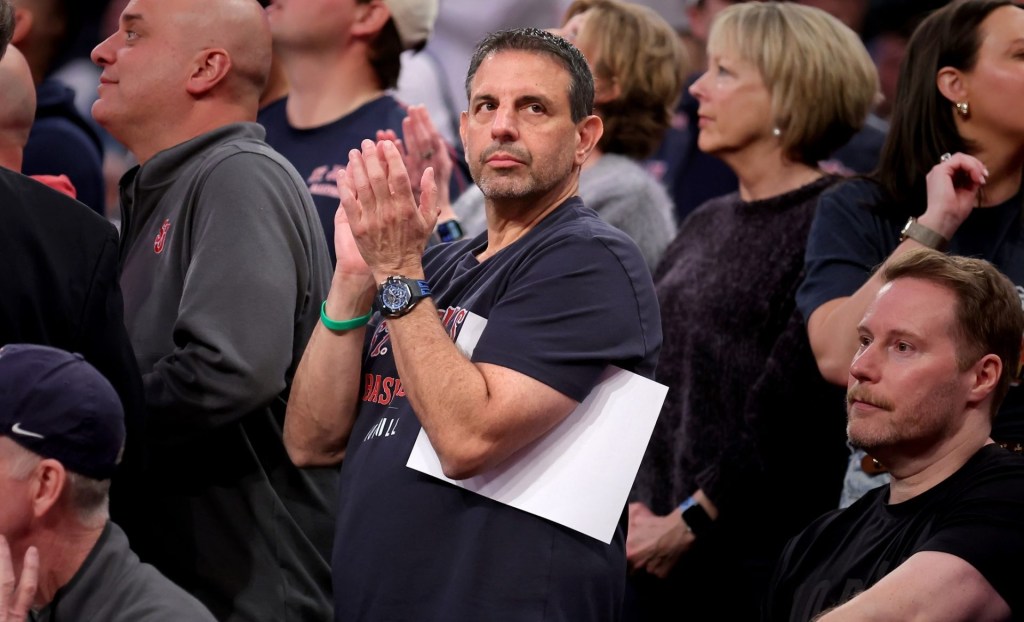

Mike Repole is adding the UFL to his growing sports investment portfolio.

The billionaire cofounder of Vitaminwater and Body Armor has made a major investment in the spring football league, making him a co-owner.

Impact Capital, Repole’s private-equity firm, will now “lead the league’s business operations,” according to a statement from the league.

“I think today is the first day of the United Football League,” Repole said on Front Office Sports Today. “It probably took a couple of years for them to get comfortable and have the right conferences and leagues. I think they learned a lot.”

Before Repole’s investment, Fox owned half the league, with the other half co-owned by Dwayne “The Rock” Johnson, Dany Garcia, and RedBird Capital Partners. A league spokesperson declined to comment on how the league will be structured after Repole’s investment, but said he will not be the league’s majority owner.

ESPN and Qatar’s sovereign wealth fund also have previously undisclosed stakes in the league. Qatar’s investment authority did not immediately respond to a request for comment.

Repole has a net worth of $1.6 billion, according to Forbes. He was credited for helping revive St. John’s men’s basketball by injecting his alma mater with millions to spend on players; the Red Storm won their first Big East title since 1992 in March. Now the UFL is hoping he can have a similar impact.

“He’s obviously a force of nature in so many ways,” UFL chief executive officer Russ Brandon told Front Office Sports. “His vision, strategy, marketing, brand-building, has a long track record of success.” Brandon will remain president and CEO of the league.

He joins the league after a disappointing second season that saw dips in ratings and attendance. Television viewership dropped 20% with an average of 645,000 viewers per game across Fox and ESPN-affiliated networks. Attendance dropped everywhere around the league except for Detroit, where the Panthers drew well in-state despite playing in an NFL market. Despite that, the league is also reportedly moving half of its franchises, including the Panthers, to new cities.

“We’re not looking to compete with the NFL,” Repole told FOS. “We’re complementing the NFL and riding off their momentum.”

The reported new destinations are Boise, Idaho; Columbus, Ohio; Orlando; and Kentucky. None of the new cities previously had USFL teams before the merger, though the Orlando Renegades played one season in the previous iteration of the USFL in 1985.

It’s not clear which team will move where. Repole told FOS one of his first moves will be to look at where the games are being played and possibly move them, including out of football stadiums.

“I think that partnering up with some of these MLS teams is going to be very, very exciting,” Repole said. “When we have 12,000 fans in a 60,000 [capacity] stadium, it looks like a COVID game. When you have 12,000 fans in a 15,000 [capacity] stadium, you’re basically sold out.”

Brandon said Repole’s investment isn’t a bailout for the league.

“I look at it completely differently,” Brandon said. “We’re going into Year Three of the UFL. When you look at our ratings and see over a million people touching our games and watching our games and a peak of two million, those are pretty powerful numbers. We’ve got a lot of work to do in local markets and the infusion of Mike and his team’s expertise that’s going to be one of our main efforts. We’re very pleased on what we have to build upon.”

Editors’ note: RedBird IMI, in which RedBird Capital Partners is a joint venture partner, is the primary investor in Front Office Sports.

—Ryan Glasspiegel contributed reporting.