The most surprising aspect of the Buss family’s blockbuster deal to sell the Lakers to Mark Walter at a $10 billion valuation—which broke the record for a pro sports franchise sale by almost $4 billion—is that it isn’t really surprising.

The deal set a new benchmark for what a marquee franchise can command, significantly eclipsing the recently announced $6.1 billion sale of the Celtics. It may also have implications for future expansion fees and league ownership rules, experts say, although the exact effects won’t be clear for a while.

For now, the sports universe is still reacting to the news. The Lakers had been in the Buss family since 1979, when Jerry Buss bought the team, and other assets, including the NHL’s Los Angeles Kings and The Forum, where both the Lakers and Kings used to play, for a reported $67.5 million. When he passed away in 2013, the franchise went into a trust controlled by the six Buss children. In 2017, Jeanie Buss was installed as controlling owner after a contentious battle with her brothers that ended up in court.

Once the sticker shock of the $10 billion figure wore off, the reality of the current market for sports franchises set in.

“It was not hard for me to believe,” says longtime sports executive Dave Checketts. “The first thing I thought was ‘are we sure [Jerry Buss] is gone? To me, this sounded exactly like what he would do if he was going to sell the team.”

Tripp Crews and Tim Lee of business valuation and advisory firm Mercer Capital were also unsurprised. Although they believe the Lakers’ valuation is not very shocking, “caution is warranted when projecting the implied valuation of the Lakers onto other NBA teams.”

“Truly ‘premium’ brands in the professional sports space that could command this type of valuation are rare,” they tell FOS.

It is widely believed the Cowboys and Yankees are among the select group of teams that could surpass the Lakers’ valuation.

Jesse Silvertown, principal at forensic accounting firm The Ledge Company, tells FOS the valuation is “completely reasonable given the math and environment.” He also says to “keep an eye on what this means for potential NBA expansion fees,” which even before the Lakers deal were expected to reach as high as $5 billion.

NBA commissioner Adam Silver has not hidden from the NBA’s desire to expand—both with new teams domestically, including potential teams in Seattle and Las Vegas, as well internationally. In March, Silver announced the league is exploring a potential league in Europe with FIBA as partners.

Franchise Values Are Soaring

Franchise values have been on the rise, and recently it seems like each deal is breaking the record set by the last. Before the Celtics, the Commanders sold at a $6.05 billion valuation, and before the Commanders, the Broncos sold at a $4.65 billion valuation. The NFL has had recent minority investments valuing franchises in the $8 billion range (the 49ers and Dolphins), but the Celtics and Lakers stand as the two largest-ever change-of-control transactions for a pro sports franchise.

There are many reasons for the uptick in team values. For the NBA, the recent $77 billion media-rights deal that kicks in next season is a key factor.

Randall Boe, a senior counsel at law firm Akin Gump Strauss Hauer & Feld LLP, says the current state of NBA valuations can be traced back to the $2 billion sale in 2014 of the other Los Angeles franchise.

“The change in thinking that has really buoyed NBA valuations was when Steve Ballmer bought the Clippers,” says Boe, who previously served as EVP and general counsel for Monumental Sports & Entertainment—the holding company for Ted Leonsis’s sports assets, including the Wizards, Mystics, and Capitals.

“[Ballmer’s] reasoning was, ‘I have the money, this is an asset I love, and there aren’t that many of them,’” Boe tells FOS. “If you want to look at winners today, Steve Ballmer’s got to feel pretty good.”

Scarcity of Assets, Scarcity of Buyers

It’s correct to say there aren’t many of these assets; the NBA has 30 teams. Not only is there a scarcity of teams, however, there’s a scarcity of buyers.

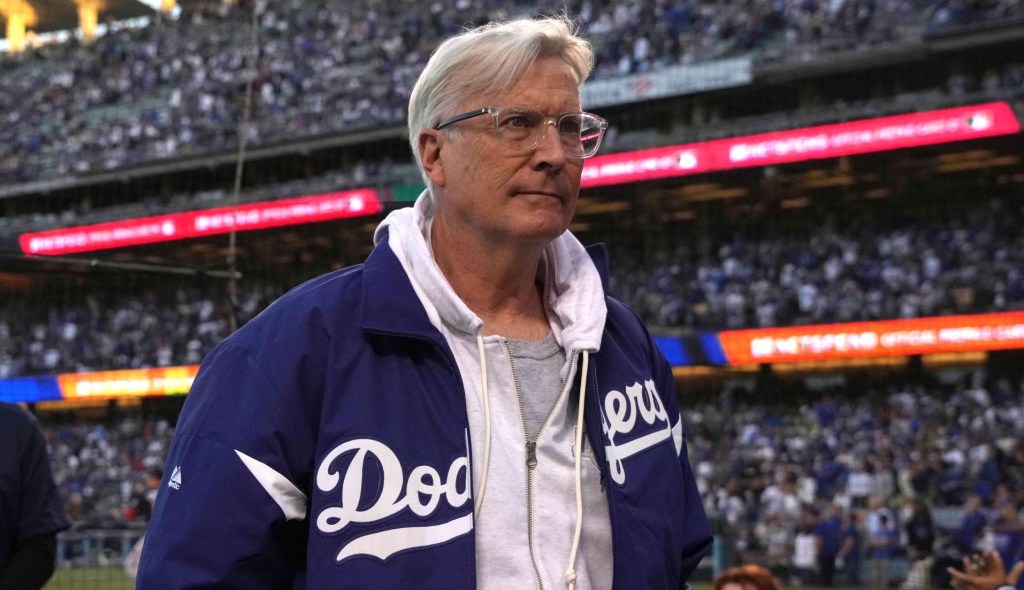

Under NBA rules, the controlling owner must hold at least a 15% stake in the team. Walter, who already owned a 27% stake in the Lakers dating back to 2021, will need to put up a hefty sum, and is likely going to gather a group of investors to make up the rest of the purchase price.

Checketts, a seasoned executive with long tenures running the Knicks and Jazz, says private equity will come into play. “There’s going to be a big part of it that will be private equity,” he says.

Under NBA private-equity ownership rules, individual PE funds can own up to 20% stakes in as many as five franchises, but their ownership holdings are completely passive.

“Limitations on private equity are going to have to open up,” Checketts tells FOS.

The Unknown

The flashy announcement has been made, but there’s still a lot of unknown with the Lakers deal. According to ESPN, the Buss family will continue to hold a minority share of the team “for a period of time,” and Jeanie Buss will continue to run the team for “at least a number of years.” Per ESPN, that arrangement was “guaranteed” as part of the deal, and “Walter fully endorsed this plan.”

Just because ESPN is reporting that as being set in stone, will the NBA definitively allow it? Mark Cuban was supposedly going to stay on to oversee basketball operations for the Mavericks when he sold his majority stake at a $3.5 billion valuation in December 2023, but that didn’t end up working out, as Cuban was just as shocked as the rest of the world when Luka Dončić was traded to the Lakers. The jury is still out on exactly what will happen with the Celtics. In that deal, which is expected to be approved by the NBA board of governors next month, Wyc Grousbeck expects to stay on through the 2027–28 season.

Once the Lakers deal is complete, how will Walter—who has historically been private but is actually a very prominent figure in the world of sports ownership—feel about Jeanie Buss still being in the room and still being a key decision-maker?

“I don’t know why either party, seller or buyer, wants that to happen,” Checketts says. “I love Jeanie, she has been great for the NBA. But I actually think the Laker fandom would probably like a fresh start.”