A business backed by Arctos Partners is purchasing the Miami Marlins’ Triple-A affiliate and the Cleveland Guardians’ Double-A affiliate, marking seven total Minor League Baseball teams that have changed hands in the last week, all to buyers with private-equity connections.

Arctos is the lead investor in Prospector Baseball Group, the new platform that on Dec. 9 agreed to buy the Jacksonville Jumbo Shrimp (a Marlins affiliate) and the Akron RubberDucks (a Guardians affiliate). The RubberDucks were sold by Fast Forward Group founder and CEO Ken Babby, who is part of the group that purchased the Tampa Bay Rays—that $1.7 billion deal was unanimously approved by MLB owners in September.

Under league rules, Babby was not allowed to remain invested in the RubberDucks because they are not affiliated with the Rays, a source familiar with the matter tells Front Office Sports.

Arctos’s involvement in Prospector Baseball Group was announced Tuesday.

The private-equity firm’s entry into MiLB comes as it is in talks with private-capital giant KKR about a potential majority stake sale. Arctos mostly owns minority stakes in pro teams, including the NBA’s Golden State Warriors, Sacramento Kings, and Utah Jazz; the NFL’s Buffalo Bills; and MLB’s Houston Astros, San Diego Padres, and Los Angeles Dodgers.

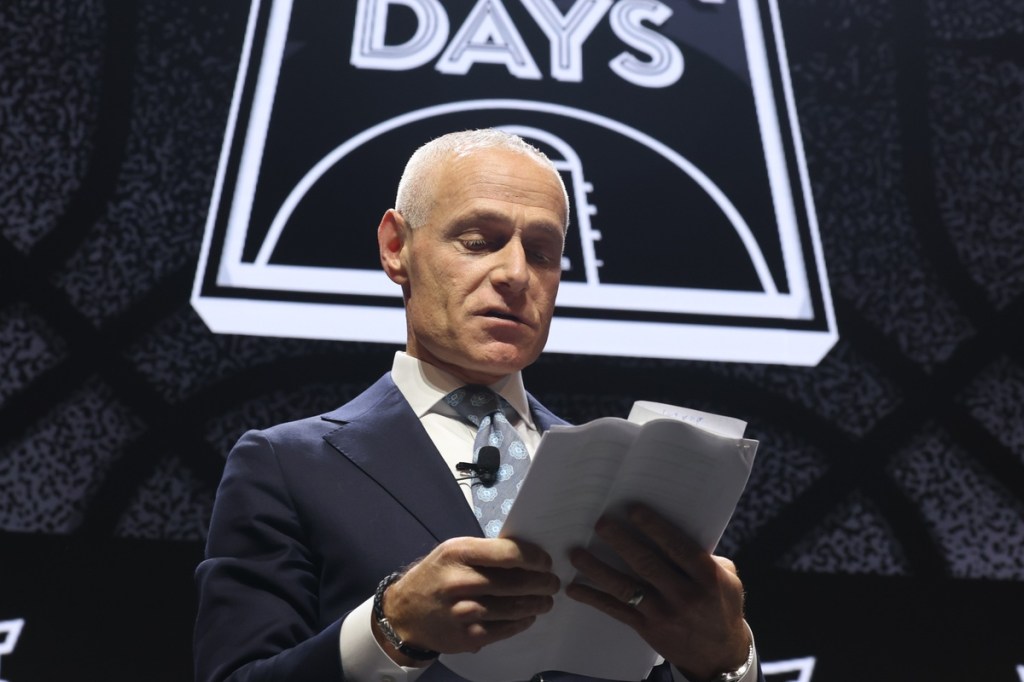

Doc O’Connor, cofounder and managing partner of Arctos, said in Tuesday’s press release that MiLB is a “powerful way to invest in local sports and strengthen the connection between teams, players, and their communities.”

Of the 120 total MiLB teams, at least 52, or more than 43%, have private-equity ties in ownership. Forty-eight of those 52 teams are owned by Silver Lake–backed Diamond Baseball Holdings. Diamond Baseball just added to its roster of MiLB teams last week with the acquisition of three Houston Astros affiliates: the Sugar Land Space Cowboys (Triple-A), the Corpus Christi Hooks (Double-A), and the Fayetteville Woodpeckers (Single-A).

Also last week, OnDeck Partners—a business under the umbrella of Marc Lasry’s private-equity firm Avenue Capital Group—agreed to buy the Montgomery Biscuits and the Visalia Rawhide; the Alabama-based Biscuits are the Double-A affiliate of the Rays, while the California-based Rawhide are the Single-A affiliate of the Arizona Diamondbacks.

MiLB teams are a cheaper way into sports compared to the pro leagues; MLB teams have an average value of $2.6 billion, according to Forbes. Financial details of most MiLB team sales are not disclosed, but no deal has been confirmed to reach even $100 million. The Triple-A Worcester Red Sox sold in December 2023 in an estimated $70 million deal, while the Triple-A Sacramento River Cats (and Sutter Health Park) were sold in 2022 for $90 million.