There’s great appeal in owning a pro sports team, but even the rich are getting priced out of leagues like the NFL and NBA. Many would-be owners are turning to soccer, particularly in Europe, where there are many teams that can be had for more reasonable prices. But European soccer ownership can be as perilous as it is tempting.

Just ask John Textor, whose failure to follow UEFA multi-club ownership rules recently cost Crystal Palace its place in Europa League. Textor is a cautionary tale for aspiring owners showing that Wrexham AFC—which is reportedly looking to sell a stake at a 19,000% valuation growth thanks to mega-famous co-owner Ryan Reynolds—is an exception, not the rule.

“The fact that Ryan Reynolds pulled it off is not because Wrexham had any special sauce,” one industry source tells Front Office Sports. “It’s a pipe dream for people to think they can be Ryan Reynolds.”

Textor’s two clubs—Crystal Palace in the U.K. and Olympique Lyonnais in France—both qualified for the 2025–26 Europa League. But under UEFA rules, teams with shared ownership that have “decisive influence” can’t compete in the same continental tournament. Textor tried to offload his 43% stake in Crystal Palace to Jets owner Woody Johnson, but the deal came too late. The club was ultimately booted.

Multi-club conflicts are just one hazard. UEFA comprises 55 national governing bodies across Europe, with hundreds of men’s and women’s teams competing under its umbrella. For inexperienced buyers, the web of league rules, cross-border governance, and financial unpredictability can turn a dream investment into a disaster.

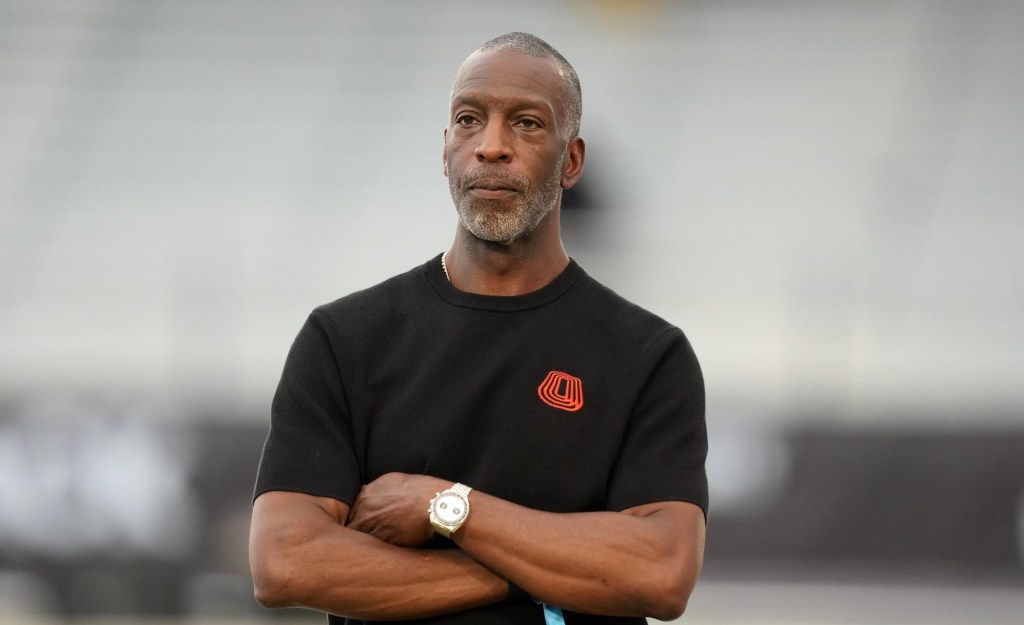

One of the most immediate threats is relegation, according to Sam Porter, a former executive for MLS team D.C. United, who now co-owns Club Necaxa in Mexico and Club Deportivo La Equidad in Colombia.

“You can buy a team in one league and you can end up in a different league, where the valuations are different, the revenues are different, and the situations are different,” Porter told FOS during an episode of Portfolio Players.

Alexander Jarvis, who advises on soccer club deals through his firm, Blackbridge Sports LLC, tells FOS that rookie investors often make avoidable mistakes, such as underestimating operational complexity, overhyping global “brand potential,” and ignoring fundamentals like stadium control or league dynamics.

“Not every football club has a Wrexham story in it,” he says.

Jarvis, whose firm recently facilitated the deal that saw Lenore Sports Partners buy a minority stake in Portuguese soccer club SL Benfica and was also involved with the Florida-based investment firm that bought Ireland’s Cobh Ramblers, says U.S. investors often misunderstand the economics of owning a soccer club in the region.

“In Europe, most clubs rely heavily on variable income—match day, player sales, performance bonuses, and promotion-related windfalls,” he says. “Relegation from the top tiers can wipe out 70% of a club’s income overnight. It’s not a capped league monopoly system. It’s survival of the fittest and smartest.”

His top advice? “Do your homework.” That includes examining not just pitch decks and return-on-investment promises but also deeper questions: Does the club control its stadium? How engaged is the fan base? What kind of political or community support exists for growth?

“What matters is what’s under the hood,” Jarvis tells FOS. “What their books and boardroom really look like—sometimes, it’s chaos.”